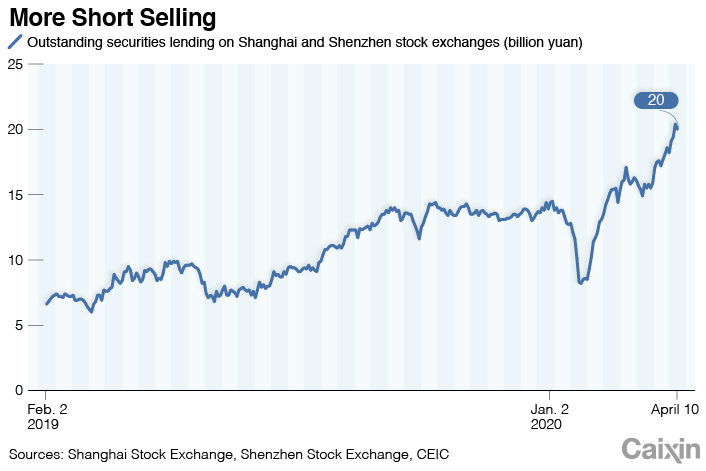

Chart of the Day: China Stock Short Selling Hits Record High

Chinese short sellers have been increasingly active over the last few months amid grim market conditions, pushing the balance of securities lending on domestic exchanges to a record high of over 20 billion yuan ($2.8 billion) on Thursday.

|

In general, securities lending is a practice in which investors borrow shares from a brokerage and then sell them in hope that the share price will fall in the future. If that happens, the investors can rebuy the stock at a discount, return the borrowed shares and profit from the difference.

The balance of securities lending rose to 20.4 billion yuan on Thursday, breaking the 20 billion yuan mark for the first time, according to data from the Shanghai and Shenzhen stock exchanges. The number inched down to slightly over 20 billion yuan the next day.

Cao Haifeng, an analyst at UBS Securities Co. Ltd., said in a note that the rise has been driven largely by securities lending on Shanghai’s Nasdaq-style, tech-oriented STAR Market launched last year.

A brokerage source told Caixin that although securities lending is relatively easier on the STAR Market than on the main boards, stocks available for lending are still in short supply.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Gavin Cross (gavincross@caixin.com)

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas