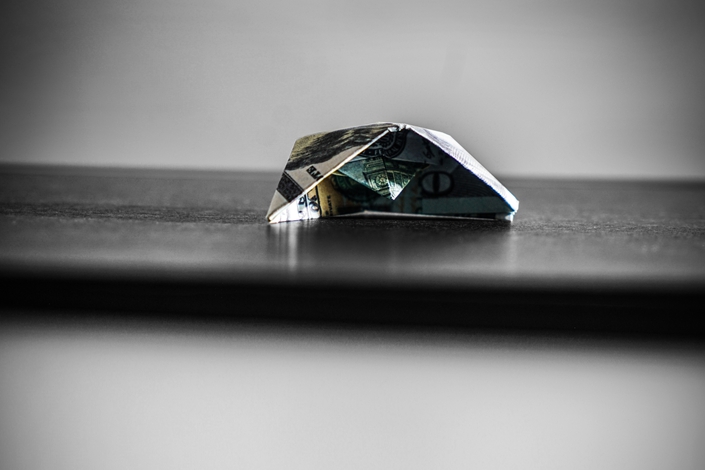

Opinion: The Doomsday Scenario of U.S.-China Financial Decoupling

As a broader decoupling between the U.S. and China is underway, terms from the military have entered the financial lexicon, signaling a widening rift between both nations.

“Weaponizing financial networks,” referring to the imposition of financial sanctions by the U.S. to take hold of critical chokepoints in the financial architecture, to allusions of the “nuclear option” that threaten excommunication from the U.S. dollar-dominated SWIFT messaging system, are now frequently bantered about. The hardening rhetoric marks a notable shift for the financial sector, which up to this point has stood as a haven of cooperation, fostering meaningful collaboration rather than accentuating a broader systemic rivalry.

Joel A. Gallo is CEO of Columbia China League Business Advisory Co., a Guangzhou-based management consulting firm, and a former executive at Deloitte, E&Y, PwC, and EMC Corp.

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas