Ant Financial Ups Travel Benefits for ‘Creditworthy’ Individuals

(Beijing) — Individuals deemed “financially reliable” by Ant Financial Group’s personal credit-rating system will be spared a trip to the bank when filing visa applications to Japan and Luxembourg, the company said Tuesday.

Those assigned a high score on Sesame Credit — the personal credit-assessment program developed by Ant Financial — will be exempt from the normally required process of submitting bank records when applying through the e-commerce giant’s travel-booking arm for visas to Japan, and Schengen visas to Luxembourg.

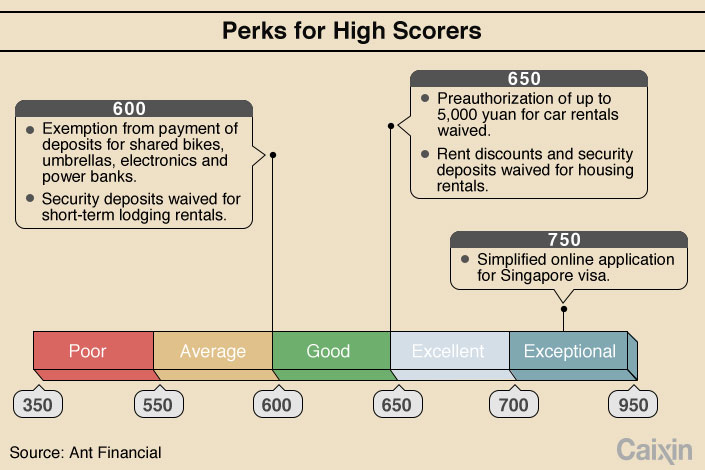

The exemption threshold for Japan has been set at 750 Sesame points, while a score of 700 will suffice for travelers to Luxembourg. The perk is currently available only to residents of five of China’s eastern provinces.

Sesame Credit scores range from 350 to 900, and are compiled based on 100 payment-related data sets harvested through Ant Financial. The system has currently rated about 100 million users.

Some of the more heavily weighed criteria include online spending records, regular payments of utilities, timely settlement of credit card bills, frequent booking of trips and accommodations using payment platform Alipay, as well as the user’s city of residence and ownership of a house and car. The scores of acquaintances are also factored into a person’s final tally.

But there is no clear indication of what exactly constitutes Sesame’s definition of an “extremely creditworthy” individual — with a score between 700 and 900 — or what would make a user merely “average,” scoring between 550 and 600.

A company spokesperson told Caixin that Sesame’s algorithms are “beyond the realm of advanced mathematics,” and vary from person to person.

Normally, Chinese citizens are required to present bank records for the past three months when applying for a Schengen visa for Luxembourg. The bar is even higher for a five-year multiple-entry visa for Japan, with applicants required to prove that a minimum of 500,000 yuan ($73,600) has been deposited into their financial accounts over the course of the past year.

This is the second travel benefit granted to qualified Ant Financial users seeking entrance to tourist destinations. In 2015, Alibaba’s travel-booking platform Alitrip introduced an initiative allowing users with a credit score of 700 or above to use a simplified application to apply for a Singaporean visa.

Ant Financial said figures on the number of users who have used the Singapore visa process were unavailable.

The company has been incrementally adding other, non-travel-related privileges for users with higher Sesame scores, mostly in the form of waived deposits for various services, such as bike and car rentals.

|

None of these guinea-pig firms has convinced authorities of its competence, however, with their respective performances all falling “short of expectations,” according to Wan Cunzhi, director of the People’s Bank of China’s Credit Information System Bureau.

Banks and private lenders are dubious about the reliability of the assessments made by firms like Sesame. Wan told Caixin that often the scores are a poor reference for an individual’s actual financial trustworthiness.

In official publication by the central bank, Wan disapproved of Sesame using credit-rating data to waive shared bike deposits, calling the behavior an abuse of consumer information.

“Personal credit-rating information should only be used for risk control in lending activities, and should not be widely used by governments and companies as a tool to regulate citizen behavior,” he wrote.

Contact reporter April Ma (fangjingma@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas