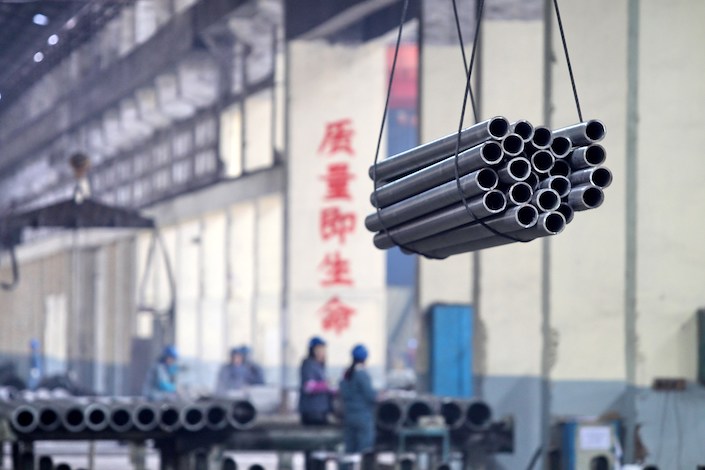

Steel Demand Plunges Amid Coronavirus Epidemic, Depressing Prices

Weakening demand for steel in China related to the coronavirus epidemic is depressing prices and putting pressure on steel companies. It is likely to hurt the industry’s first-quarter outlook, an industry group said Thursday in a report.

With limited ability to transport goods during the outbreak, volumes of traded steel have plummeted in the domestic market. Prices of raw materials and finished products are falling in response to dwindling demand as many factories are closed to curb the epidemic’s spread, according to a report (link in Chinese) from the government-backed China Iron and Steel Association (CISA). Some steel companies have experienced a drop in asset value and have begun panic selling, the report said.

The China Iron Ore Price Index fell by 11% to 310.38 on Feb. 6 from 348.65 on Jan. 23, the last working day before the Lunar New Year holiday, industry consultancy website Mysteel showed. The average price of Chinese steel has dropped from 3,940 yuan ($565) per ton on Jan. 20 to 3,811 yuan per ton on Feb. 7, down 3.3% month-to-month.

As much as 23.32 million tons of Chinese steel were in stock as of Feb. 2, up 35.7% month-to-month, according to Mysteel. Among them, 8.29 million tons were in companies’ inventories, a jump of 55% compared with January.

Director of Mysteel Xu Xiangchun told Caixin that under the current inventory overhang, some steel mills in regions like Hebei and Shaanxi have started overhauls earlier than usual, shutting down blast furnaces. Data from Mysteel showed that because of the coronavirus, 40 blast furnaces across the country were under early maintenance during the holiday, with 12 more set to be revamped.

Research from Huatai Futures predicted that the resumption of work on some of the biggest downstream steel projects could be delayed for two to three more weeks if the virus’s spread slows. As of Sunday, 1,246 construction projects were halted by real estate giant Evergrande Group and were required to not restart before Feb. 20.

Lin Yao, vice president of Ansteel Economic Development Research Institute, warned of an early end to the three-year industrial cycle that started in 2016. He said the pattern of China’s steel industry is a “bad” three-year cycle following a “good” three-year cycle. The industry was on the upswing from 2016 to 2019.

“I thought the industry could have relief in 2020 before entering a new ‘bad’ cycle in 2021,” Lin said. “But now it looks like the arrival of new round could come earlier, which means the recurrence of imbalance between supply and demand, steel prices keep going down and unprofitable companies being eliminated.”

However, CISA forecast that the second quarter of 2020 would see a release of demand in the Chinese steel market as the containment of the epidemic could improve and Beijing may roll out countercyclical policies.

“Inelastic demand for steel still remains,” said a person at CISA. “China needs around 900 million tons of steel to consume, and there is nothing that can change it.”

Contact reporter Lu Yutong (yutonglu@caixin.com)