China Carbon Watch: Trading Tumbled in Short January

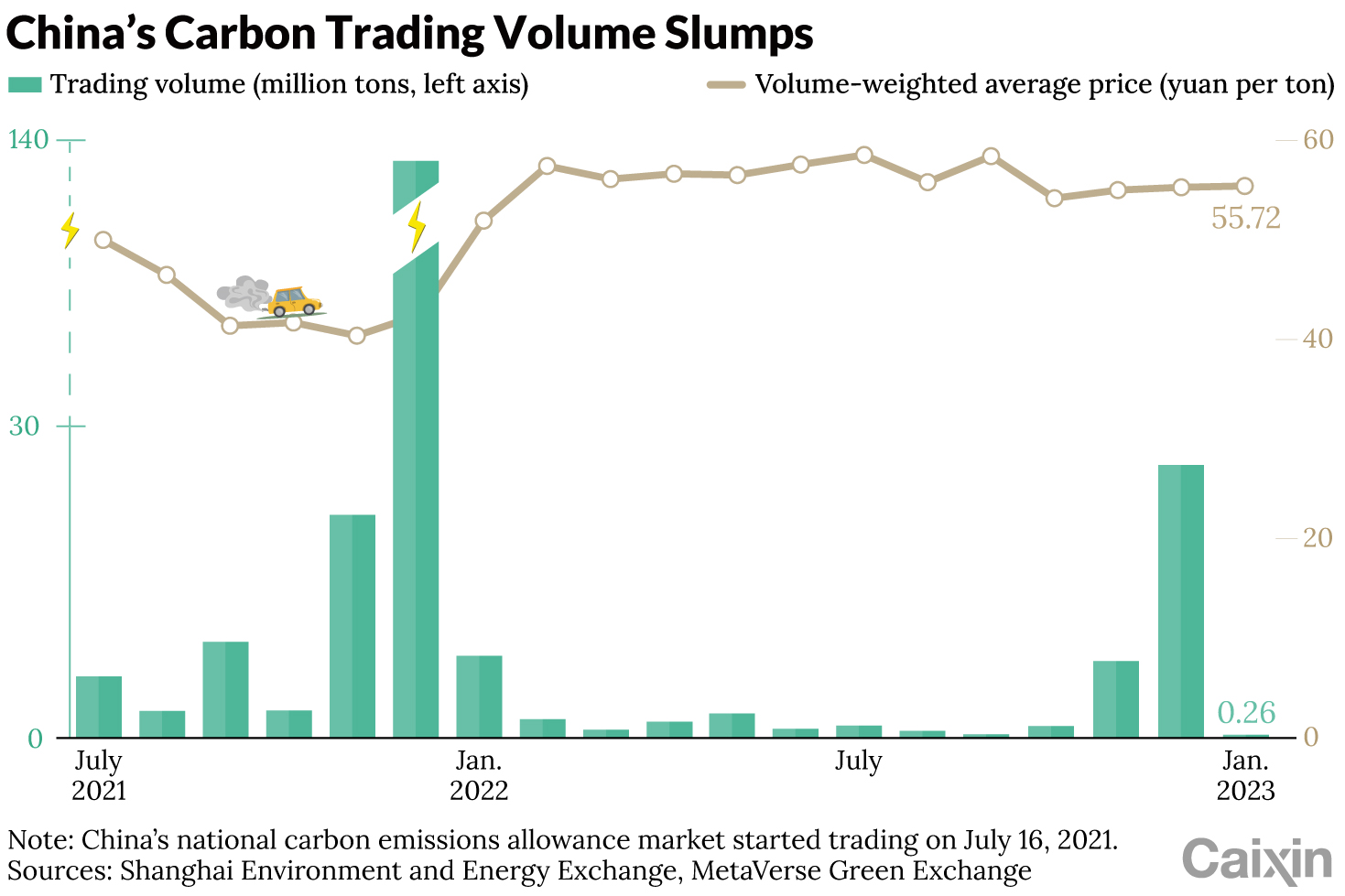

Trading in China’s national carbon emissions allowance (CEA) market dropped to its second-lowest monthly volume on record in January, as the Lunar New Year holiday left only 16 trading days, during which there was a complete absence of block trades.

Entities covered under China’s emissions trading scheme (ETS) had likely finished with their year-end internal CEA balancing. With the deadline for the 2021-2022 compliance cycle still 11 months away, they were back to the wait-and-see mode that prevailed for most of 2022.

|

Market activity is not likely to gain much traction in the foreseeable future, at least not before policymakers can shed some light on key issues, such as the inclusion of additional industrial sectors in the ETS and permission for financial players to participate in the CEA market.

Market prices changed little amid thin volumes, further evidence of the lack of interest from market participants.

The daily closing price of open market transactions moved within a range of 55 yuan ($8.14) to 56 yuan per ton for January, ending the month unchanged at 56 yuan per ton for each of the last five trading days.

The volume-weighted average price for all trades in December was 55.72 yuan per ton.

Bai Bo is executive chairman and co-founder of the Singapore-based MetaVerse Green Exchange.

The analysis and opinions expressed in third-party articles are those of the authors and do not necessarily reflect the positions of Caixin.

Contact editor Jonathan Breen (jonathanbreen@caixin.com)

Download our app to receive breaking news alerts and read the news on the go.

Get our weekly free Must-Read newsletter.

- PODCAST

- MOST POPULAR