Weekend Long Read: How a London Power-Duo Outfoxed China’s Biggest Private Steel Giant

(London) — Nestled in London’s exclusive Mayfair district among high-end brands and eye-watering rents sits 51-52 New Bond Street, home to the London flagship store of Italian luxury fashion house Armani.

The seven-floor building was recently bought by the Reuben brothers, expanding a vast property portfolio for notoriously media-shy siblings David and Simon. The wealth of the Mumbai-born pair was estimated this year by the Sunday Times at 21.5 billion pounds ($29.6 billion), making them Britain’s second wealthiest on the list.

That nest egg is likely to have been helped amply by the at least 6.2 billion pounds they gained in a shrewd deal with a Chinese-invested consortium headed by Jiangsu Shagang Group Co. Ltd., China’s largest private steel firm.

Shen Wenrong, 75, is the founder and actual controller of Shagang Group, which like many Chinese mega firms has in recent years sought new revenue streams outside its core business amid a changing market.

In 2004, the Reuben brothers had purchased Global Switch Holdings Ltd. (GS) — the largest data center operator in Europe and Asia Pacific — for almost 600 million pounds.

|

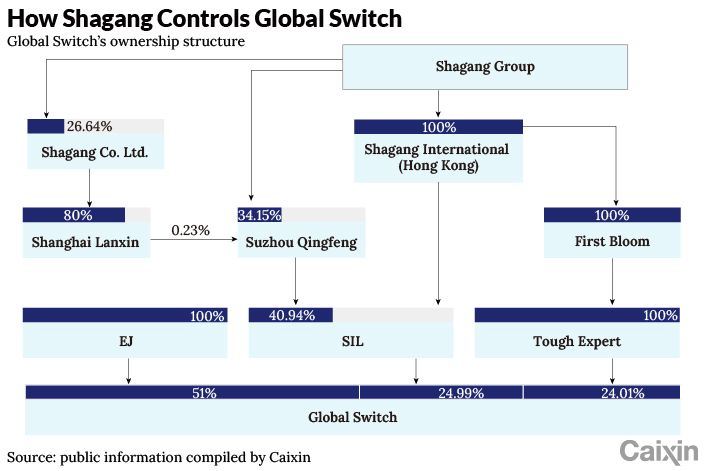

Between 2016 and 2019, the brothers sold GS to a Chinese-invested consortium headed by Shagang Group in three installments.

Including financial costs, the Shagang Group had to raise 7 billion pounds for the purchase. About 2 billion pounds came from its own coffers, while it pieced the rest together through a mish-mash of Chinese financial institutions. The actual capital contributors mostly invested through the trust schemes and bank wealth management products of those institutions, involving AVIC Trust Co., Ltd., Anxin Trust & Investment Co., Ltd. and dozens of banks.

Views differed on whether the deal was worthwhile. But Shagang Group, the holding company of the listed Jiangsu Shagang Co. Ltd. (002075.SZ), and the consortium it had assembled maintained their resolve, partly because the deal was a key part of the firm’s long term reorganization strategy. If GS could just be integrated into a company listed on China’s A-share market, Shagang’s value was bound to pass 100 billion yuan, putting profit from the deal within reach.

But Shagang’s cross-border major asset restructuring plan was beset by continual frustrations and setbacks. Financing costs rose for consecutive years. The firm fell under an insider trading investigation in which its shares were suspended from trading for a record 788 days and led to the departure of key staff.

Finally, on July 7, the Merger and Reorganization Committee of the Department of Listed Company Supervision of the China Securities Regulatory Commission (CSRC) put the kibosh on its planned shareholder reorganization. The firm’s application to issue shares, purchase assets in cash, and fundraise had not been approved because the applicant had failed to fully disclose overseas policy risks to the core competitiveness of its underlying assets, giving rise to uncertainties about profitability.

Shagang opened with a limit down for three consecutive trading days on July 8, July 9 and July 12, with the latest price at around 7.5 yuan ($1.60).

The rebuke caught Shagang and its financial advisors Huatai United Securities Co. Ltd. and China Securities Co. Ltd. (CSC) off guard. They thought it was a sure thing. A restructuring plan five years in the making was back at square one.

Shagang faces a dilemma. It is more than 60 billion yuan in the hole. There are huge uncertainties surrounding its listing on the Hong Kong Stock Exchange and U.S. stock market, as well as its entire or partial sale. The parties to the purchase of GS may be unable to recover their investments.

According to its 2020 annual report, Shagang Group’s operating income totaled about 152.9 billion yuan that year, while its net profit reached approximately 5.1 billion yuan, up 56% year-on-year. At the end of last year it held assets of approximately 211.7 billion yuan, but was saddled with debt — 125 billion yuan of it, up slightly from the previous year.

Starting in Shanghai — Shagang

Shagang’s acquisition of GS has roots in a dinner party held in August of 2016.

It was the M&A heyday for China’s listed giants. Major shareholders would set up shareholding platforms and tap consortia to acquire overseas assets, then issue A-share stocks to purchase the assets of the shareholding platforms, and finally consolidate their financial statements to inject the assets into the listed company.

|

Gradually, Shagang shifted its focus to GS. For the steel giant there were three goals: publish a restructuring plan that would perk up the listed firm’s stock price, grow its business and improve profitability, and make a windfall when it cashed out.

Founded in London in 1998, GS was already one of the world’s leading data center operators in Europe and the Asia-Pacific region by the time Shagang came sniffing around. It counts Apple Inc., Facebook Inc. and Amazon.com Inc. among clients that range from governmental organizations and tech firms to financial institutions to telecoms operators, and runs 13 data centers in London, Paris, Frankfurt and other cities.

In 2020, GS had an operating income of about $560 million with net profit of about 240 million, after turning around a loss the previous year.

The firm does not actually make core technology, but is a developer and operator. GS’s business income mainly comes from customer subscriptions, power services and other value-added services.

By June 2020, GS held about $7.9 billion in assets. Of that, property holdings made up the lion’s share — approximately $7.4 billion of their total assets.

GS’s initial intended acquirer was not Shagang Group but Beijing-based data center company Daily-Tech Beijing Co. Ltd. In mid-August 2016, Daily-Tech’s general manager, a former Shandong tax official named Li Qiang, met Nie Wei, the CEO of Shagang’s investment arm, Shagang Investment Holdings, at a dinner party in Shanghai. Speaking on behalf of Shagang chief Shen Wenrong, Nie asked Li about injecting the assets of Daily-Tech and another firm, Suzhou Qingfeng Investment Management Co. Ltd., into Shagang. Li agreed.

Suzhou Qingfeng was a special purpose vehicle established by Li in January 2016. The previous October, he had reached a preliminary agreement with GS’s shareholders concerning the acquisition of 51% of the firm’s equity. Li wanted to acquire GS through Suzhou Qingfeng, but he needed a tremendous amount of finance. A consortium of investors including Shagang Group and Anxin Trust were tapped to take a share of Suzhou Qingfeng, while the most powerful, Shagang Group, became the largest shareholder.

On Sept. 19, 2016, Shagang’s listed company announced its shares would be suspended due to a plan for a major asset acquisition, kicking off the protracted merger and reorganization.

Caixin can reveal there was more to the story between the little-known Daily-Tech and GS.

Prior to the deal, Hong Kong’s wealthiest tycoon Li Ka-shing was looking for investable U.K. assets, and took a fancy to the data center operator. But the Reuben brothers wanted to sell their asset to a firm that could create added value — since they had brought in all GS customers through their relationship network.

Despite Daily-Tech lacking the gravitas of one of Hong Kong’s richest men, Li Qiang was able to clinch the deal by proposing a plan to build new GS data centers in Europe and Asia, saying he could secure substantial leases from Chinese giants such as China Telecom Corp. Ltd. and Alibaba Group Holding Ltd.

For the Reuben brothers, it was smart business to sell GS to an investor who could deliver such contracts, which would drive up the company’s valuation.

Although Li Qiang said he had the contacts, he did not have the funds. So he courted Shagang Group, which was looking to invest outside of the steel industry.

Li Qiang’s connection to Shagang began prior to that dinner party in the summer of 2016. In February the prior year, Jiangsu Shagang’s ownership structure announced a huge change: Shagang Group “sold off” 55.12% of its shares to nine individuals, including Li Qiang, who planned to invest 741 million yuan to acquire 140 million shares of Shagang Group's listed arm.

Li Qiang still owes Shagang Group 329 million yuan in share transfer, and he still holds a small number of Shagang shares after selling 30 million on Aug. 6, 2019, cashing out about 209 million yuan.

Back in 2015, he had planned to push Daily-Tech to complete a backdoor listing through Shanghai-listed Sichuan Golden Summit (Group) Co. Ltd. (00678.SH) in 2015, but the plan had fallen over by January the next year. After that, Li Qiang’s became increasingly intertwined with Shagang, but in the end the firm cleaned him out due to his lack of financial clout.

Smart business

Li Qiang, Shagang and the China-invested consortium backing them were no match for the shrewdness of the Reuben brothers.

When Suzhou Qingfeng acquired 51% of GS’s shares through its wholly owned overseas subsidiary Elegant Jubilee Ltd. (EJ) in December 2016, GS already had an impressive valuation of 4.6 billion pounds ($6.3 billion). Through clever leveraging, the duo would eventually sell it for 2.3 billion pounds more.

Less than a year and a half after the first installment, when SIL, another shareholding platform composed of Shagang International (Hong Kong) Co. Ltd. and the consortium, acquired 24.99% of GS’s shares, the valuation for GS rose to 7.18 billion pounds. A year later in March 2019 when Shagang took GS’s last 24.01% through its wholly-owned overseas subsidiary Tough Expert, GS had a still higher valuation of 7.4 billion pounds.

GS’s continuously rising valuation was largely due to the Reuben brothers structuring the deal in their favor.

According to public information, in the share transfer deal of December 2016, GS’s valuation was determined by 19 times the estimated earnings before interest, taxes, depreciation and amortization (EBITDA) of its fiscal year 2017, minus that year’s estimated liabilities, while taking into account the related transaction costs. In contrast, the two deals in 2018 and 2019 were based on business negotiations between the two sides that relied on value analysis from advisory giant Deloitte.

Caixin can reveal that when they sold the initial 51% share of GS, the Reuben brothers convinced Li Qiang to sign a tag-along clause that stipulated the sale of the remaining share should be calculated according to the most recent EBITDA. If the sale did not go through, the brothers would have the right to sell the remaining 49% to a third party, along with the tag-along rights on the 51% of shares that they had already sold. The buyer would have to acquiesce.

The fact that Li Qiang won the project by promising to provide GS with big orders from China was bound to drive up GS’s valuation, while the Reuben brothers required that their remaining 49% of the shares would be sold at the higher price.

“It was a case of ‘help me make money and then help me count it,’” said one insider close to the deal.

“If (the Shagang consortium) didn’t buy the remaining 49%, (the Reuben brothers) could sell the rest — and what they’d already sold to them — to someone else,” the person explained.

When the Reuben brothers sold the shares for the first time, they would have predicted a continuous rise in the valuation and targeted a higher price. They also made meticulous calculations in response to their concerns that the China-invested consortium may fail to complete the acquisition of the remaining 49% of the shares. According to one trader close to the deal, the Reuben brothers signed an intention agreement with Elliott Management, a vulture fund in the U.S., as a minimum guarantee plan.

This was not deception or intrigue, but smart business.

Unfortunately for him, Li Qiang signed all the agreements, including the tag-along right clause, and then brought in the China-invested consortium. It was only later that other participants in the China-invested consortium realized the Reuben brothers had never intended to advance or retreat with them, but to sell GS at a sky-high price.

After taking 51% of the shares, Li Qiang and Suzhou Qingfeng brought in some new business as promised. Daily-Tech Hong Kong signed agreements with GS on data center business in Hong Kong, Singapore and Frankfurt North in 2017. But this also created the hidden danger of Daily-Tech Hong Kong’s future default, which had a significant impact on GS’s revenue in 2019.

The ideal and reliable arrangement for the Chinese side was to hold GS with foreign investors while maintaining the controlling interest. However, the existence of the tag-along right clause made it clear to the China-invested consortium that this would no longer be possible. After the last transaction in August 2019, the Reuben Brothers withdrew completely from GS and resigned from the board, but CEO John Corcoran and CFO David Doyle remained. The other four members of the board were from the Chinese side — aside from Nie and Li Qiang, they were Shen Qian, the second son of Shen Wenrong and chairman of the Shagang Group board, and the board’s vice chairman He Chunsheng.

The Reuben brothers pocketed 6.242 billion pounds in cash. They had worked for the money — when they purchased GS for 600 million pounds in 2004, seven years after it was founded, the firm was a nonperforming asset in a distressed asset package, which had lost money for years. After the Reuben brothers acquired GS through their subsidiary Aldersgate, they invested in the firm, helping it turn around its operations, setting up centers all over the world, and growing it into the largest third-party data center operator in Europe.

David and Simon Reuben were born in Mumbai, India in 1941 and 1944, to Jewish parents with origins in the Persian Gulf, and immigrated to London when they were teenagers. They did not receive a higher education and went directly into business. David started his career as a metals trader, while Simon first entered the carpet industry.

The older brother did well, and soon began to invest in real estate, buying a lot of property in the early 1970s and selling it in a market crash in 1972, then snapping up property in London at low prices, while David set up his own metals production and distribution company, Trans-World (TW), in 1977.

What really made them was their acquisition of Russia’s United Company, RUSAL. In the changing times of the early 1990s, the brothers sensed a business opportunity and bought the then-privatized Russian aluminum company RUSAL at a bargain price through TW. They expanded the aluminum producer’s revenue streams from aircraft to automakers such as Mercedes-Benz AG, swinging its losses into profit.

For a time, the brothers were arguably Russia’s most powerful foreign businessmen and worked with the nation’s new oligarchs, but were also embroiled in disputes. The duo made made billions through TW in the years after the dissolution of the Soviet Union — in their heyday, TW and its associated companies controlled 7% of the global aluminum trade.

At that time, some in Russia saw TW as emblematic of greedy foreign capital. At a smelter in Krasnoyarsk, the third-largest city in Siberia, the so-called “Great Patriotic Aluminum War” took place from 1994 to 1998. This was a bloody battle for control between local gangs and smelters. In the end, dozens of people were killed in a series of murders, including local bankers, crime leaders and factory managers. These victims included TW’s partners and competitors.

After the bloodshed, the Reuben Brothers sold RUSAL to Russian oil tycoon Roman Abramovich in 2000 for 300 million pounds.

Reuben Brothers Ltd., founded by the brothers under their surname, is now a diversified investment company with businesses such as real estate, private equity, venture capital and nonperforming assets. Its real estate investments involve offices, retail, hotels, residential and infrastructure properties around the world.

The tax man from Shandong

In a June 2017 reply to the Shenzhen Stock Exchange, Shagang’s listed company named Li Qiang as a man experienced in the operation and management of data centers and related industries, and said he possessed professional competence, providing expert guidance for Suzhou Qingfeng’s acquisition of GS.

Born in Shandong in 1968, Li worked at the Shandong Laoling Municipal Tax Service and served as director of the Jinan Innovation Zone Tax Service. He later became deputy director of the Shandong UniTax Certified Tax Agent Firm. Finally, he served as president of Chinese data center operator Daily-Tech.

Li Qiang is a complex figure. While signing the tag-along right clause exposed his lack of attention to detail, winning the GS project demonstrated his impressive ability to mobilize resources.

Shagang, which was looking for cross-border mergers and acquisitions, did need a fixer like Li Qiang at the beginning of the deal. But due to various issues and his own comparatively shallow pickets, Li Qiang would be knocked out early.

Suzhou Qingfeng’s core assets included the 51% of GS’s equity and 12% of Daily-Tech’s equity, but Daily-Tech’s performance was disappointing. It had been in the red from 2013 to 2016, with spiraling debts. In 2016, its net deficit reached 51.9 million yuan.

In the initial stages of the GS acquisition, Daily-Tech’s wholly owned subsidiary in Hong Kong had developed business ties with GS. However, Daily-Tech Hong Kong failed to pay GS for business transactions and broke the contract, incurring liquidated damages of billions of yuan. In 2019, GS reported losses of 2.6 billion yuan, largely incurred by Daily-Tech. This directly led to Suzhou Qingfeng’s operating revenue of 3.1 billion yuan in 2019, a net deficit of 4.4 billion yuan.

Details of the aforementioned dinner party were disclosed in the CSRC’s October 2019 written decision on an insider trading case against a Beijing restauranteur named Hua Lei. Li Qiang was a regular at Hua Lei’s restaurant. Hua drew the attention of the regulator when he suddenly bought 1.31 million Shagang shares at a price of nearly 20.96 million yuan in August 2018.

The CSRC determined that the relationship between Hua and Li Qiang, who had insider information, had driven the stock purchase — which was timed to benefit from Shagang announcing its GS deal. The CSRC ordered Hua to forfeit his ill-gotten gains and fined him 600,000 yuan. No punitive action against Li Qiang was announced.

More troublesome for Li Qiang was his falling out with Shagang. Under continuous pressure from A-share investors, Shagang was determined to get GS listed on the domestic stock market. But the firm changed course slightly, opting to pull out of acquiring the 88% of Daily-Tech. Instead, it aimed at acquiring 100% of the shareholding platform Suzhou Qingfeng. In June 2019, Suzhou Qingfeng changed its designated negotiator to Nie, the CEO of Shagang’s investment arm.

Notably, according to an announcement dated Sept. 21 2020, from Shagang, Nie asked to step down from his roles as vice president and general manager for personal reasons, and said he would not take any position in the listed company. It was less than half a year after his appointment. Rumors swirled about the reason behind the sudden resignation of the relatively young and skilled general manager. Nie graduated from the Zhongnan University of Economics and Law with a master’s degree in finance. He served as senior manager at China Construction Bank Corp.'s (CCB) risk management department prior to his roles as assistant to the director of the investment department of Shagang Group’s board of directors and deputy director of the investment department.

Sources told Caixin that Nie remains in his position at Shagang Group, and is still a director of GS. His resignation from the listed company has been attributed to other factors and is internally connected to the restructuring plan that has been full of twists and turns.

At that time, the efforts expended in the A-share market brought no progress. After the international environment faced major changes in 2017, Li Qiang made an attempt to merge his Daily-Tech into GS to some extent for Hong Kong’s IPO in the second half of 2019, but Shagang Group insisted on the A-share market and rejected him.

According to the analysis of an insider with close connections to the transaction, “Li Qiang was in a dire financial situation. Shagang Group didn’t support him, so he had to pay financial costs every day and he couldn’t bear the pressure. Meanwhile, the Chinese-funded financial institutions that had previously backed Li Qiang gradually turned their backs and signed agreements with Shagang Group. Finally, Li Qiang had to hand over his power of management and leadership over the project.”

In May 2020, GS’s board of directors was reshuffled. Shen Qian and Li Qiang were replaced by AVIC Trust Vice President Li Peng and Shagang Group’s chief accountant Wei Guo. Li Qiang was turfed out.

The listing dream evaporates

To acquire all of GS’s shares plus financial costs, Suzhou Qingfeng and Chinese-invested consortiums put in more than 60 billion yuan. Of that sum, Shagang Group directly contributed more than 20 billion yuan, accounting for the largest share. Many of the Chinese-invested consortiums sustaining Suzhou Qingfeng opted to cash out and withdraw after the A-share listing.

|

|

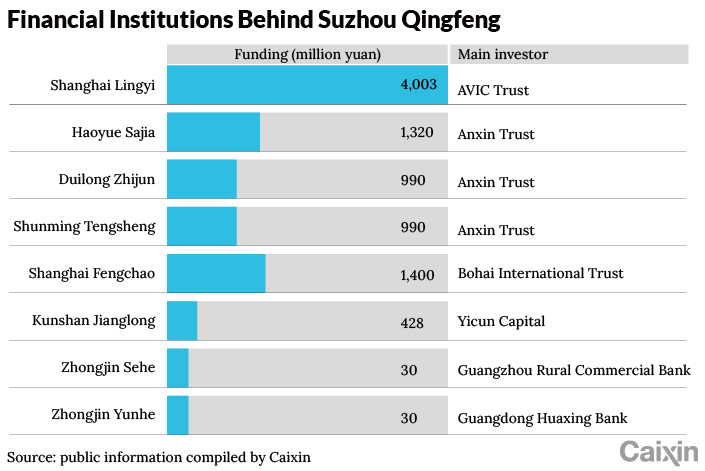

The shareholders contributed a total of 21.7 billion yuan to Suzhou Qingfeng. Previously, during the acquisition of the 51% of GS's equity, a total of 2.3 billion pounds was paid for the deal and relevant affairs. According to public data, Shagang Group is the largest shareholder, with 34.15%, of Suzhou Qingfeng. The other 14 shareholders are mainly backed by financial institutions.

Suzhou Qingfeng’s second-largest shareholders are the Shanghai Lingyi Investment Center (Limited Partnership) which holds 18.39% of the shares and three parties acting in concert — Haoyue Shajia, Duilong Zhijun and Shunming Tengsheng — that collectively hold 18.39% of the shares. The former was supported by the AVIC Trust with a contribution of 4 billion yuan, while the latter was backed by the Anxin Trust with a contribution of 3.3 billion yuan. In addition, Bohai International Trust Co. Ltd. contributed 1.4 billion yuan and the V-Capital Group invested 428 million yuan.

Caixin has learned that when SIL purchased the 24.99% of GS for 2.1 billion pounds, Shagang’s Hong Kong subsidiary contributed 40% of the funds, while the remaining 60% included a loan of $1 billion offered by China Citic Bank International Ltd. — China Citic Bank’s subsidiary in Hong Kong — and capital from China Merchants Bank Co. Ltd. Shagang Group guaranteed the bottom line. Beyond that, the AVIC Trust’s products were guaranteed by Shagang Group; that is to say, the trust and wealth management should be considered Shagang’s financing. Shagang handled highly leveraged buyout deals.

Behind these financial institutions lie multi-layered nested structures of trust and asset management schemes and wealth management products. For example, the AVIC Trust’s 4 billion yuan came from 24 entities, including Huishang Bank Corp. Ltd., Heihe Rural Commercial Bank Co. Ltd., Bank of Xingtai Co. Ltd. and Jinshang Bank Co. Ltd., while Bohai Trust’s 1.4 billion yuan mainly came from JC Bank (now Shanxi Bank)’s equity capital and financial capital; the Beijing Zhongjin Sehe Venture Capital Center (Limited Partnership) and Beijing Zhongjin Yunhe Venture Capital Center (Limited Partnership) invested 30 million yuan each from the wealth management products of Guangdong Huaxing Bank Co. Ltd. and Guangzhou Rural Commercial Bank Co. Ltd., respectively.

Anxin Trust’s contribution of 3.3 billion yuan was offered by Jianghai Securities Co. Ltd., Bank of Zhengzhou Co. Ltd., Changchun Rural Commercial Bank Co. Ltd. and other institutions. Since the Anxin Trust faced restructuring due to its own financial problems, its capital contribution to Suzhou Qingfeng was frozen by the Shanghai Financial Court in 2019. Shagang explained in an announcement that this portion was managed by and registered under the Anxin Trust, and was not included in its own assets. It may have been caused by a mistake made in the application by the execution applicant. After an investigation, the court reversed the decision to freeze the assets.

There were more risks. After the launch in 2016, financial products with maturity dates were under great pressure to withdraw due to the failure to implement the firm’s restructuring. At present, a portion of Suzhou Qingfeng’s shareholders have withdrawn from the deal by transferring their stakes to new shareholders and Shagang Group.

For example, Qinhan New City Wanfang Investment Partnership (Limited Partnership), a former shareholder of Suzhou Qingfeng, was supported by Bank of Benxi Co. Ltd., Leshan City Commercial Bank Co. Ltd., Hunan Longhui Rural Commercial Bank, Hunan Shaoyang Rural Commercial Bank and others. In March 2020, Qinhan Wanfang transferred its 0.23% stake in Suzhou Qingfeng to new shareholder Yuxin (Xiamen) Big Data Equity Investment Fund Partnership (Limited Partnership); in September, it transferred the remaining 4.37% (corresponding to a contribution of 950 million yuan) to the new shareholder Tianjin Jiayuan Kesheng Partnership (Limited Partnership). In addition, the Shanghai Daobi Asset Management Center (Limited Partnership) transferred its 3.68% stake (corresponding to a contribution of 800 million yuan) to the Shagang Group prior to its withdrawal.

However, some investors have extended the maturity dates of their financial products. For example, the financial capital of Guangdong Huaxing Bank and Guangzhou Rural Commercial Bank were provided for the Beijing Zhongjin Sehe Venture Capital Center (Limited Partnership) and Beijing Zhongjin Yunhe Venture Capital Center (Limited Partnership) — shareholders of Suzhou Qingfeng — through Shenzhen Rongtong Capital Management Co. Ltd. The expiration date of RT Capital’s financial products was Jan. 24, 2020, but the product manager and ultimate equity holder committed not to liquidate before the IPO lockup period expired.

The risk prospects of these financial products and institutions depend on the future of GS and the decisions of Shagang Group.

Data centers become sensitive

In June 2017, the Australian Department of Defence announced it would terminate its cooperation with GS by 2020.

The Global Switch Sydney East / West Data Center held top secret information for the Australian government, including sensitive details of national defense and intelligence arrangements. Australia will spend approximately $200 million to transfer the data to a government facility.

In early 2021, Shagang responded that most Australian public institutions still maintain a cooperative relationship with GS. Since the proportion of income GS gained from Australian public institutions was low, the withdrawal of some public institutions would have a minor impact on GS, and predicted the company would quickly win new enterprise clients to fill this gap.

Alarm bells should have been ringing.

Globally, telecoms operators have gradually withdrawn from the data center industry while large cloud service providers and internet companies have made a concerted push into the space. Cloud computing has led the global data center industry to prosperity and continuously raised the requirements for access to the data center market, concentrating it around firms such as Amazon and Alibaba, as well as rising entrant Huawei Technologies Co. Ltd.

But in a world of cybersecurity reviews and trade blacklists, Chinese ownership has increasingly become a liability for firms like GS.

China is just the latest nation to indicate the data center industry is now a matter of national security, with a high-profile post-U.S. listing investigation of ride-hailing platform Didi indicating that firms with even relatively small data sets that are involved in cross-border transfers will be scrutinized by the Chinese government.

In a sign of the times, regulators have long been concerned about the possible consequences brought by GS’s integration into an A-share listed company, and policy uncertainty overseas has emerged as a significant barrier. The CSRC and Shenzhen Stock Exchange interviewed Shagang about the relevant issues during several previous rounds of inquiry.

In accordance with the foreign investment law of France, where GS operates a data center, any foreign investor that has directly or indirectly controlled any French company engaged in sensitive industries — including the data center industry — is obliged to declare such information with the French Ministry of the Economy and Finance. Foreign investors are required to report any subsequent change in equity.

Meanwhile in Germany, the Foreign Trade and Payments Act holds that any investor from outside the European Union that has directly or indirectly obtained more than 10% of the right to vote in German companies engaged in “important infrastructure” shall declare its investment transactions to the German Federal Ministry for Economic Affairs and Energy. According to the German Federal Office for Information Security Bill, any data center with a power capacity of more than 5 megawatts as of June 30 of any year should be considered “important infrastructure.” This requires GS’s subsidiary data center in Germany to observe the Foreign Trade and Payments Act.

Shagang indicated in its deal scheme that the deal could not be implemented until it had received the foreign investment review of the French Ministry of the Economy and Finance, and the foreign investment control review of the German Federal Ministry for Economic Affairs and Energy. In addition, Shagang asserted that there would not be any substantial barrier to no-objection procedures.

In 2016 when the deal began, former British Foreign Secretary Malcolm Rifkind publicly expressed his concern: “The Government needs to be satisfied there are no risks involved. I would assume they will be taking advice as we speak from the intelligence agencies, from GCHQ in particular, and from others with the expertise to know the risk factor. It will be based on that as to whether there should be some intervention. If there is a significant national security dimension then anyone selling a British company would normally listen very carefully to the advice they receive from the British Government."

In its letter of inquiry, the Shenzhen Stock Exchange raised the same concerns with Shagang. It asked the company to disclose whether there were other items that required approval regarding GS’s integration into an A-share listed company, and whether this integration needed to undergo an antitrust investigation in other countries and regions according to their requirements for the security and confidentiality of the data center industry. The exchange wanted to learn whether this would result in anything that would hurt GS’s businesses, credit rating or financing costs after the deal, given the current political environment.

Shagang replied that GS generally did not provide internet services or information technology network security and data security services for its clients. GS’s employees and contractors were not allowed to access the clients’ servers without the clients’ permission, while GS itself would never access clients’ data under any circumstances. According to Shagang, GS had established a perfect system to ensure clients’ data security. This system included the independent and professional security control committee that recruited external experts to report regularly to clients and external institutions, thereby ensuring a high-level data security protection.

Pushing ahead

|

As it turned out, GS had prepared for both eventualities. In December 2019, U.K. outlet Sky News reported GS’s plan to be listed in Hong Kong. The firm selected CLSA, Goldman Sachs, JPMorgan Chase & Co. and Morgan Stanley to handle its IPO in Hong Kong. The IPO prospectus was ready.

Considering the scale of GS, its IPO would be a large project of high value to the Hong Kong market. But the plan would be frustrated by Shagang Group, which was still intent on integrating GS into a mainland-listed company.

After the failure of the integration, Shen Wenrong faced a problem: should Shagang put forward another similar proposal, or launch a GS IPO in Hong Kong or the U.S., or just sell off its stake in GS?

According to the data disclosed in this deal, excluding the breach of contract and exchange gains and losses of Daily-Tech Hong Kong, the operating income of GS reached 345 million pounds in 2018, including net profit of 133 million pounds. In 2019, the operating income and net profit were 355 million pounds and 116 million pounds, rising to 366 million pounds and 126 million pounds respectively last year.

So what is GS worth?

In December 2016, when EJ acquired 51% of GS, the valuation was 4.6 billion pounds. This figure increased to 7.2 billion pounds in March 2018 when SIL acquired a 24.99% stake. A year later, Tough Expert acquired the remaining 24.01%, this time putting the valuation at 7.4 billion pounds.

On Dec. 11, 2017, Deloitte Consulting LLP released a GS equity value analysis report that took June 30, 2017, as the base day and analyzed the 100% equity value of GS through the discounted cash flow model. The report shows that the valuation of GS with a discount rate of between 7% and 9% was between 8 billion pounds and 12.9 billion pounds.

According to the Shagang proposal rejected by the CSRC, investment banks took June 30, 2020, as the base day and estimated the 100% equity value of GS through the income approach to be 4.4 billion pounds, or 38.7 billion yuan. This differs from the valuation conducted in March 2019 by nearly 2 billion pounds.

Shagang said that the difference was mainly caused by different valuation methods. The previous transactions were all cash transactions of overseas assets, which are highly marketized, and the transaction price was determined by both parties through negotiation. As this was a business negotiation, Shagang did not recruit an independent appraiser to give the equity value of GS through the income approach, and Shagang thus failed to predict the profits corresponding to the prices of the previous three equity transfer transactions.

This time, Shagang’s reorganization trade plan was to be completed by a listed company through issuing shares to purchase assets, constituting a major asset reorganization. According to CSRC regulations, the trade price of this kind of transaction should be determined by both parties through negotiation based on the asset evaluation results and in accordance with asset evaluation standards, and national laws and regulations.

It was reported that in the IPO prospectus prepared at the end of 2019, investment banks took March 2019 as the base day and evaluated the GS equity value to be around 6 billion pounds.

Whatever the rate, rumors are swirling that The Blackstone Group Inc. and Li Ka-shing are circling. The thinking is that with the support of Blackstone, GS could stabilize its clients, and Shagang Group could retain its 49% overseas equity to repay trust products with its domestic receipts.

Nevertheless, Shagang Group may continue to push to integrate GS into an A-share listed company, though the lockup period would create costs and challenges.

GS did not respond to inquiries.

Contact reporter Yue Yue (yueyue@caixin.com) and editor Flynn Murphy (flynnmurphy@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- MOST POPULAR