Charts of the Day: PipeChina’s Vast Acquisition of Energy Infrastructure Worth Hundreds of Billions of Yuan

China’s new state-run pipeline giant, PipeChina, is snapping up the oil and gas transmission and storage assets of the country’s dominant energy conglomerates, with the goal of boosting production, leveling the playing field and centralizing the planning of the country’s energy infrastructure.

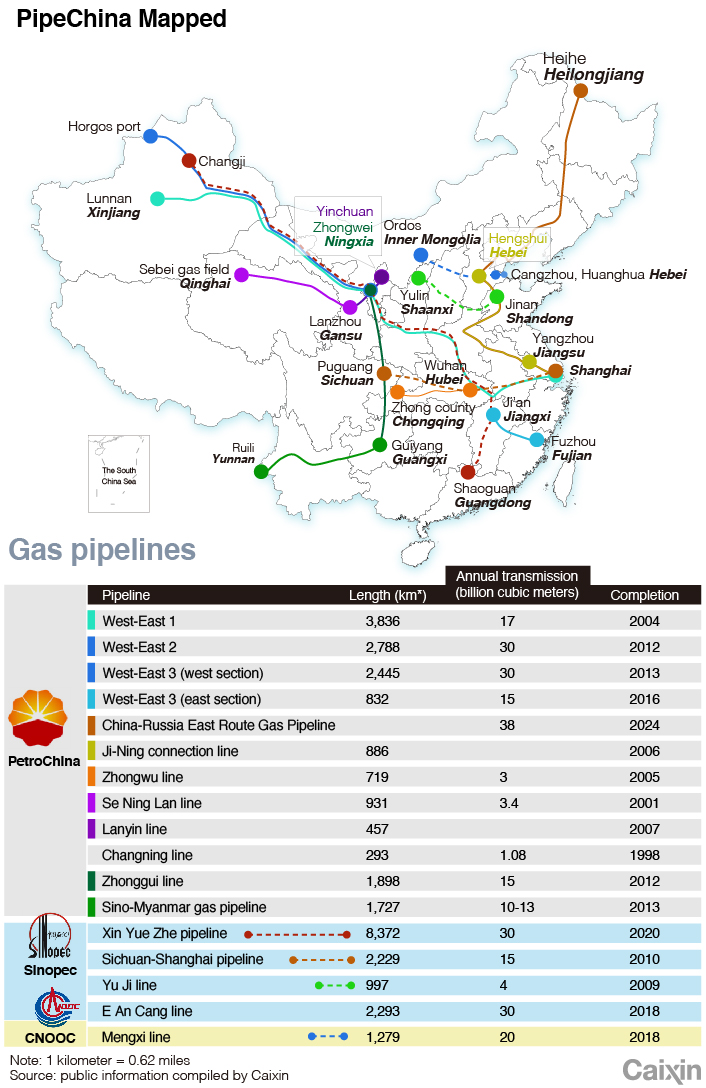

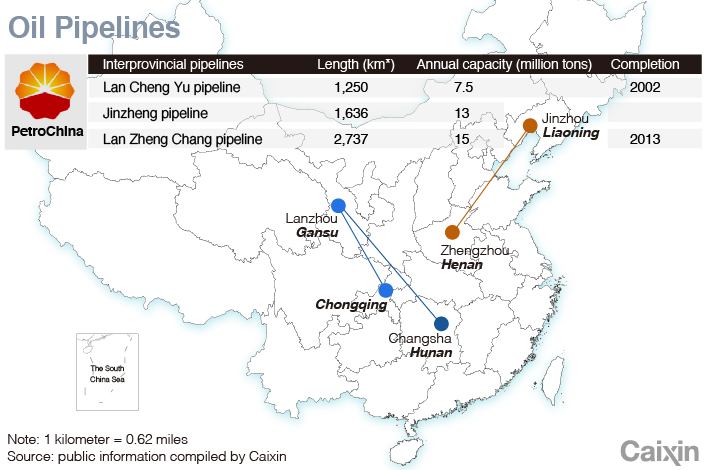

As part of this government-led push for industry consolidation, PetroChina — the listed arm of state-owned giant China National Petroleum Corp. (CNPC) — is set to part with its oil and gas pipeline assets, including a west-east pipeline that runs through nine provincial-level regions and two international pipelines that stretch through Russia and Myanmar. These assets generated a third of PetroChina’s profits last year.

|

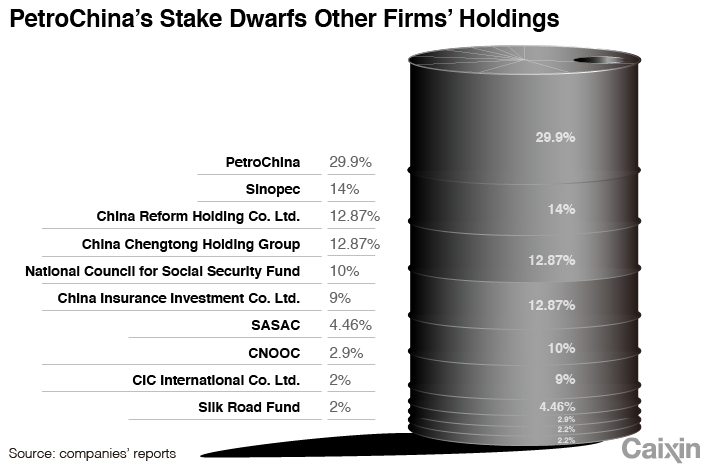

In exchange, PipeChina will hand over cash and equity worth 258.7 billion yuan ($37.2 billion), consisting of 119.2 billion yuan in cash and a 29.9% stake in PipeChina, which will make PetroChina the largest shareholder in the new behemoth.

Investment bank Morgan Stanley bumped up its rating of PetroChina stock to its most favorable level on July 24 after the news broke of how much cash the company would receive, though the company’s Chief Financial Officer Chai Shouping said that day that the company’s operational cash flow would shrink by as much as 40 billion yuan. That would be equivalent to 11% of its cash flow last year.

Chai said the money will be used to invest, disperse dividends and repay debts. PetroChina aims to develop its natural gas and new-energy businesses in the future, Chai added.

China Petroleum and Chemical Corp., known as Sinopec, will sell 10 of its pipeline subsidiaries for 122.6 billion yuan to PipeChina, which will be composed of a 14% stake in the new enterprise and 52.6 billion yuan in cash. This acquisition will have less of an impact on Sinopec, as the assets being transferred accounted for just 3.3% of its profit in 2019.

|

The cash will go to exploiting natural gas fields, constructing refineries and building electric car charging stations, Sinopec said.

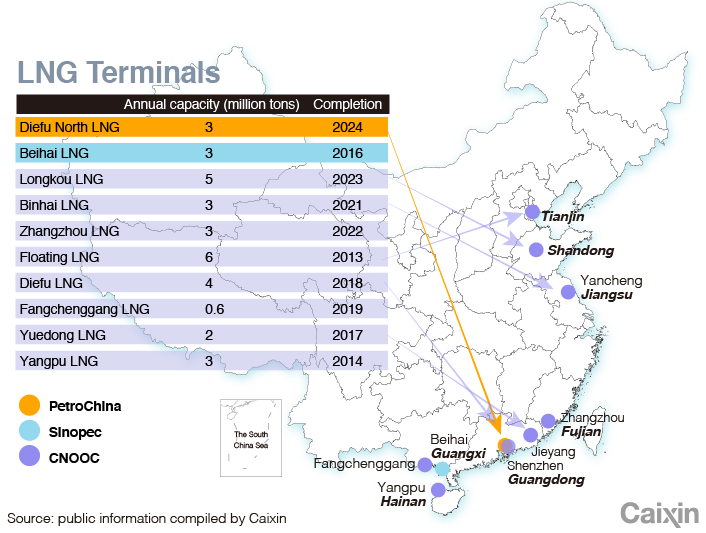

China National Offshore Oil Corp., which specializes in offshore extraction, is going to con-tribute eight liquefied natural gas terminals and one oil pipeline in a deal worth 14.5 billion yuan, including a 2.9% stake in PipeChina.

|

The other 53.2% of PipeChina not held by the three state-owned energy companies will be held by seven state-owned enterprises, with China Reform Holdings Co. Ltd. and China Chengtong Holdings Group each taking a 12.87% stake.

|

By consolidating pipes across the nation, PipeChina intends to provide equal access to market players unable to build their own transmission networks, such as smaller privately owned companies. But the large stake held by PetroChina has sparked concerns about PipeChina’s independence. “It (PetroChina) owns the biggest share, it may be able to sway sales and operation in its favor,” said a person who once worked in CNPC’s pipeline department.

The current round of consolidation excludes the assets of Kunlun Energy Co. Ltd., an entity in which PetroChina holds a 54.4% stake. Kunlun is one of China’s largest oil and gas enterprises. It operates a major pipeline network linking Northwest China’s Shaanxi province with Beijing, which involved 41.4 billion yuan of investment. A CNPC analyst said that PetroChina could gain even greater influence over PipeChina if Kunlun’s assets are added to its portfolio.

Zhao Xuan contributed to this story.

Contact reporter Lu Yutong (yutonglu@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- 1Luckin-Backer Centurium Capital to Buy Blue Bottle Coffee From Nestlé

- 2Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 3First Tanker Crosses Strait of Hormuz Since Iran’s Closure Threat

- 4In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 5In Depth: China’s Biotech Push Into Small Nucleic Acid Drugs Draws Global Pharma

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas