U.S. Hospitals See Healthy Opportunities in China

(Beijing) — U.S. hospital chains are trying to carve out a slice of China’s growing medical pie, by joining hands with private hospitals on the mainland.

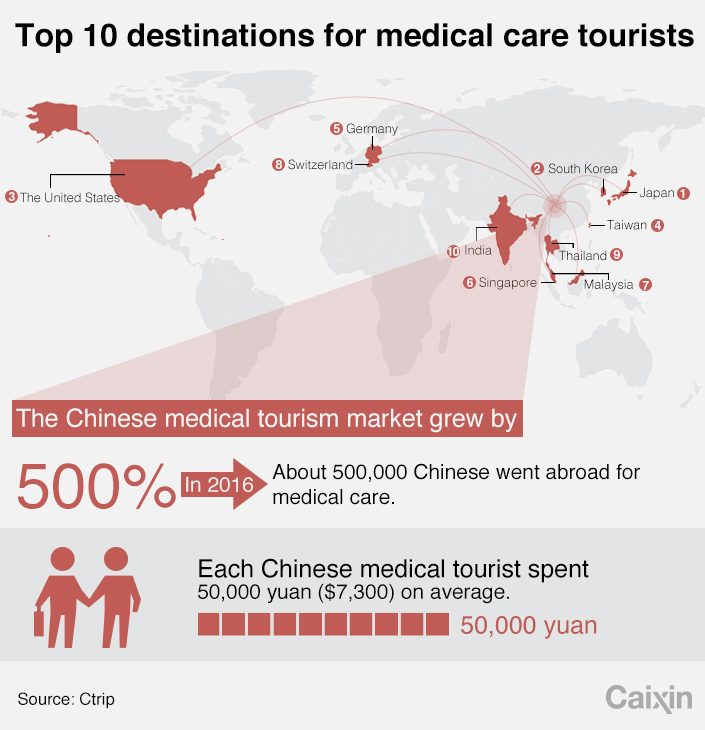

For years mainland patients, dissatisfied with overcrowded facilities and the lack of access to the latest medicines and treatments at home, have headed overseas in search of top-notch health services. But now, the clamor for more care options by China’s rising middle-class is attracting foreign players to Chinese shores.

|

New Jersey-based Children's Specialized Hospital said it had inked a partnership deal with health care investment firm LIH Investment & Management Co. Ltd. last month to open a rehabilitation center in the southern city of Shenzhen for children with severe injuries or those suffering from mental illness or developmental disorders.

Both U.S. hospitals said they will be sharing their expertise in patient care and nursing, and offering guidance to their local partners on hospital administration. They are also looking at the possibility of a physician exchange and other training programs, the hospitals said in statements.

Beijing has allowed clinics wholly-owned by foreign capital to operate in the country since 2010. But only a few overseas hospitals have set foot in the country so far given the bureaucracy involved with getting the relevant approvals. The country’s first foreign hospital, Landseed International Hospital in Shanghai, launched by Taiwan’s Landseed International Medical Group in 2012, had to obtain 150 government-sealed documents for approval, Hanson H. Li, an executive director of Huatone China Strategic Investment Solutions Inc., said in an opinion piece in The New York Times.

|

These entry-barriers have kept foreign clinics at bay for years, but many have turned to joint ventures with local health care partners in recent years.

In 2015, Beijing-based medical group Amcare Corp. partnered with well-known U.S. medical services group Mayo Clinic starting off a trend that is expected to pick up steam in coming years.

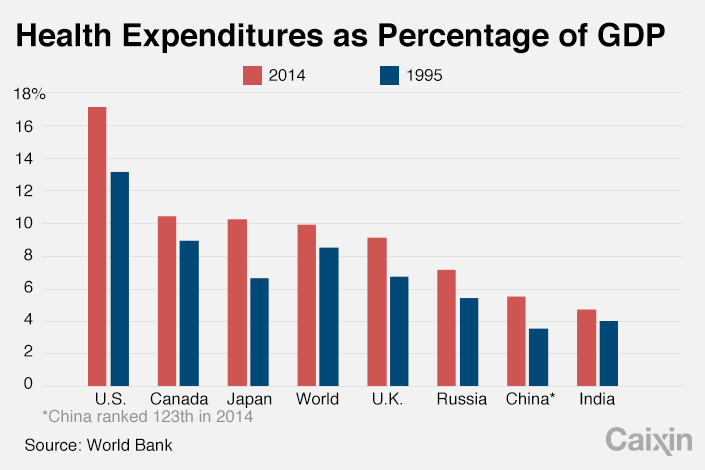

That is because China health expenditure accounted for only 5.5% of total gross domestic product (GDP) in 2014, far behind the world’s average of 9.9%, according to the World Bank, which offers a large opportunity for health care providers to exploit.

Contact reporter Coco Feng (renkefeng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas