Caixin Insight: Economists Fight Over the Money Printer

The annual National People’s Congress meeting is just two days away, with all kinds of speculation about the content of the government work report adding to anticipation of the year’s most important political event. A fierce debate has been raging over the last week on monetization of the fiscal deficit and special treasury bonds, although we don’t anticipate any shocking moves on that front given the strong opposition from those like monetary policy committee member Ma Jun. But a new document from the Party Central Committee contains some hints of what may be coming at the Two Sessions.

On May 19, we held a webinar titled “Curtain Raiser for Two Session Economic Policies.” Among the speakers were Tu Xinquan, dean and professor at the China Institute for WTO Studies at UIBE, and Li Wei, professor of economics and associate dean at Global MBA at CKGSB, whose insights can be found here.

Macro Data Digest

Major economic indicators showed modest signs of recovery in April from record lows earlier in the year, with business activity picking up as China shook off the impact of the coronavirus epidemic, National Bureau of Statistics data showed on May 15.

- Fixed-asset investment declined at a much more moderate pace last month and industrial output bounced back into expansionary territory for the first time this year.

- Retail sales continued to decline on a year-on-year basis and performed worse than expectations, falling 7.5% year-on-year despite improving from March’s 15.8% decline.

- Fixed-asset investment fell 10.3% year-on-year (link in Chinese) in the first four months of 2020, broadly in line with the median estimate of a 10% drop from a Caixin survey (link in Chinese) of economists.

- Infrastructure investment shrank 11.8% in the first four months, narrowing from a 19.7% decline in the first quarter.

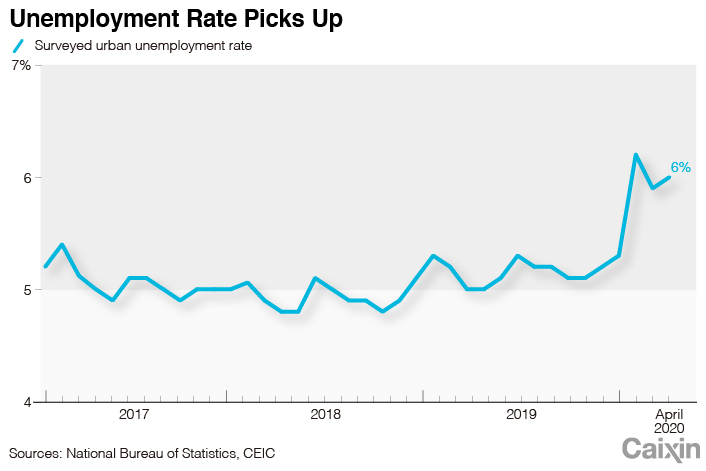

- The surveyed urban unemployment rate inched up 0.1 percentage points from the previous month to 6.0%. However, as we discussed on April 29, this does not show the whole picture: migrant workers do not factor in, and Goldman Sachs has estimated that 18.3% of nominally employed people are not actually working.

|

China Has Issued Almost $3 Billion Consumption Vouchers, Triggering Call for Caution

The Ministry of Commerce announced in a press conference that China has issued a total of over 19 billion yuan ($2.7 billion) of consumption vouchers, most retail or catering related.

Alipay data show that every 1 yuan spent on vouchers has driven an extra 8 yuan of consumption on average, reaching 15 yuan in some areas.

Still, some concerns have emerged about this policy, with observers expressing worries that it might further entrench the duopoly of Alipay and WeChat Pay, the primary channels used to distribute the vouchers. (We’re not so sure the vouchers are all that important on that point.) Others, however, rightly point to the fact that the voucher strategy is not particularly sustainable as a stimulus policy, as household consumption only makes up a small portion of the nation’s economy, and the coupons unfairly favor a narrow set of industries.

Furthermore, the vouchers aim at discretionary spending rather than necessities. Some academicians are calling more help for the lower-income earners and the most vulnerable, as discussed on the recent Caixin Global Webinar.

Deficit Monetization and MMT

A quite heated debate over monetization of China’s fiscal deficit and special treasury bonds has erupted since Thursday, with heavy hitters on both sides.

Liu Shangxi, president of the Academy of Fiscal Sciences, began the discussion with a call (link in Chinese) call for deficit monetization to provide greater fiscal policy space given the need to increase spending on the “six guarantees.” (see our last issue) His camp argues that traditional fiscal expansion is likely to actually bring greater risks, and that we should rethink existing monetary and fiscal policy theories to improve coordination between the two.

This viewpoint has been roundly rejected by PBOC monetary policy committee member Ma Jun and others (including Wu Xiaoling, Zhang Wenkui, Zhong Zhengsheng and more...like we said, it’s been heated). This camp cautions against throwing fiscal discipline out the window, and allowing so-called “voodoo economics” to push China down a slippery slope of inflation, real estate bubbles, and government malinvestment crowding out of the private sector.

Given that Modern Monetary Theory is still fairly far outside the mainstream, it is remarkable that Liu’s opinion has drawn such a strong response. Unfortunately, however, focus has shifted away from the basic principles of MMT and fiscal and monetary policy coordination, and turned more into a discussion of fiscal discipline.

Of course, that conversation is also an important one, but we’re eager to see if the debate comes back around to Liu’s original assertions about the nature of money and impact of treasury bonds on China’s liquidity environment.

Weathervane

The State Council and Central Committee released a (massive) new document on Monday, the Opinions on Accelerating Improvement of the Socialist Market Economy System in the New Era. It’s an overarching guideline for economic policy at the macro level, and builds on some of the signals we’ve discussed in this newsletter over the past few weeks.

This is a newsletter, so we will not dive into every aspect (you have to pay us for that) but the fourth section is particularly notable for its discussion of factor markets, which have been a recurring theme over the past few weeks. The topic’s inclusion in this top-level document confirms its position as a top priority, and backs our April prediction that Beijing is set to drive its economic recovery as much via reform as stimulus.

SMEs, property rights, SOE reform and all the big issues received due attention, with the main thread being to give more play to the market. But among the more interesting sections of the document was a discussion of science and technology, calling to accelerate construction of related infrastructure with a focus on indigenous innovation, linking new infrastructure initiatives and the drive for technological independence amid intense U.S.-China competition.

The tech and industrial aspects of the document are also closely associated with two new terms from last Thursday’s Politburo meeting. While the meeting, like most in the last few months, revolved around Covid-19, it also focused in particular on supply chain stability and competitiveness.

In its discussion of supply-side reform, it called explicitly to “build a new development pattern mutually promoting domestic and international circulation,” and to “give full play to the advantages of the new national system.” Both of these phrases are complete jargon, but that doesn’t make them unimportant — they are calling to strengthen China’s position in international industrial chains amid decoupling and strengthen domestic capacity in an uncertain external environment.

What to look for at the Two Sessions

- Will China set a numerical or qualitative GDP growth target?

- Will the fiscal deficit be allowed to rise above 3%?

- Further details on special treasury bonds (and their potential monetization)

- Further details on marketization of production factors (particularly on land, hukou reform and data)

Contact analysts Gavin Cross (gavincross@caixin.com) and Zhang Qizhi (qizhizhang@caixin.com)

This weekly brief is provided by Caixin Global Intelligence, the strategic advisory arm of Caixin Global. We help clients assess policy risk and macroeconomics in China, providing actionable insight with custom market and policy analysis.

For more analysis, please follow our Twitter @caixin_intel

If you have any inquiries, please contact us at cgi@caixin.com