In Depth: China’s Top Online Brokerages Tread Narrow Path to Cash In on Surging Interest in U.S. Stocks

2020 was a banner year for two of the Chinese mainland’s best-known online brokerages.

Nasdaq-listed Futu Holdings Ltd. and Up Fintech Holding Ltd. both saw accounts on their cross-border trading platforms jump by hundreds of thousands, revenues more than double and profits surge last year.

Not bad for business that domestic brokerages aren’t technically allowed to be in — helping mainland investors trade U.S. stocks.

The situation highlights the narrow path that the big-name-backed online brokerages have to tread to serve a population with a growing amount of wealth to invest as policymakers wrestle with relaxing longstanding rules designed to keep too much money from flowing out of the mainland.

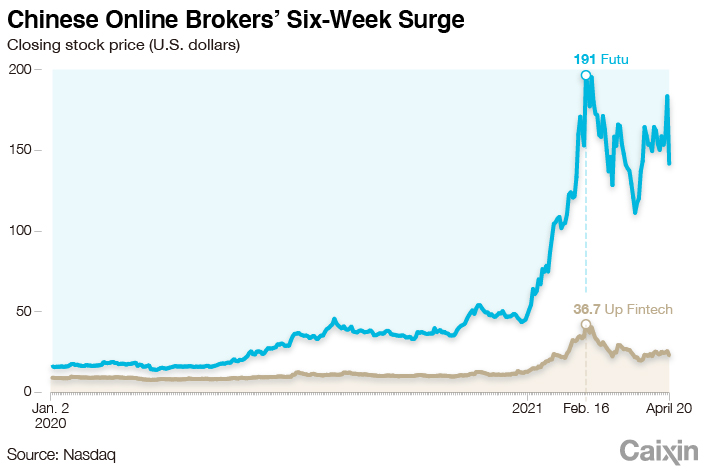

So far, so good. By mid-February, the two companies’ stock prices had tripled from the start of the year, with Futu’s hitting a record of $191 on Feb. 16.

|

The two companies have managed to stay out of regulators’ sights by running their brokerage services through overseas entities that exist outside the authority of China’s securities regulator, as well as by shunning the yuan in order to avoid running afoul with the country’s foreign exchange regulator.

“As long as online brokerages do not cross these two red lines, Chinese regulators can’t do anything to them,” a source close to authorities told Caixin.

More Chinese money in U.S. stocks

Futu is China’s largest online brokerage, both by revenue and market cap. Up Fintech, also known as Tiger Brokers, is backed by veteran American investor Jim Rogers, smartphone giant Xiaomi Corp. and U.S. brokerage giant Interactive Brokers Group Inc. Both are looking to cash in on the growing amount of Chinese retail investor money pouring into U.S. stocks.

From 2017 to 2020, China’s personal investable assets grew by an estimated 34% to 182 trillion yuan ($27.9 trillion), and the figure is expected to rise to 287 trillion yuan by 2025, according to consultancy Oliver Wyman.

In 2020, the value of U.S.-listed company shares held by residents of the Chinese mainland grew by roughly 28% to $260.9 billion, according to U.S. government data.

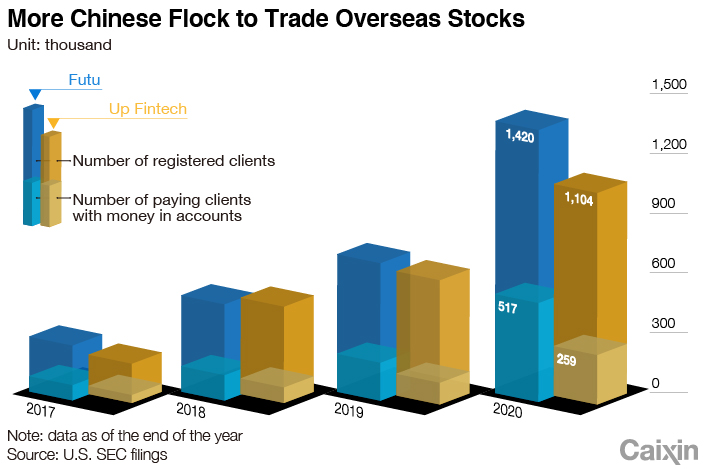

Both Futu and Up Fintech have hyped their surging numbers of new customers last year, particularly paying clients with assets in their accounts. Futu, which is 22.8% owned by internet giant Tencent Holdings Ltd., had 1.4 million open accounts at the end of 2020, according to its annual report. Futu’s number of paying clients skyrocketed by 160% last year to about 517,000, up nearly fourfold from 2018.

At Up Fintech, the number of open accounts rose 70% last year to 1.1 million, according to its unaudited full-year financial results. The figure includes 258,700 accounts owned by paying clients, an increase of around 130%.

|

At the end of March, Chinese mainlanders made up 80% of Up Fintech’s paying clients, and 55% of Futu’s, sources close to the two companies told Caixin.

Chinese retail investors have been drawn to the U.S. stock market because it remains — for now at least — home to many well-known Chinese high-tech firms, such as search engine giant Baidu Inc. and e-commerce titan Alibaba Group Holding Ltd.

Operating outside the rules

To run a securities firm on the mainland, overseas brokerages need the approval (link in Chinese) of the China Securities Regulatory Commission (CSRC).

Neither Futu nor Up Fintech has that approval. But they also don’t technically operate securities businesses on the mainland, despite the fact that the majority of their customers reside there. Instead, they have subsidiaries that operate securities businesses that are based and licensed overseas.

This set-up allows the companies to avoid CSRC supervision because their brokerage businesses operate outside of its jurisdiction, the source close to regulators told Caixin.

For example, Futu’s securities business is run through its wholly owned, Hong Kong-based subsidiary Futu Securities International (Hong Kong) Ltd. which has a license from the Securities and Futures Commission of Hong Kong to deal in securities. Over the past three years, Futu Securities International generated about 97% to 98% of Futu’s annual revenue.

The two brokers also own mainland-based subsidiaries that back up their overseas units with technology support and research. Futu has a wholly owned subsidiary based in the southern mainland city of Shenzhen, right next to Hong Kong, which develops internet technology products.

In its IPO prospectus in March 2019, Up Fintech disclosed that one of its mainland-based companies received a notice from the CSRC’s Beijing branch in September 2016 that instructed the company to “refrain from providing support to “unauthorized foreign service providers that conduct securities business in China.”

After that, the company moved links for opening new accounts off its mainland-developed website. Nowadays, potential customers can open new accounts on a website run by a subsidiary based in New Zealand. As of the time it filed for its IPO, Up Fintech said it hadn’t received any more rectification notices from the CSRC.

Avoiding problematic exchanges

Futu and Up Fintech have also managed to avoid other regulatory altercations, not so much by circumventing the rules, but by existing outside of them.

If mainland-based brokerages use their customers’ yuan to buy stocks denominated in the U.S. dollar or other foreign currencies, the resulting foreign currency exchange could draw the ire of China’s foreign exchange regulator.

The two companies’ online brokerages get around the problem by refusing to take deposits in the yuan, ensuring they never deal in the Chinese currency.

That leaves any foreign exchange problem to their customers. China’s foreign exchange rules ban mainlanders from using their annual quota of $50,000 worth of foreign currency exchange to purchase offshore securities.

However, that hasn’t stopped everyone from falsely reporting the purpose of their foreign currency exchanges, transferring that money to an offshore bank account and then using the money to invest in foreign stocks through a platform like Tiger Brokers, market observers said.

“Our customers make their deposits with money from overseas bank accounts. But we don’t know how they do it. That’s none of our business,” said Li Hua, Futu’s founder and CEO.

China’s State Administration of Foreign Exchange (SAFE) has been keeping a close eye on fund outflows for overseas stock investments, and occasionally sends instructions and risk alerts to banks, a source at a domestic brokerage’s Hong Kong subsidiary told Caixin.

Read more

China May Ease Controls on Citizens’ Offshore Investments

However, although the foreign exchange regulator can require banks to ensure that mainlanders don’t use the foreign currency they buy to make overseas investments, the regulatory cost of reviewing every forex purchase would be too high, a senior regulatory official said.

That leaves gaps that mainland residents can exploit to get out from under the supervision of China’s authorities.

“People can always find ways of moving money overseas, while regulatory rules always lag behind,” said a source who specializes in cross-border asset management business.

A senior official at SAFE said in February that the regulator is studying the possibility of easing capital controls to allow mainlanders to use their annual foreign exchange quota to invest in overseas securities.

However, it’s next to impossible to make this happen in the near future, a person close to regulators told Caixin.

“Faced with huge cross-border investment demand that cannot be ignored, regulators would better off bringing it into the fold rather than suppressing it,” said the source in the asset management business.

Peng Qinqin contributed to this report.

Contact reporter Luo Meihan (meihanluo@caixin.com) and editor Michael Bellart (michaelbellart@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Follow the Chinese markets in real time with Caixin Global’s new stock database.