Caixin Insight: Caixin PMI, Securities Licenses for Banks, Pinduoduo’s New CEO

Data digest

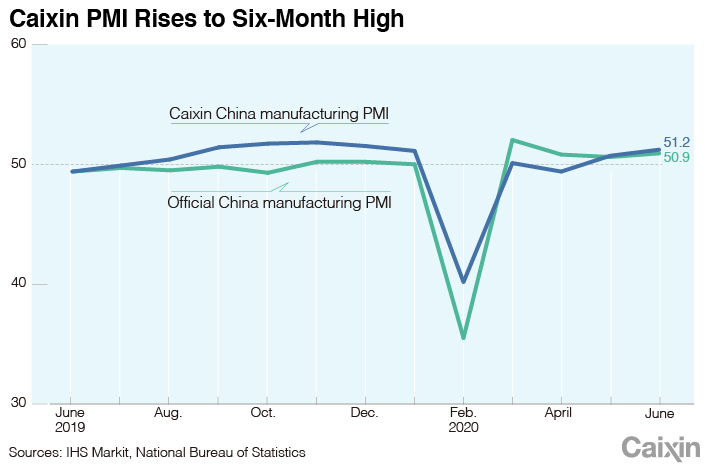

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose to 51.2 from 50.7 in May, reaching a six-month high.

|

The rise illustrates China’s continued recovery from the impact of Covid-19, which Nomura International economists attributed to “pent-up demand, a catch-up in production, a surge in medical product exports and stimulus in both China and other major economies that has bolstered demand for goods made in China.”

The official PMI also improved, rising to 50.9 from 50.6 the previous month. The official services PMI rose to 54.4 from 53.6 in May, similarly reaching a seven-month high.

However, new export orders continued to fall as the pandemic impacted top export markets including the U.S. and Europe, and the Caixin manufacturing PMI employment subindex remained in contractionary territory for the sixth consecutive month. “Manufacturers remained cautious about increasing hiring,” said Wang Zhe, a senior economist at Caixin Insight Group. “Some companies still had layoffs planned and were in no hurry to hire new workers to fill vacancies.”

Beijing builds securities “aircraft carrier” to compete against foreign entrants

The good times for Chinese securities companies may be coming to an end, as the country’s top securities regulator plans to grant licenses to commercial banks, inside sources say. The China Securities Regulatory Commission (CSRC) has been considering the move for years, but was previously dissuaded by the 2015 stock market crash and other events. The last development came at the end of 2018 when ICBC, the world’s largest bank by assets, applied to set up a wholly-owned securities subsidiary offering a full range of services with 100 billion yuan of registered capital.

There were rumors that it would receive permission after former ICBC head Yi Huiman became CSRC chairman in January 2019, but the decision was again delayed. The move to start granting banks securities licenses now comes as more and more foreign firms take majority stakes of their joint ventures in the country. Commercial banks, which are gigantic in comparison to securities companies (the assets of all of China’s securities companies combined are less than one-third the size of ICBC’s assets) represent China’s hope of building “aircraft carrier-size” investment banks to compete with foreign financial firms entering the Chinese market.

At least two major commercial banks, ICBC and China Construction Bank, are likely to receive licenses to start offering certain investment banking services. Some analysts say the decision might stimulate the securities industry to become more efficient, and drive market consolidation by pushing smaller securities companies out of business or forcing them to merge with larger players such as CICC and Citic Securities.

Huang Zheng steps down as Pinduoduo CEO

Huang Zheng, founder of e-commerce giant Pinduoduo, announced on Wednesday in a letter to employees that he would step down as CEO while remaining chairman of the board. Pinduoduo CTO Chen Lei has been named the new CEO, effective immediately.

Huang also reduced his personal stake in Pinduoduo from 43.3% to 29.4%, according to a July 1 filing with the U.S. Securities and Exchange Commission, where the company went public in July 2018. By stepping back from day-to-day operations, Huang hopes to “focus on longer term strategy,” according to a company statement.

Established in 2015, Pinduoduo has attracted over 600 million active users and surpassed JD.com in May to become the second-most highly valued e-commerce retail platform in China. In June, Huang became the second-richest person in China, with a net worth of $45.4 billion that put him behind only Pony Ma, founder and CEO of Tencent.

What to watch for

• Details on securities licenses for ICBC and China Construction Bank

• Luckin Coffee’s upcoming July 2 board meeting and July 5 shareholder general meeting, which will determine if Lu Zhengyao stays on as chairman

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas