China’s Big Four Banks Binge on Mortgages

(Beijing) — Mortgages drove new loan growth in 2016 at China’s four largest commercial banks, highlighting the scale of money tied up in the frothy property sector.

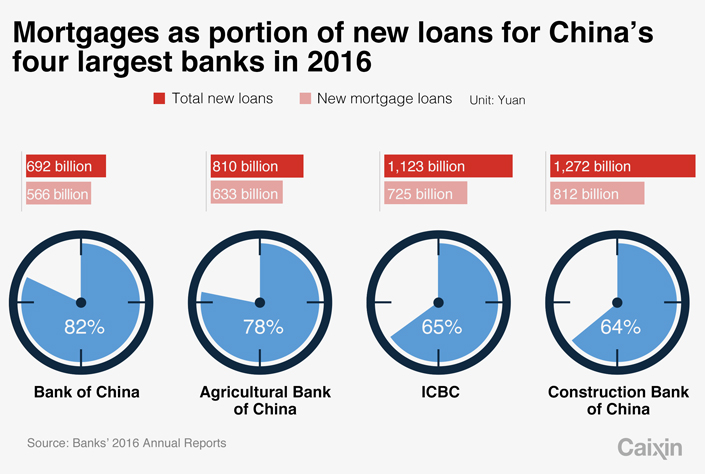

The Industrial and Commercial Bank of China Ltd., Agricultural Bank of China Ltd., Bank of China and China Construction Bank Corp. saw between 64% and 82% of their new loans last year go toward mortgages, totaling 2.7 trillion yuan ($391 billion).

Such high levels of private-sector debt run against the government’s push for consumption-driven growth, as borrowers will need to pay off mortgages with money that could be spent to help the larger economy.

The percentage increase in new loans was derived from calculations made from the banks’ annual reports, released at the end of March.

|

The percentages suggest that the largest banks are dealing more in mortgages than the entire banking sector. Figures released in January by the People’s Bank of China said that 45% of all new loans last year went to mortgages. The government will try to reduce this number to 30%, Zhou Xuedong, director of the central bank’s business management department told Shanghai Securities News.

The government’s efforts to cool the housing market started last year and grew in intensity in March. Beijing, for example, introduced nine real estate-related regulations within 10 days last month.

These measures included higher down-payment requirements and mortgage rates, enhanced scrutiny of purchases by divorcees, and toughened eligibility requirements for non-residents. Most recently, the banking regulator ordered banks to conduct internal reviews to assess risks, including those associated with mortgages.

Opinions are mixed over whether more money will pour into mortgages this year given the government’s continued efforts to ensure “houses are used for living rather than for speculation.”

One bank employee told Caixin that mortgages as a percentage of new loans will inevitably drop. “There are barely any more houses to sell in some first-tier cities,” said the bank employee, referring to major cities. “Demand for upgrading housing has eased as a result of higher down-payment requirements for second homes.”

Tang Chuanyao, a mortgage analyst with Rong360, told Caixin he expected the approval process for mortgages to become more rigorous. “While major cities will see a reduction in mortgages as a proportion of new loans, demand is likely to spill over to smaller cities, where credit requirements are more lax,” Tang said.

Contact Liu Xiao (liuxiao@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas