Biopharma Startup Eyes Hong Kong Listing as Markets Tank

|

|

|

Money-losing biotech drug maker InnoCare Pharma Ltd. plans to raise up to HK$2.24 billion ($288 million) through a Hong Kong listing, betting investors will buy into its story as global markets go through one of their worst periods in more than a decade.

The move would make the company, whose founders include several big names from the sector, Hong Kong’s first biotech company to list in 2020. Hong Kong previously forbade listings by such money-losing firms on its main board. But it made an exception starting in 2018 for high-growth drug-making startups that often lose money while products are in development during their first few years.

The company plans to sell about 250 million shares for between HK$8.18 and HK$8.95 per share, according to its prospectus filed on Tuesday. It began taking orders on Wednesday and will set a final price on March 16. It aims to start trading on Hong Kong’s main board on March 23.

|

Like many young biotech startups, InnoCare, which focuses on biologically-based cancer and immunity drugs, has yet to earn any profits. Its core Orelabrutinib lymphoma treatment is the closest to hitting the market, after China’s regulator included the drug on its priority list for new drug launches in January. The company also has two other drugs in various stages of clinical testing.

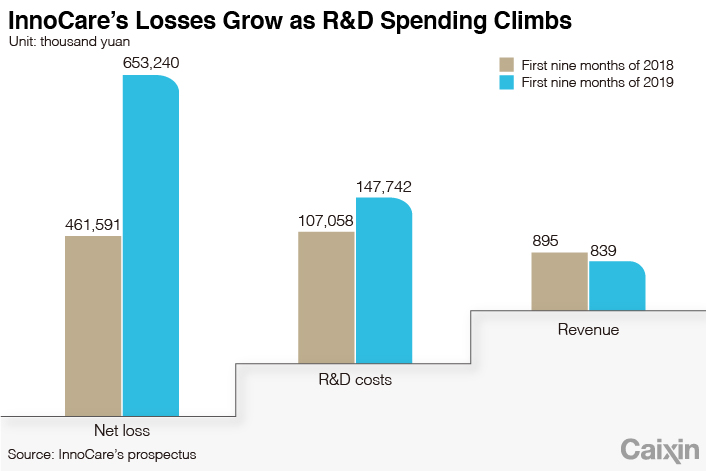

Reflecting its lack of sales history, InnoCare posted just 839,000 yuan ($120,000) in revenue in the first nine months of last year, while its loss for the period ballooned more than 40% to 653 million yuan.

The company has enlisted 12 cornerstone investors, which have pledged to buy $164 million worth of shares, or more than half the total. The largest of those, a fund set up by the central government in Beijing, will buy $35 million worth of shares, or about 12.7% of the total being sold. Other big investors include Vivo Funds, which focuses on medical companies in the U.S. and China; and Asia-focused investors Matthews Asia and Tiger Pacific Master.

The company will make the listing into one of the worst markets since the global financial crisis of 2008, as investors worldwide dump shares over concerns that the global Covid-19 outbreak could push the world into recession. Hong Kong’s benchmark Hang Seng Index is down 13% from a peak in mid-February, including a 3.7% drop on Thursday.

Contact reporter Yang Ge (geyang@caixin.com; twitter: @youngchinabiz)

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Two Sessions: With 4.5%-5% Growth Target, China Aims to Create Space for Reform

- 3China Business Uncovered Podcast: Brazil’s ‘Very Chinese Moment’

- 4Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 5First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas