Wang Tao: China’s Demographic Challenges for the Next Decade (Part 1)

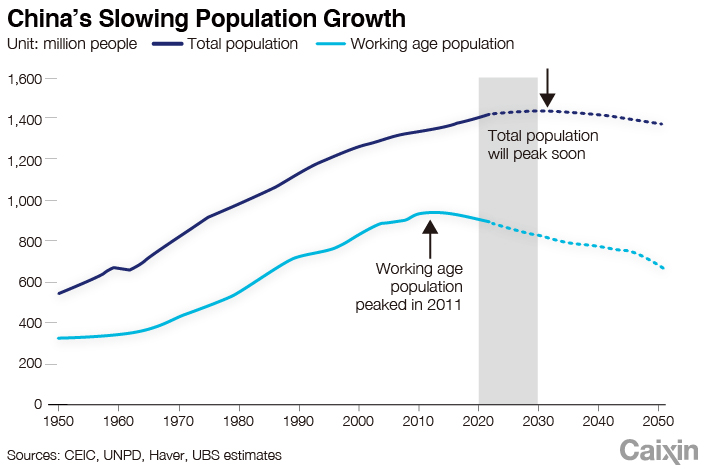

China’s much anticipated population census data was released. Not surprisingly, the country’s population growth continued to slow even as it fully relaxed the one-child policy in 2015. The latest census data also showed that total fertility rate had dropped to 1.3% in 2020, the share of people aged 60 and over had increased to 18.7%, and the average age of the population had increased 38.8 in 2020. These data have increased concerns about China’s future growth trend and other challenges brought by an aging population. Some pessimists are calling this a population crisis — one that will lead to grave economic consequences.

Before we analyze the implications of this on different sectors and asset prices, it is important to note that demographic trends tend to emerge over long periods, and their impact on macroeconomic indicators are often influenced by other key variables, such as macroeconomic policies and technological development.

What happened with demographic shifts in the past decade?

Some key numbers may be worth highlighting from the latest population census data:

* Population growth slowed to 0.53% a year this past decade from 0.57% previously, and total fertility rate dropped to 1.3 in 2020 (from 1.62 in 2010 and 1.69 in 2000, according to UNPD), though he latest drop may be affected by the pandemic in 2020. The relaxation of one-child policy first in 2013 and then in 2015 helped to push up birth rate in subsequent few years, though the effect did not look like it would last long. The third generation effect of the 1960s baby boom also helped to push up the number of births in the past decade, though that is behind us and China is likely to enter into a period of lower birth in the next decade.

|

* The population is aging rapidly. In 2020, the average of China’s population was 38.8, compared with 38 in the U.S. and 35.7 in 2010 and 31.9 (UBS estimate) 20 years ago. The share of 0-14 year olds increased by 1.35 percentage points from 2010, thanks to the relaxation of one-child policy and the ripple effect from the 1960’s baby boom (which pushed up the number of people in peak fertility age compared with the previous decade). There were 260 million people aged 60 year olds and over in 2020, or almost 19% of the population. Fewer people now enter the labor force than the number those retiring each year — working age population declined by about 40 million since 2010.

* Urbanization continued, though growth of rural migrant worker has slowed. In 2020, over 900 million people, or 63%, formally lived in cities, an increase of 236 million from 2010. The migrant population in urban areas totaled 331 million or an increase of 70%, of which 249 million were from rural areas, and 82 million were from other cities, reflecting increased labor mobility. At the same time, the latest China’s rural migrant worker survey showed that the population of rural migrant workers grew by only 18% in the past decade. Also, the share of migrants who moved outside of their home provinces declined, likely reflecting growth and job opportunities outside of coastal regions.

* Regional differences are apparent. As young people move to areas with more economic opportunities, the Northeast and central regions have seen both a drop in population and lower birth rates than elsewhere. Eastern coastal provinces remain the biggest draw for people, as Guangdong became the most populous province with 126 million people.

Almost a decade ago, we wrote that China faced challenges from aging over the next 10 years, outlining the likely demographic trends and implications for the economy. Back then, there were also concerns that the aging population would lead to a sharp decline in China’s GDP growth and manufacturing competitiveness. Reviewing the actual developments over the past decade relative to our predictions and those who feared bigger negative impact may help inform the thinking of the demographic challenges over the next decade.

In the 2012 report, we predicted that from 2011-2020:

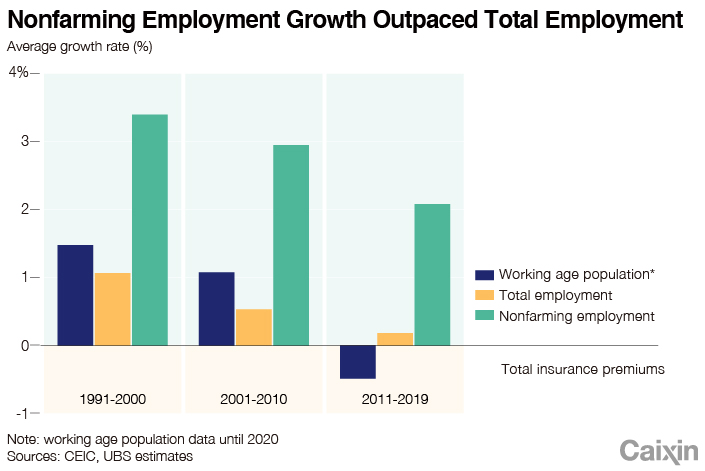

* China’s working age population would decline but nonfarming employment, the more relevant labor input for GDP growth, would continue to grow;

* GDP growth would slow but would still average more than 7%, faster than U.S. and Japan at the similar demographic stage

* Arrival of Lewis Turning Point does not necessarily mean losing manufacturing competitiveness as productivity gains can help

* Low-end labor intensive sectors might lose market share and some may move out of China, while higher value-added industries, such as automation equipment, health care and insurance should gain weight

* Pension systems would not face a big fiscal challenge from 2011 to 2020, but reforms would need to be done to prevent problems in the decades to come

* The rise in the dependency rate might only lead to a marginal decline in the household saving rate, and it cannot be expected to take care of rebalancing of the economy

* Property demand and demand for commodities may slow (the weaker of the predictions). The latest census data and economic development over the past decade are generally consistent with our view, showing that demographic impact was not as grave as some had feared.

|

A shrinking working age population

The working age population (15 years old to 59 years old) shrunk over the past decade, by a total 40 million people, but total employment continued to grow by an average 0.2% a year, likely reflecting increase in the underlying (not official) labor participation rate and the decline in the actual unemployment rate. Most importantly, nonfarming employment grew at an impressive 2.1% per annum between 2010 and 2019, albeit slower than in the previous two decades. The evidence supports our view that China still has not completed its labor transfer from nonproductive rural sector, and that total population or working age population was not a good prediction for employment growth, or labor input.

|

Also consistent with our prediction, China’s GDP growth slowed to a still rapid pace of 7.4% per annum from 2011 to 2019, before the Covid-19 pandemic brought 2020 growth down to only 2.3%. This pace was considerably faster than achieved by Japan in the 1980s, when it was at a similar demographic stage. During that decade, Japan’s average growth was 4.6% a year. In other words, China “getting old before getting rich” does not necessarily mean it cannot continue to get rich.

China’s overall manufacturing competitiveness did not drop as much as some had feared after reaching the Lewis Turning point — when wage growth started to rise. Labor productivity grew significantly to help keep unit labor cost (ULC) in the industrial sector from rising too sharply. In fact, manufacturing ULC rose by less in the past decade than in the previous one. China’s exports as a share of the global total continued to rise until 2015, before stagnating (though the figure recently moved higher due to China’s earlier recovery from the pandemic).

However, as predicted, China’s low-end manufacturing industry and labor intensive sectors did lose out due to rising labor costs. As some of the companies moved out of China (UBS Evidence Lab CFO surveys showed rising labor costs were among the top factors for companies moving production out of the country), China’s labor-intensive exports in global market share dropped, while Vietnam, Bangladesh and others picked up market share.

Growth in higher-end industries

Meanwhile, higher value-added manufacturing sectors, including automation equipment, expanded more rapidly. Industrial production (value-added) of these higher value-added and more sophisticated industries including machinery and equipment grew by an average of 9% in the 2011-2020 period, compared with 5% for labor-intensive industries such as textiles, garments, shoes and leather goods. Sales of industrial robots grew by 28% per annum in the last decade. Also, value-added in the medical and pharmaceutical sector grew by 11% per annum in the past decade, while life insurance premiums grew by 9.5% per annum for 2011-2020.

As we predicted, the aging population did not cause major stress in the pension system in the past decade — total pension revenue exceeded pension expenditures, resulting in a cumulative surplus of nearly 4 trillion yuan in the past decade. However, funding gap did appear in 2020 with pension revenue falling below expenditure, though this may be partly related to the pandemic’s hit to the labor market. The government did take policy actions such as expanding pension coverage and health insurance coverage significantly to help improve social protection for the aging population. However, it has not taken serious action on extending the retirement age or revising the pension payout structure to improve long-term fiscal sustainability. The government did transfer more state-owned equity to the national pension fund to help shore up the funding needed for the expected increase in pension gaps at the local level.

Still saving

China’s household saving rate declined only modestly in the past decade even with the rise in the dependency ratio. This has helped to sustain China’s high investment rate even as the government tried to reorient the economy toward more consumption. This is supportive of the demographic theory (see Mason and Lee, 2006; Wang Feng and Andrew Mason, 2008) about the “second demographic dividend”: a population with an increasing number of older workers who will face a long period of retirement has stronger incentives to save and accumulate assets, especially if they are not confident in the ability of their families or government to take care of their retirement. These savings can be invested to boost capital per worker and productivity growth. Correspondingly, China’s consumption as a share of GDP only rose gradually in the past decade. Clearly one cannot expect the demographic change to take care of rebalancing of the economy alone, as other policies are needed to help this process.

In the property sector, property sales, new starts and property investment growth all slowed in the 2011-2020 period from the previous decade, though it was still positive. The decline of the population in the main home-buying cohort and slowing urbanization pace contributed to the deceleration in housing market. On the other hand, average size of households continued to decline from 3.1 people per household in 2010 to 2.62 in 2020, and the average size of urban households became even smaller. This drop in household size generated an extra 77 million households in the past decade, far exceeding the increase in number of households that would have been brought by population growth alone (23 million). This and the recent “hukou” relaxation may have helped to support the housing market.

We have also seen average years of education of working age population increase further in the 2011-2020 decade, from 8.5 years in 2000 (UBS’s estimate) to 9.67 years in 2010 and further to 10.75 years in 2020. The latest demographic data also suggest the average years of education for those under 15 years of age rose from 9.08 years in 2010 to 9.91 years. Economists usually use average years of education as proxy for the quality of the labor force, or a measure of human capital, when calibrating the potential growth of an economy. The notable increase in the years of education of China’s labor force means a higher quality labor force, which has likely helped to offset the negative impact of the diminishing overall size of the labor force.

Wang Tao is the head of Asia economics and chief China economist at UBS. Investment Bank. The article is the first part of the author’s analysis on China’s latest census.

The views and opinions expressed in this opinion section are those of the authors and do not necessarily reflect the editorial positions of Caixin Media.

If you would like to write an opinion for Caixin Global, please send your ideas or finished opinions to our email: opinionen@caixin.com

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.