In Depth: Village Banks Thrive, but Risk Concerns Mount

(Beijing) — While China’s banking system is now the world’s largest, a major part of its vast countryside has been left out of the country’s mainstream financial infrastructure.

Filling the gaps are over 1,000 rural community banks that have been opened over the past decade to offer basic financial services like taking deposits and organizing loans for those living in underserved rural areas. But such banks come with their own unique problems, including high loan risks associated with borrowers’ inadequate collateral, and the difficulty the banks have making a profit.

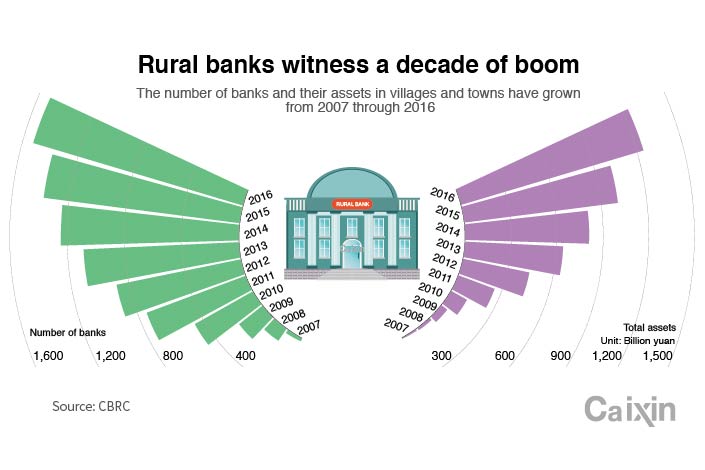

Since the first rural community bank was opened in 2004 in Ma’an, in northeast Sichuan province, a total of 1,519 rural banks have opened in towns and villages across the country by the end of 2016.

Community banks are usually founded by larger banks that tend to hold no less than a 15% stake and agree to provide technology, employee and management support. If a community bank encounters a liquidity crisis, the founding bank is obliged to rescue it, according to banking industry rules. But unlike subsidiary banks, community banks are registered as independent legal entities and operated independently. Their business is usually limited to within the township in which they are located.

Authorities have thrown their weight behind policies to improve financial services in the country’s rural hinterlands, home to more than 600 million people, but big commercial banks have shown reluctance to do so due to the prohibitive costs associated with building branches in less-developed regions.

A 2006 policy issued by the China Banking Regulatory Commission (CBRC) to grant private capital access to the rural banking sector and lower capital requirements on community banks encouraged policy banks, state commercial banks, joint stock banks as well as foreign banks to charge into the sector. In 2007, HSBC Holdings PLC opened the first foreign-funded community bank in Suizhou, Hubei province, followed by Citigroup Inc., Standard Chartered PLC and Australia and New Zealand Banking Group Ltd.

Bank of China, one of China’s largest lenders, has founded 82 community banks in 12 provinces, the most among all domestic banks.

As of the end of 2016, the number of community banks represented over 30% of China’s registered banks. Community banks had combined assets of more than 1.24 trillion yuan ($180 billion) and more than 700 billion yuan in outstanding loans at the end of 2016, according to recently released data from the CBRC.

Over 80% of the loans extended by community banks are offered to rural households or small and micro-businesses, the biggest sources of rural credit supply, according to Ma Xiaoguang, deputy director of the CBRC’s rural financing department.

Some community banks have seen their assets surge to more than 10 billion yuan over the past decade, equivalent to those of small commercial banks, but most community banks are still small players with a capital size ranging from 50 million yuan to 100 million yuan, according to Guo Qin, an official at the CBRC bureau in Henan province.

|

Risk Control

Rural community banks are designed to offer low-cost loans for small amounts of money to meet the financing needs of rural dwellers, but the banks are exposed to high levels of risk as most of their borrowers are rural households and small businesses that have inadequate collateral.

To address the problems, community banks have made bold innovations such as offering joint guarantee loans and village-based credit lines.

According to Li Danyang, president of Hubei Daye Tailong Village Bank, most community banks make a credit assessment of a village as a whole and organize credit lines for all households in the village based on the assessment, excluding those with extremely weak repayment capacity. Villagers can obtain loans through joint guarantee arrangements.

Daye Tailong Village Bank has issued credit lines totaling 420 million yuan to 14 villages, covering over 8,000 households, Li said.

“Offering credit lines to whole villages is an efficient way to get customers,” said Li, but he added that bank staff had to conduct thorough studies and face-to-face interviews to work out the repayment ability of villagers covered by the loans.

However, under such arrangements, “if a few households can’t make their repayments, it may leave the whole village overdue,” said Li Guifu, president of Zhongmou Zhengyin County Bank in Henan province.

Regulators make no exception for community banks regarding bad-loan requirements, Guo said. “No matter how community banks grow, they must follow industry rules to keep nonperforming loan ratios under 5%.”

Draining Profit

With business limited to deposit and loan issuance, the main profit source for community banks is interest margins. However, as China gradually liberalizes interest rates, the gap between deposit and lending rates has been narrowing, leaving most community banks facing weakening profitability, according to Huang Yi, president of Sichuan Tianfu Bank.

According to Zhongmou Zhengyin’s Li, since community banks’ investment activity is under strict regulatory control, most banks have to put their capital in their founding banks to earn deposit interest, which sometimes barely covers their loan issuance costs.

Some banks have set aside extra capital to cushion bad-loan risks. For example, Daye Tailong’s 2016 provision coverage ratio stood at 994%, much higher than the 150% regulatory requirement, although the bank’s bad-loan ratio was only 0.4% that year.

Community banks’ profitability is closely linked to local economic conditions. Since 2012, the CBRC has asked commercial banks to set up more community banks in less-developed central and western regions, but banks are concerned about the business prospects.

“If a community bank is set up in an extremely poor region, there is no way to profit,” said a source from a commercial bank.

To expand profit sources, some community banks have tried to skirt oversight and have engaged in interbank businesses, industry sources said. But several cases involving rural community banks’ irregular bank bill business have put such operations under the spotlight since late last year. Sources close to the CBRC told Caixin that the commission in November asked local branches to inspect bank bill business of rural community banks.

In late February, another village bank in Sichuan was involved in an interbank business dispute with a city commercial bank, Hengfeng Bank. Hengfeng sued Xuanhan Chengmin Village Bank for allegedly defaulting on 111 million yuan worth of bank acceptance bills. But the defendant argued that the seals used for the bill transaction agreement were fake. The case is still under investigation.

Community banks, usually with weaker risk control capacity and smaller capital size, are vulnerable if any risk occurs, the president of a community bank said.

Contact reporter Han Wei (weihan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas