Hong Kong New Board Won’t Be Hotbed of Shell Companies, Stock Exchange Chief Says

(Hong Kong) — Hong Kong’s third board, still in the proposal stage, won’t become a hotbed of “shell” companies that have little investment value, the operator of the city’s stock exchange said Wednesday.

In mid-June, Hong Kong Exchanges and Clearing (HKEx) proposed setting up the New Board, the city’s third trading platform. According to the proposal, the New Board will have two tiers — “New Board PRO” for startups and “New Board PREMIUM” for growing companies.

The New Board aims to attract new listings from so-called “new economy” and technology companies, including Alibaba Group Holding Ltd., which decided to list in New York instead of Hong Kong in 2014. One way to do that is for HKEx to take on companies without any record of turning a profit, but that has become a controversy in the city on concerns about weakening the overall standards of corporate governance and investor protection.

Some are concerned the New Board may become a market for “trash” companies that exist primarily to be sold later as “shells” for other companies that want to go public via this backdoor listing.

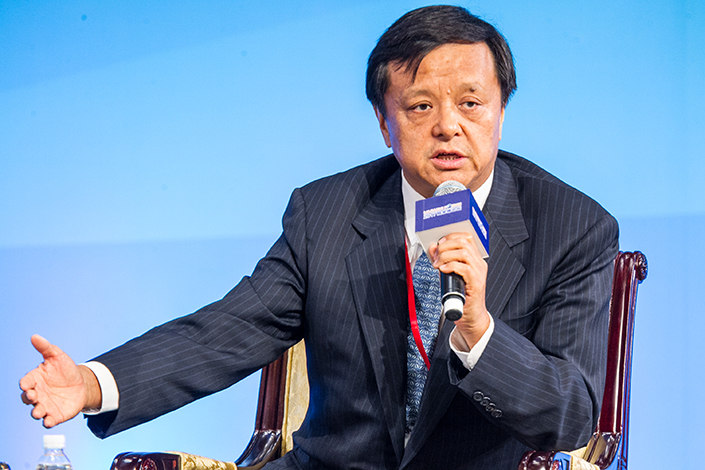

On Wednesday, Charles Li Xiaojia, chief executive of HKEx, tried to allay the concern in an article on the operator’s social-media platform.

“As listing on New Board PRO will be much easier, there would not be demand for the listing status or ‘shell’ which would drain away much of its value as a tradable commodity,” Li wrote.

Li said lowering the listing requirements for the New Board is because a high bar could strangle promising startups that have potential to develop into stellar companies in the future.

“If we do not want to miss the grand slam home runs, we have to make it easy for early-stage companies to access capital without making them spend limited valuable resources to work through a rigorous vetting and regulatory process,” he wrote.

To protect ordinary investors, HKEx is planning to allow only professional investors to access these risky stocks when the New Board begins.

HKEx is seeking public comment about the proposed New Board, the third platform beside the existing Main Board and the Growth Enterprise Market (GEM).

A big chunk of companies listed in Hong Kong are in the financial and real estate sectors, accounting for 44% of all money raised on the Hong Kong stock market. In comparison, new economy companies listed over the past 10 years only account for 3% of the market capital, according to HKEx.

Li also revealed on Tuesday that HKEx will launch a new venture called HKEx Private Market in 2018 to nurture early stage companies before they are ready to go public. The off-exchange venue platform, based on blockchain technology, will enable the companies to conduct pre-IPO financing not restricted by the Securities and Futures Ordinance, he said.

Contact reporter Wu Gang (gangwu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas