Caixin Insight: Ant Group Ushers in Wave of IPOs

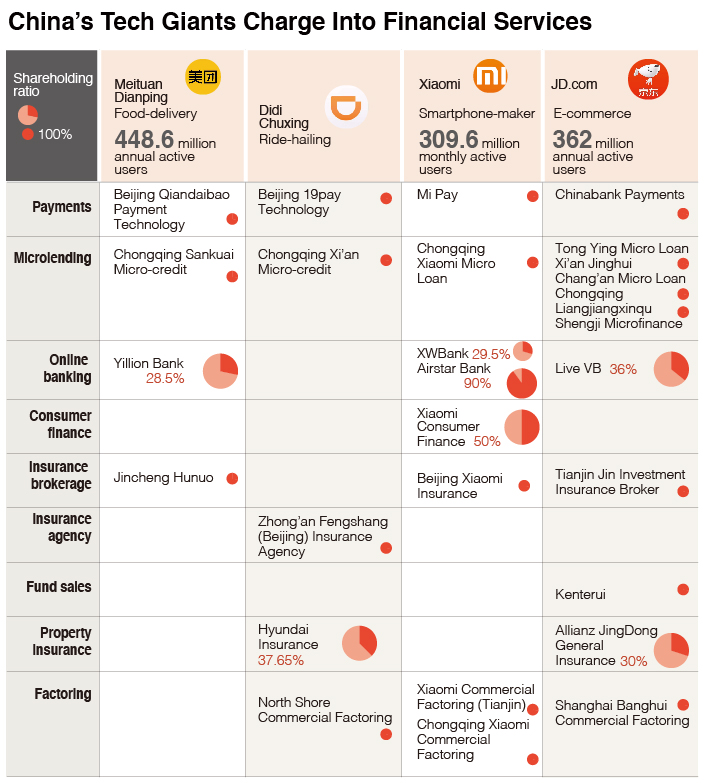

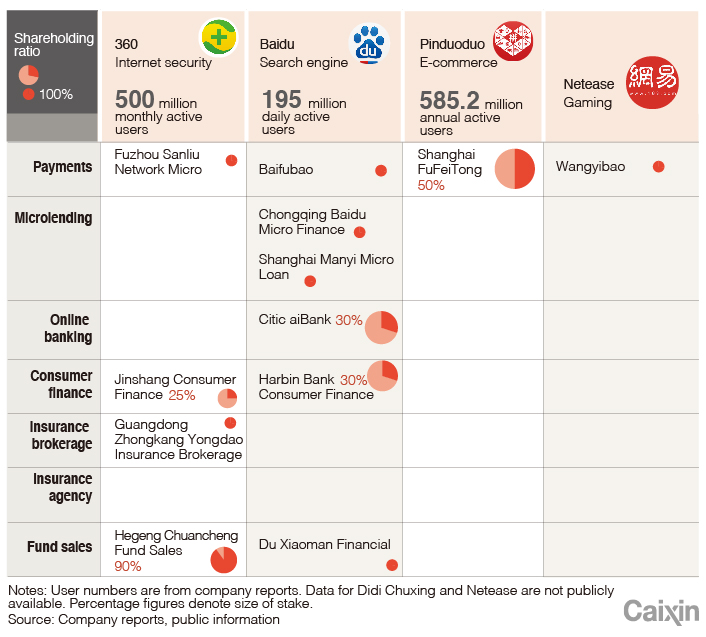

China’s tech giants breaking into financial services

Some of China’s most successful tech giants, such as ride-hailing company Didi Chuxing, online-to-offline services giant Meituan Dianping, and e-commerce retailer JD.com, are eyeing the financial services market. Meituan, for example, offers a $28,590 special loan to customers with a daily interest rate of less than 0.02%. Didi Chuxing is also touting its loan service offering lower interest rates than banks. The promotions are seen by market analysts as attempts to replicate the success of Alibaba’s Alipay and Tencent’s WeChat Pay, which control more than 90% of the market.

|

|

These companies’ giant pools of customer data enable them to easily deliver targeted ads, assess lending risks and rank customers’ creditworthiness. In the early days, some tech companies funded their lending operations by teaming up with banks who provided them with financing in return for a cut of the profit, yet many banks worried about the risks of making unsecured loans.

The Chinese government has been encouraging the development of online financial services by tech companies to help drive inclusive finance, with regulators putting faith in established tech companies to provide relatively low-risk accessible loans based on their data on borrowers’ spending habits.

“As an important supplement to traditional offline loans, Internet loans can serve customer groups that are difficult to reach through traditional financial channels, and its inclusive financial characteristics are more prominent,” the regulator said in a statement on Friday.

But one former regulator told Caixin that Internet enterprises often pursue short-term gains, and their business model doesn’t necessarily work in the financial sector, where firms need to survive an entire economic cycle before one can judge their performance.

“No matter big data or cloud computing, there is still a long way to go until they prove they’re successful in the financial field,” he said. “We have to take a long-term view, and it’s still too early to tell the story of the success of big data.”

Alibaba’s Ant Group seeks dual IPO in Shanghai and Hong Kong

Ant Group, the financial affiliate of e-commerce giant Alibaba Group Holding Ltd. which runs the Alipay electronic payment service, has announced plans to conduct a dual IPO in Hong Kong and on Shanghai’s nascent STAR Market. Although the company did not disclose specifics about the timing and size of the share sales, the IPO is likely to be the world’s largest in years, and Reuters reported last week that the company aims to achieve a valuation of more than $200 billion.

Caixin has learned that the company has picked China International Capital Corp. and JPMorgan Chase & Co., among other institutions, to underwrite the share sale.

The IPO decision surprised some market analysts in that Ant bypassed the NYSE. As U.S.-China tensions escalate, HKSE recently amended rules that previously banned dual-class listings, a move that Ant said underpinned its decision.

Both Shanghai and Hong Kong exchanges welcomed Ant’s listing. The Hong Kong bourse soared as much as 9.5% a few days after Ant’s IPO announcement, the biggest surge in five years.

A big week for IPOs

Analysts point out that Ant Group’s IPO plan might have encouraged other Chinese firms to go public while the going is good, before market conditions deteriorate. Brock Silvers, Adamas Asset Management Ltd. chief investment officer, told Bloomberg “Right now liquidity is available, but the Chinese and global economies are fraught with risk. Everyone thus wants to strike now, while the iron is hot.” In the past week, notable IPO plans and updates include:

1. Didi rides toward Hong Kong IPO

Caixin learned exclusively on Tuesday that ride-hailing giant Didi Chuxing plans to list its shares in Hong Kong after spending years denying such a plan. The source, close to the top executive of Didi, emphasized that the IPO process is still in the planning phase.

2. Ant Group underwriter CICC to triple its IPO shares

Four months after China International Capital Corp. announced its A-share IPO plan, the company declared on Monday that it plans to triple the number of shares on offer from 459 million to 1.44 billion, a move that sources say will better meet the company’s financing needs. The announcement came the same day as media reports revealed CICC would underwrite Ant Group’s dual listing.

3. Chinese e-scooter maker Segway-Ninebot seeks IPO in the STAR Market

Backed by Sequoia Capital China and Xiaomi, Beijing-based electric scooter maker Segway-Ninebot submitted its prospectus for a planned $297 million IPO on the STAR Market. If approved, Segway-Ninebot could become the first foreign-registered company with a variable-interest entity (VIE) structure to go public on the A-share market on the Chinese mainland.

Weathervane

There has been quite a lot of news over the last week on U.S.-China relations and other international issues with major economic implications, but the biggest domestic development, a meeting with prominent entrepreneurs chaired by Xi Jinping and attended by members of the Politburo standing committee, has received a bit less attention in English-language media. Xinhua reported that Xi “urged efforts to spur the vitality of market entities and promote entrepreneurship,” calling for more attention to be paid to policy support for private businesses, but the most interesting aspect of the meeting was its emphasis on a concept that first emerged at a Politburo meeting in May. We touched on it briefly in this newsletter at the time, and Xinhua has now come out with an official translation of the phrase, saying “a new development pattern will gradually be created whereby domestic and foreign markets can boost each other, with the domestic market as the mainstay.” Their translation is still pretty jargony, but the gist is about reorienting China’s economy toward the domestic market amid depressed external demand due to the pandemic and other factors. The entrepreneurs in attendance included chairmen of Hokvision, Sinochem, Guide Infrared, SMIC, Cambricon, and others, along with top executives of foreign firms including Microsoft Research Asia and Panasonic China.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas