Curtailing Real-Time Stock Connect Data Will Make Market More Stable, Insiders Say

Listen to the full version

The Hong Kong Stock Exchange’s decision to stop disclosing certain real-time data for northbound trading under the Stock Connect program will make the market less transparent but more stable, market insiders said.

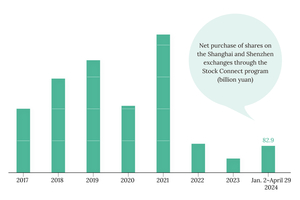

Real-time figures for sales, purchases and total turnover through the northbound link, which allows overseas investors to trade Chinese mainland-listed stocks through Hong Kong, have been unavailable since Monday, according to a circular issued by the Hong Kong exchange.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- The Hong Kong Stock Exchange ceased disclosing certain real-time data for northbound trading under the Stock Connect program, aligning with practices of mainland China's Shanghai and Shenzhen exchanges.

- Real-time data on sales, purchases, total turnover, and remaining daily purchase quotas are now restricted to enhance market stability and reduce speculation-driven volatility.

- These changes aim to encourage long-term investments by northbound investors and bring consistency with other foreign capital entry channels like the Qualified Foreign Institutional Investor program.

The Hong Kong Stock Exchange has recently ceased providing certain real-time data for northbound trading under the Stock Connect program, a move that is seen by market insiders as reducing transparency but increasing stability [para. 1]. The specific data no longer available includes real-time figures for sales, purchases, and total turnover through the northbound link, which facilitates overseas investors in trading stocks listed on the Chinese mainland via Hong Kong. This change took effect from Monday as per a circular from the exchange [para. 2].

Additionally, the real-time display of the remaining daily purchase quota for northbound investors will now only be shown when it falls below 30% of the total quota [para. 3]. These adjustments are intended to align with the practices of mainland exchanges in Shanghai and Shenzhen as stated in the circular [para. 4]. Originally, the disclosure norms for the northbound link were established to inform investors about how trading quotas were being utilized. However, these practices differed from those on the mainland, prompting a reevaluation [para. 5].

A key principle of the Stock Connect program is to adhere to regulations prevalent in target markets. Thus, disclosures related to northbound trading are expected to follow rules set by Shanghai and Shenzhen exchanges [para. 6]. It was also pointed out that another major route for foreign capital into mainland stock markets—the Qualified Foreign Institutional Investor program—does not provide such real-time data. Therefore, continuing to do so under Stock Connect was deemed inappropriate [para. 7].

The rationale behind these changes extends beyond regulatory alignment. According to Yan Zhaojun, a strategist at Zhongtai Financial International Ltd., this shift aims at curbing market fluctuations which were exacerbated by speculators using real-time data for making swift investment decisions [para. 8]. Furthermore, Yan Kaiwen from China Fortune Securities Co. Ltd., suggests that these adjustments could encourage northbound investors towards more long-term investments rather than speculative short-term trades [para. 9].

Overall, while these changes might reduce some aspects of market transparency, they are viewed as steps towards greater regulatory consistency and potentially fostering a more stable and less volatile investment environment within Chinese mainland stock markets accessed via Hong Kong's Stock Connect program.

- Zhongtai Financial International Ltd.

- Zhongtai Financial International Ltd. is a financial firm where Yan Zhaojun works as a strategist. According to Zhaojun, the recent changes in the disclosure of real-time northbound trading data under the Stock Connect program are aimed at reducing market fluctuations, which were previously exacerbated by speculators using this data for investment decisions.

- China Fortune Securities Co. Ltd.

- China Fortune Securities Co. Ltd. is represented by analyst Yan Kaiwen, who commented on the Hong Kong Stock Exchange's decision to limit real-time data disclosure for northbound trading under the Stock Connect program. Yan believes these adjustments will encourage northbound investors to focus on long-term investments rather than short-term speculation.

- PODCAST

- MOST POPULAR