China Moves to Rein In Skyrocketing Plate Glass Prices

China’s industry ministry has moved to curb plate glass prices after high demand from the real estate sector and capacity limits pushed the key building material to highs last seen more than a decade ago.

Businesses have been urged to increase production, improve coordination across the supply chain and pay attention to the price of raw materials like quartz sand, soda ash and natural gas in order to restore price stability, the Ministry of Industry and Information Technology (MIIT) said in a statement (link in Chinese) on Wednesday.

|

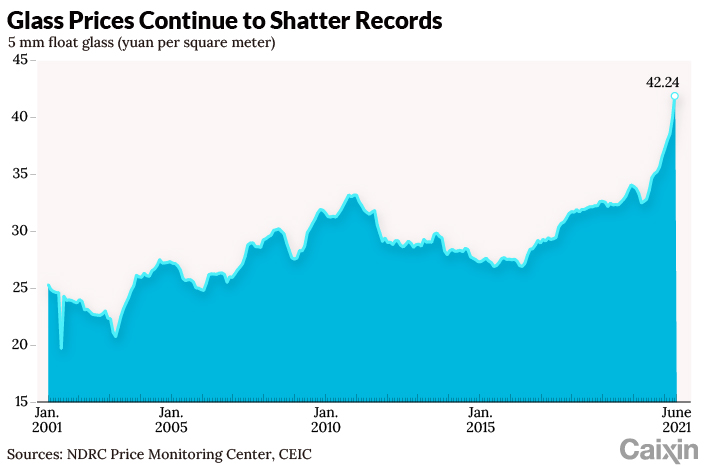

The move comes against the backdrop of a year of elevated glass prices. Data released last month by the National Development and Reform Commission, China’s top economic planner, showed that the average monthly price of 5-millimeter float glass rose nearly 30% to 42.24 yuan ($6.53) per square meter between May last year and June.

Glass futures also hit all-time highs of 3,079 yuan per ton at the end of last month, accelerating from their more modest rises earlier in the year, according to data from the Zhengzhou Commodities Exchange.

“Plate glass prices reached their highest point in a decade at the end of last year and have risen by a further 50% or so this year,” said a raw materials analyst at a major brokerage who requested anonymity as they are not authorized to speak to the media.

The high prices mainly benefit China’s large glass manufacturers but put the squeeze on small and midsize downstream firms, a trend that may have prompted the action from the central government, the analyst said.

Domestic producers of plate glass — which is used in windows, doors and some screens — saw their revenue grow by 46.2% year-on-year in the first six months of 2021, while total profit rose by 155%, according to MIIT data.

The trend has been driven in part by high demand in the real estate sector as developers take advantage of policy incentives during China’s recovery from the Covid-19 pandemic, the analyst said. The nation added 25.7% more floor space in the first half of the year than it did in the equivalent period of 2020, according to government data.

At the same time, China’s glass industry is in the grip of a supply squeeze, after more than a decade of government moves to reduce overcapacity and pollution led many factories to close or scrap planned expansions.

“The corporate impulse to invest in glass capacity has been restrained by policy guidance,” the analyst said, adding that the controls had exacerbated the mismatch between supply and demand that began to push prices higher last year.

Prices for plate glass have also climbed alongside those for energy and raw materials. As of July 28, spot prices for natural gas in Northeast Asia had leapt by 493% year-on-year and 232% compared with 2019, according to commodities consultancy Oilchem. Prices for quartz sand are also on the rise amid high downstream demand and increased extraction costs.

Contact reporter Matthew Walsh (matthewwalsh@caixin.com) and editor Flynn Murphy (flynnmurphy@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR