Caixin ESG Biweekly: Green Finance in China Needs Clear and Unified Rules

In depth

Regulators Can’t Keep Up With China’s Growing Carbon Financing Market

In the first quarter of 2021, Chinese companies issued more than 80 billion yuan ($12.3 billion) in carbon-neutrality bonds and asset-backed securities. However, the country’s rapidly growing carbon financing market lacks clear and unified regulatory standards to guide financiers to worthwhile projects and help them assess the carbon-reduction benefits of their investments. Read in-depth coverage on China’s carbon financing market here.

Top news items

People’s Bank of China (PBOC), National Development and Reform Commission (NDRC) and China Securities Regulatory Commission (CSRC)

PBOC, NDRC and CSRC jointly issued the Green Bonds Endorsed Project Catalogue (2021 Edition) (绿色债券支持项目目录2021年版), indicating that China will exclude high-carbon emission projects from its catalogue, such as for the clean utilization of fossil fuels, and will adopt the internationally recognized principle of “no significant harm” to introduce stricter carbon reduction constraints. The goal is to make China’s green bonds standards stricter, more normative and better aligned with the international mainstream.

National Energy Administration (NEA)

On April 22, NEA issued the Guiding Opinions on Energy Work in 2021 (2021年能源工作指导意见), setting out the main targets for this year: in terms of energy mix, China will lower the proportion of coal consumption to less than 56%, will increase roughly 200 billion kilowatt-hours of power through electricity replacement and increase the proportion of electricity in final consumption to 28%. In terms of supply, China will achieve total energy production equivalent to 4.2 billion tons of standard coal, 196 million tons of oil and 202.5 billion cubic meters of gas, and will bring its total installed capacity for non-fossil energy power to 1.1 billion kilowatts. In terms of efficiency, China will lower its energy consumption per unit of GDP to around 3%.

General Office of the CPC Central Committee and General Office of the State Council (Central Office and State Office)

On April 26, the Central Office and State Office published the Opinions on Establishing and Improving the Value Realization Mechanism of Ecological Products (关于建立健全生态产品价值实现机制的意见); they also issued a notice urging all regions and all departments to implement the Opinions according to their actual situations. The Opinions require all regions and departments to establish and improve relevant mechanisms for evaluating ecological products — including the investigation and monitoring mechanism, value evaluation mechanism, operation and development mechanism, protection compensation mechanism, value realization guarantee mechanism and value realization promotion mechanism.

State-owned Assets Supervision and Administration Commission of the State Council (SASAC)

On April 25, Zhang Xiaohong, deputy head of SASAC’s Bureau of Sci-Tech Innovation and Social Responsibility said that the commission will incorporate and prioritize ESG in the scope of social responsibility while encouraging central state-owned enterprises to strengthen ESG information disclosure. “Some listed state-owned enterprises have certain problems and deficiencies when it comes to ESG work, mainly a dearth of attention to ESG, low-quality ESG information disclosure and the lack of a well-established ESG governance mechanism.” Zhang said that SASAC will include ESG as a point of emphasis within the scope of social responsibility and accelerate SOEs’ work on ESG.

Ministry of Ecology and Environment (MEE)

On April 22, Li Gao, head of MEE’s Department for Addressing Climate Change, said that construction of a national carbon market had already entered a critical stage. The ministry will issue related rules and regulations for registration, trading and settlement as soon as possible, complete additional construction on registration and trading systems, properly organize quota allocation and operational testing and strive to launch online trading ahead of schedule. The first batch of 2,225 power enterprises has completed account data review on the registration system for domestic carbon emissions. At the time of release, they were working to complete all required data filings for third-party review by the end of April. Insiders estimate that the trading volume of China’s carbon market may reach 250 million metric tons, with a turnover of 6 billion yuan ($930 million).

China Securities Regulatory Commission (CSRC)

On April 19, the opening ceremony of the Guangzhou Futures Exchange was held. According to the CSRC, the establishment of the Guangzhou Futures Exchange is a significant move to improve the multilayer capital market system and serve the Guangdong-Hong Kong-Macau Greater Bay Area. In the next phase, the CSRC will strengthen financial support for green and low-carbon industries, support the issuance of green financing products, accelerate construction of the carbon emission futures market, and research listed companies’ environmental information disclosure systems. There is speculation that the first product issued by the Guangzhou Futures Exchange will be carbon emission futures.

SF Holding

On April 26, SF Holding Co. Ltd. announced that SF Express issued a 500 million yuan carbon neutrality bonds. Known as 21 SF G1, the bonds will mature in three years and have a coupon rate of 3.79%. SF Holding has become the first private firm to make such an issuance since the launch of carbon neutrality bonds. The bonds were oversubscribed by a factor of 2.3, with CSC Financial Co. Ltd. and Citic Securities Co. Ltd. as the lead underwriters. The delivery firm said that it plans to use at least 70% of the proceeds to repay green construction loans obtained for its headquarters, while the remainder will be used to replenish working capital.

Highlight

|

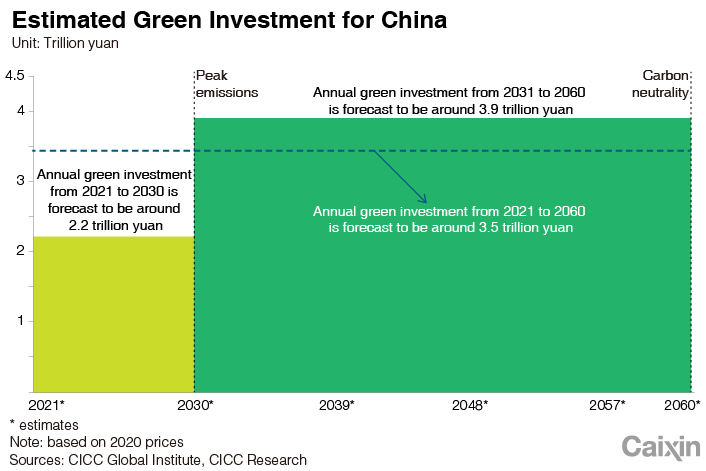

A study by CICC suggested that China’s green investment demand would total about 139 trillion yuan to accomplish carbon neutrality. On average, annual green investment demand accounts for about 2% of GDP.

Specifically, China’s annual green investment demand was estimated at 2.2 trillion yuan over 2021–2030 to reach peak carbon emissions, and at 3.9 trillion yuan over 2031–2060 to accomplish carbon neutrality. Over 2021–2060, the estimation was 3.5 trillion yuan.

Read more Caixin ESG Biweekly here.

Get our ESG Biweekly newsletter and more delivered to your inbox.

Download our app to receive breaking news alerts and read the news on the go.

- PODCAST

- MOST POPULAR