May 22, 2014 07:01 PM

Former JPMorgan Executive Arrested by HK's Graft Fighter

|

|

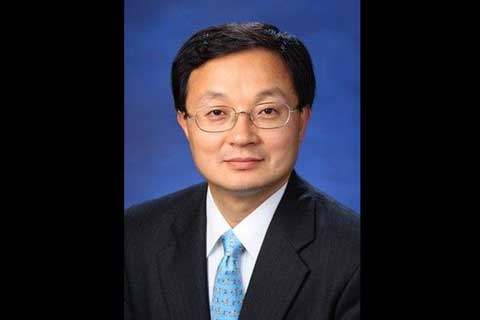

Fang Fang |

(Hong Kong) – The former chief executive officer of JPMorgan Chase & Co.'s China investment bank has been arrested by Hong Kong's Independent Commission Against Corruption (ICAC), two individuals close to the matter say.

Fang Fang was released on bail and told not to leave the city, one of the sources, who refused to be named, said.

You've accessed an article available only to subscribers

VIEW OPTIONS

Share this article

Open WeChat and scan the QR code