Update: China’s Consumer Inflation Sinks to 19-Month Low

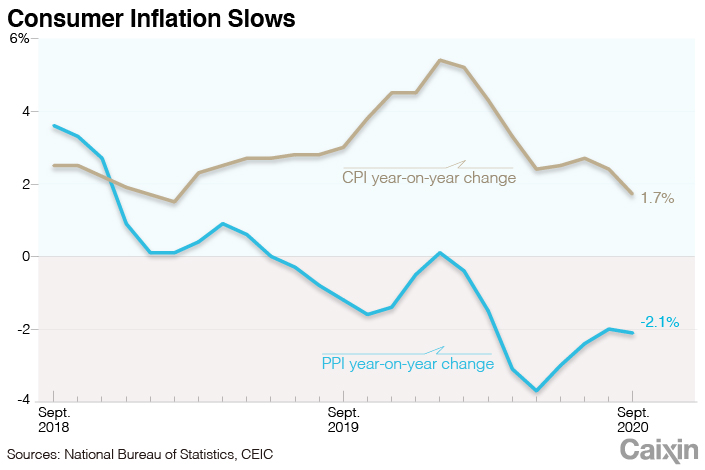

China’s consumer inflation slowed to a 19-month low in September as growth in pork and other food prices eased, while factory-gate prices contracted at a faster-than-expected pace due to weaker oil prices, official data showed Thursday.

The consumer price index (CPI), which measures changes in the prices of a basket of consumer goods and services, rose 1.7% year-on-year last month, narrowing from 2.4% growth in August, data (link in Chinese) from the National Bureau of Statistics (NBS) showed. The reading was slightly lower than the median estimate of 1.8% growth in a Caixin survey (link in Chinese) of economists.

|

Food prices collectively rose 7.9% year-on-year last month, down from 11.2% growth in August, contributing 1.7 percentage points to the CPI inflation, said (link in Chinese) Dong Lijuan, a senior NBS statistician.

Pork prices, one of the key drivers of inflation over the past year amid pork supply shortages caused by the African swine fever crisis, rose 25.5% year-on-year in September, the second consecutive monthly moderation and down from 85.7% growth in July. The supply of pork rose because of a sustained recovery of live pig stocks and more pork reserves being released onto the market, Dong said.

Read more

In Depth: How Secrecy and Loopholes Fueled China’s Swine Fever Crisis

The core CPI — which excludes more-volatile food and energy prices and may better reflect long-term inflation trends — rose 0.5% year-on-year in September, unchanged from growth for the previous month, according to the NBS.

“With infrastructure-led stimulus still being ramped up and consumption rebounding, demand-side pressures on prices will probably strengthen in the coming months, pushing up underlying inflation,” economists at research firm Capital Economics Ltd. said in a research note released Thursday.

“But the rebound in core consumer price inflation will still leave it relatively subdued and food price inflation looks set to drop back further in the near-term as pork supply continues to recover,” they said.

The producer price index (PPI), which gauges changes in the prices of goods circulated among manufacturers and mining companies, fell 2.1% (link in Chinese) year-on-year last month, NBS data showed, slightly steeper than the 2% drop in August and the median estimate of a 1.8% decline in the Caixin survey. The PPI declined for the eighth month in a row.

Given fluctuations in global oil prices, prices in the oil and gas extraction industry as well as the petroleum, coal and other fuel processing industry both saw a steeper decline in September than the previous month, according to Dong.

Economists with HSBC Global Research said in a Thursday note that the softer consumer price pressures will give more space for policymakers to stay accommodative. “While recent data suggests there is continued momentum in the recovery of both the external and domestic sectors, the global backdrop continues to face uncertainties and the recovery in China’s private sector remains tenuous,” the economists said.

They expected Beijing would allow more liquidity to flow to the real economy by conducting further tax and fee reductions. The central bank would likely cut credit costs through lowering the benchmark national loan prime rates as well as cuts to the reserve requirement ratio for banks, they said.

Contact reporter Tang Ziyi (ziyitang@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR