Opinion: As Policies Shift, How do Foreign Investors View Chinese Assets?

Chinese policies have recently shifted toward encouraging more births and common prosperity. These policies are aimed at addressing medium- to long-term and deep-rooted issues in the economy, but they are difficult for foreign investors to understand, and tend to cause them to panic and become risk averse.

In July and August, we saw declines in the flow of overseas funds through the Stock Connect programs into the Chinese mainland’s stock market and occasionally large outflows, accompanied by pessimistic comments from some foreign investors. But in early September, inflows seemed to have gone up again. So how exactly do overseas investors currently view A-shares and how will they invest in the future?

|

A small number of foreign investors believe they should stay away from the Chinese market, which may drop further. Most investors, while acknowledging short-term adjustments and volatility, haven’t changed their willingness to invest in the Chinese market in the long term.

A survey of global public institutions shows investors’ understanding of, and interest in, Chinese assets further increased after the Covid-19 pandemic, and their willingness to invest in the medium to long term also increased.

Global Public Investor 2021, a survey of more than 100 central bank reserve managers, sovereign funds and public pension funds controlling a total of $42.7 trillion in assets, shows that nearly 40% plan to increase their exposure to Asia, up significantly from 15% last year. The interest was driven in large part by a jump in enthusiasm for China and the yuan, the survey said.

In contrast, only 8% and 7% of the institutions plan to increase their net holdings in North America or Europe, respectively. The survey was released in July by the Official Monetary and Financial Institutions Forum (OMFIF), a global think tank.

Firstly, the internationalization of the yuan is an important factor for foreign investors’ growing acceptance of Chinese assets.

The rise in yuan internationalization is driven by China’s insistence on opening-up and its integration into the global system, by central banks’ demand for asset diversification, and by certain geopolitical factors, such as the sell-off of dollar holdings and the increase in yuan holdings by Russia’s National Wealth Fund.

According to the OMFIF survey, 30% of global central banks plan to increase their yuan exposure in the next 12 to 24 months, significantly higher than last year, and 68% said they would be more involved with the yuan over a longer period of time.

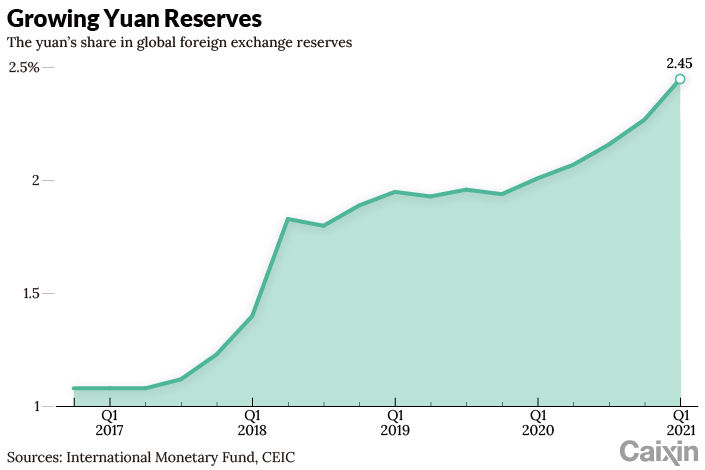

International Monetary Fund data show that, at the end of March 2021, the yuan’s share in international foreign reserves rose to 2.45% from 1.08% at the end of 2016, corresponding to an increase from $90.8 billion to $287.5 billion, having tripled in about five years.

|

Secondly, China’s relatively quick recovery from its domestic Covid-19 epidemic created an appealing investment environment, and a better economic outlook promises relatively high returns. This has boosted foreign investors’ interest, and is in line with the demands of long-term investment institutions in this post-pandemic era of extremely low interest rates.

However, some international investors also expressed concerns about Chinese assets, with worries focused on two main areas: geopolitical issues such as U.S.-China relations, and domestic regulatory and corporate governance issues.

Amid the deterioration of U.S.-China relations, Washington has introduced measures to restrict some public institutions’ investments in China, such as strengthening the scrutiny of U.S. pension funds’ investments in Chinese securities, prohibiting all investment in certain Chinese stocks, and cracking down on Chinese firms listed in the U.S.

However, these policies are usually limited to the public sector and do not involve the private sector, and the U.S. public sector’s holdings of Chinese assets are limited, so the impact of these measures has been minor.

Moreover, recent signs of detente in U.S.-China relations have helped to alleviate the concerns of foreign investors. President Xi Jinping’s telephone call with U.S. President Joe Biden on Sept. 10 sent out a positive message, signaling the likelihood of a thaw and marginal improvement in the coming period.

Looking ahead, environmental, social and governance (ESG) and green investments are likely to become more and more important. The OMFIF survey shows most institutions indicate that they are making ESG investments in some way.

More than 90% of surveyed central banks have invested in green bonds as part of their reserves; 60% plan to increase their holdings of green bonds, up from 45% a year earlier. ESG is gaining traction globally and is likely to be an important investment direction for years to come, as well as a key area of enhancement for China’s capital market to be integrated into the global system.

Luo Yunfeng and Liu Yaxin are macro analysts of China Merchants Securities Co. Ltd.

This article has been edited for length and clarity.

Contact translator Zhang Yukun (yukunzhang@caixin.com) and editor Joshua Dummer (joshuadummer@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR