China’s Insurance, Trust Bailout Funds Operators to Get New Chiefs

Listen to the full version

The state-backed firms running the bailout funds for China’s insurance and trust sectors are both expected to get new chiefs, sources with knowledge of the matter told Caixin.

Guo Jing, who is now a deputy director of the finance and accounting department of the National Financial Regulatory Administration (NFRA), the country’s top financial regulator, is expected to become general manager of China Insurance Security Fund Co. Ltd., the sources said.

Unlock exclusive discounts with a Caixin group subscription — ideal for teams and organizations.

Subscribe to both Caixin Global and The Wall Street Journal — for the price of one.

- DIGEST HUB

- Guo Jing is expected to become the general manager of China Insurance Security Fund Co. Ltd., replacing Zhang Li.

- Zhang Li will become president of China Trust Protection Fund Co. Ltd. (CTPFC) and has been appointed deputy chief of CTPFC’s Communist Party committee.

- The insurance and trust bailout funds have played significant roles in navigating regulatory challenges and aiding firms like Anbang Insurance and Huarong International Trust Co. Ltd.

- China Insurance Security Fund Co. Ltd.

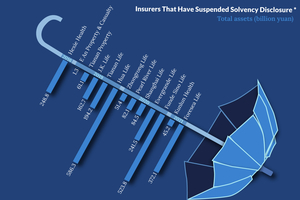

- China Insurance Security Fund Co. Ltd. is set to have Guo Jing as its new general manager, replacing Zhang Li. Guo, who has extensive experience in insurance regulation, is currently a deputy director at the National Financial Regulatory Administration. The company manages a bailout fund with 243.1 billion yuan ($33.5 billion) as of June, which supports weak insurers like Anbang, Tianan Life, and Evergrande Life Assurance through financial difficulties.

- China Trust Protection Fund Co. Ltd.

- China Trust Protection Fund Co. Ltd. (CTPFC) is a state-backed firm managing a bailout fund for China’s trust industry. Zhang Li is set to become its new president, filling a vacancy left by Bai Weiqun. CTPFC has played a crucial role in rescuing troubled firms, such as Huarong International Trust Co. Ltd., and had around 160 billion yuan in total assets as of the end of last year.

- Anbang Insurance Group Co. Ltd.

- Anbang Insurance Group Co. Ltd. was a company that received bailout funds from the state-backed China Insurance Security Fund Co. Ltd. due to regulatory challenges. The bailout funds have helped Anbang and other weak insurers navigate financial difficulties.

- Anxin Trust Co. Ltd.

- Anxin Trust Co. Ltd. (600816.SH) is one of the companies that benefited from bailout funds facilitated by state-backed firms in China. These funds helped the trust sector navigate tighter regulations and financial difficulties.

- Tianan Life Insurance Co. Ltd. of China

- Tianan Life Insurance Co. Ltd. of China is one of the insurers that have received funds from China's insurance bailout fund. The bailout fund had 243.1 billion yuan as of the end of June and has injected funds into several weak insurers, including Tianan Life Insurance, to help them navigate financial difficulties.

- Evergrande Life Assurance Co. Ltd.

- Evergrande Life Assurance Co. Ltd. is one of the insurers that received funds from the China Insurance Security Fund to help navigate financial difficulties. The insurance bailout fund, which had 243.1 billion yuan ($33.5 billion) as of the end of June, has been instrumental in supporting such weak insurers.

- Huarong International Trust Co. Ltd.

- Huarong International Trust Co. Ltd. is a subsidiary of China Huarong Asset Management Co. Ltd., one of China's “Big Four” state-owned bad-debt managers. It has benefited from the trust bailout fund, which had around 160 billion yuan in total assets as of the end of last year, to navigate financial difficulties.

- 2016:

- Guo Jing became a deputy director of the finance and accounting department at China’s now-defunct top insurance regulator.

- 2018:

- The top insurance regulator was merged with its banking counterpart to form the China Banking and Insurance Regulatory Commission.

- Last year:

- The China Banking and Insurance Regulatory Commission was transformed into the NFRA.

- As of the end of last year:

- The trust bailout fund had around 160 billion yuan in total assets.

- As of the end of June 2024:

- The insurance bailout fund had 243.1 billion yuan.

- PODCAST

- MOST POPULAR