Caixin China Manufacturing PMI Hits Over Nine-Year High

Manufacturing activity in China continued to recover from the fallout of the Covid-19 pandemic in July as businesses reported the fastest expansion of output and new orders since January 2011.

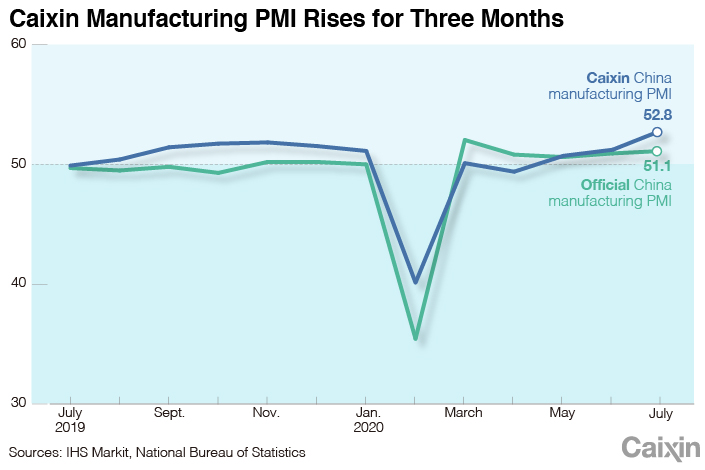

The Caixin China General Manufacturing Purchasing Managers’ Index (PMI), which gives an independent snapshot of the country’s manufacturing sector, rose to 52.8 from 51.2 in June, reaching the highest since January 2011, a report released Monday showed. A number above 50 signals an expansion in activity, while a reading below that indicates a contraction.

The figure adds to evidence that China’s economic recovery may continue in the second half of 2020. China’s GDP grew 3.2% year-on-year in the second quarter, returning to growth after a record 6.8% contraction in the first quarter.

China’s official manufacturing PMI, released (link in Chinese) on Friday, rose to 51.1 in July from 50.9 the previous month. The official PMI polls a larger proportion of big companies and state-owned enterprises than the Caixin PMI, which is compiled by London-based data analytics firm IHS Markit Ltd.

Some economists believe that China’s economic recovery should stay on track in the second half of the year, assuming that there is no large coronavirus outbreak in the country. Bur some others estimate growth will decelerate compared with the second quarter, saying that pent-up demand could lose steam, a surge in medical exports could fade, and tensions between China and the U.S. may intensify.

|

The breakdown of the July Caixin PMI showed that both supply and demand rose over the previous month, as the output subindex expanded for the fifth month in a row, reaching a nine-and-half-year high along with the subindex of total new orders.

Manufacturers remained optimistic about their business outlook over the next 12 months. “Growth forecasts were underpinned by expectations that economic activity and client demand will continue to recover from the pandemic,” IHS Markit said in a statement accompanying the PMI data.

Export and employment remained the factors dragging down the manufacturing recovery. New export orders continued falling last month, albeit at a slower pace, amid subdued overseas demand as the pandemic had not stopped raging in China’s trade partners like the U.S.

Employment shrank for the seventh month in a row in July, although the contraction was marginal. “The survey found that some companies increased recruitment to meet production needs, but some others remained cautious and laid off workers to reduce costs,” said Wang Zhe, a senior economist at think tank Caixin Insight Group.

Inflationary pressure picked up, as growth in both input costs and output prices accelerated, according to the survey.

This story has been updated with new information.

Contact reporter Guo Yingzhe (yingzheguo@caixin.com) and editor Gavin Cross (gavincross@caixin.com)

Caixin Global has launched Caixin CEIC Mobile, the mobile-only version of its world-class macroeconomic data platform.

If you’re using the Caixin app, please click here. If you haven’t downloaded the app, please click here.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas