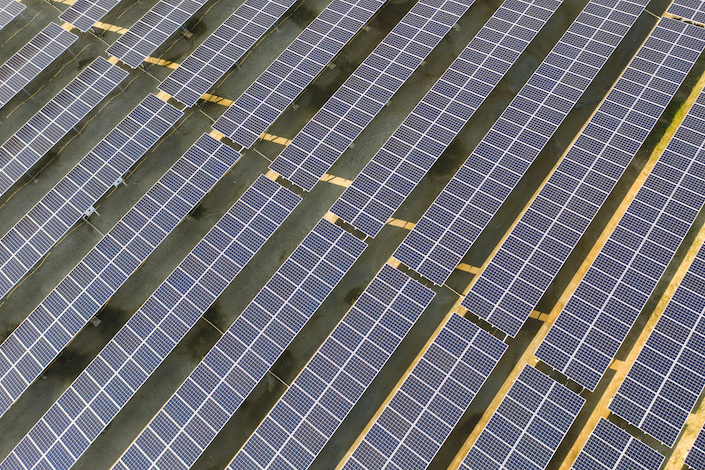

China Needs Year-End Installation Surge to Hit 2021 Solar Target

(Bloomberg) — China, the world’s biggest solar market, will need a year-end installation rush to meet growth targets as cost inflation slows development.

China added about 29.3 gigawatts of solar in the first 10 months of the year, the National Energy Administration said last week. That’s well short of the annual forecast of 55 to 65 gigawatts set by the China Photovoltaic Industry Association earlier in 2021.

- PODCAST

- MOST POPULAR