Baidu Looks Lost, JD.com Profits Excite in Latest China Internet Results

(Beijing) — Stumbling search giant Baidu Inc. was the big loser among China’s largest internet companies as it struggled for direction in the latest reporting season, while scrappier e-commerce specialist JD.com Inc. won big after surprising markets with its first-ever profit, analysts said.

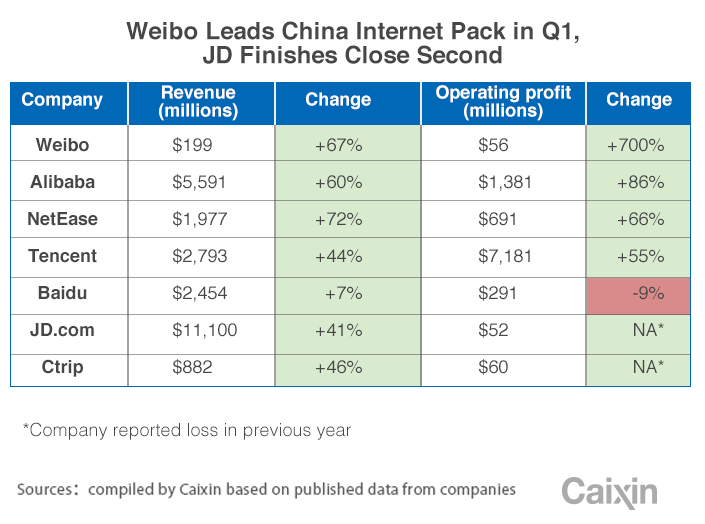

Earnings seasons for China’s biggest internet companies officially drew to a close on Thursday, when e-commerce leader Alibaba Group Holding Ltd. announced quarterly results that failed to excite investors despite a near-doubling in profit and 60% revenue growth. Investors have come to expect such heady numbers from most of China’s biggest internet companies, which are feeding on the world’s biggest internet market, where hometown players enjoy big advantages over global rivals.

|

Hobbled by Scandal

Baidu has struggled for the last year, following a scandal involving misleading search results that forced it to become more transparent and reduce the number of advertisements on its web pages. Following that scandal, the company reported two quarters of revenue decline before returning to growth in the current quarter. But a 10% profit decline in its latest results continued to spook investors, who worry about the company’s inability to diversify beyond search, analysts said.

The resignation of Baidu’s longtime chief financial officer, who will take over as head of the company’s new investment arm, also didn’t help, said Ryan Roberts, an analyst at MCM Partners.

“Baidu is still struggling to find themselves,” he said. “It’s problematic for them. They’re in a more investment phase, and it seems they’re more floundering a bit.”

Results from China’s two biggest internet companies, Alibaba and Tencent Holdings Ltd., both were strong. Tencent’s revenue and operating profit both grew by more than 40%, while Alibaba’s figures were up by 60% or more. But investors have become accustomed to such growth, and both stocks took a breather after the latest results, following recent big run-ups since the start of this year.

Meantime, JD.com and Weibo were the biggest winners, both in terms of encouraging results and stock gains. JD has long sacrificed profits to keep pace with larger rival Alibaba, and thus a first-ever quarterly profit came as a pleasant surprise to investors. Meantime, Weibo continued to show explosive growth following a recent comeback fueled by a boom in live broadcasting services. Its eightfold profit rise was easily the biggest gain among the big players, and its 67% revenue growth was second only to online game giant NetEase Inc.

“Weibo’s numbers were outstanding, but the stock is so fully valued … that it’s hard to chase them,” said Roberts, who added he rates the stock a “sell” due to its high valuation. “One of the better names this season was definitely JD. They hit operating profit, which is good for them. It’s been forever, and they’re still growing revenue at a decent pace.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas