Magnesium Prices Down 40% in Key China Production Hub as Lights Come Back On

Prices of magnesium in China’s key production region have dropped as much as two-fifths from a record high in September, as smelters ramp up output amid ongoing concerns about a global supply shortage.

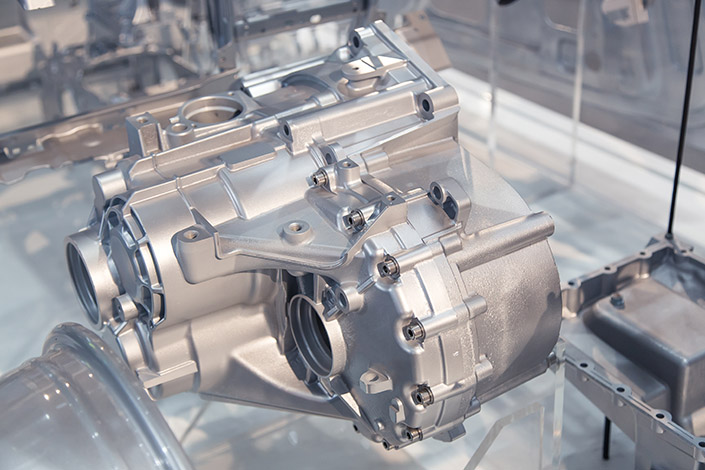

The cost of the key raw material, which is a widely-used alloying element in the production of aluminum for cars and bikes, soared last month as power shortages forced local authorities in Northwest China’s Shaanxi province to halt or limit production at many factories.

In Fugu county, which produced half of the magnesium China made last year, production was suspended from Sept. 20 to Sept. 30, slashing monthly magnesium output in the surrounding city of Yulin by almost 40% year on year.

According to data from China Magnesium, the ex-factory price range of 99.9% grade magnesium ingot from Fugu stood at 42,500 yuan ($6,643) to 43,000 yuan per ton on Wednesday, down 10% over the past week and 39% from a record high of 70,000 yuan per ton on Sept. 23.

Magnesium smelters in Fugu have recovered about half of their lost capacity since the beginning of the month. Falling prices of raw inputs such as coal and ferrosilicon have also helped ease pressure.

China produced 86% of the world’s magnesium last year, and Shaanxi accounted for 64% of the country’s total output, according to the China Nonferrous Metals Industry Association. Fugu county alone produced 478,600 tons of magnesium last year, accounting for half of the country’s overall output.

Warnings of a magnesium shortage were triggered earlier this month by industrial users in Europe, which imports 95% of its magnesium from China. There were also jitters in North America, Japan and South Korea. Some analysts have compared the impact of a magnesium shortage on the global auto industry to the current shortage of semiconductors.

On Oct. 22, a dozen European trade associations issued a joint statement warning of potential plant shutdowns and a loss of jobs stemming from a drastic reduction in magnesium supply from China since September, calling it “an international supply crisis of unprecedented magnitude.” Europe is expected to run out of magnesium stocks by the end of November, the letter added.

Contact reporter Kelsey Cheng (kelseycheng@caixin.com) and editor Flynn Murphy (flynnmurphy@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR