Asian Rich List Swells on Billionaire Boom in China

The Chinese mainland added an average of two new billionaires to its super-rich list every week last year, according to new report, helping Asia replace the U.S. as the world's most fertile cradle for individual wealth.

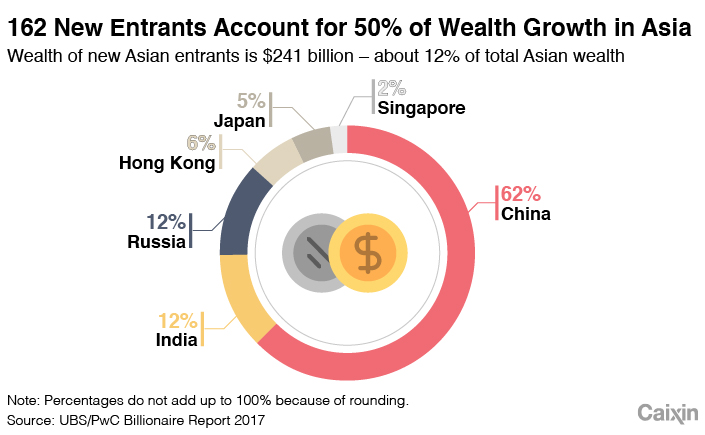

The report released Thursday by the investment firm UBS AG and consultancy PricewaterhouseCoopers (PwC) said 101 of the 162 Asians whose personal wealth passed the $1 billion threshold for the first time in 2016 were Chinese citizens.

China's new billionaires helped boost Asian membership of the ultrawealthy club to 637 last year, compared to 563 in the U.S., according to the firms' annual Billionaires Insight Report. It marked the first time that Asia could be called home to more billionaires than the U.S.

The report covered 1,542 billionaires residing in 14 markets worldwide. They account for about 80% of all individual wealth held by the world's super-rich.

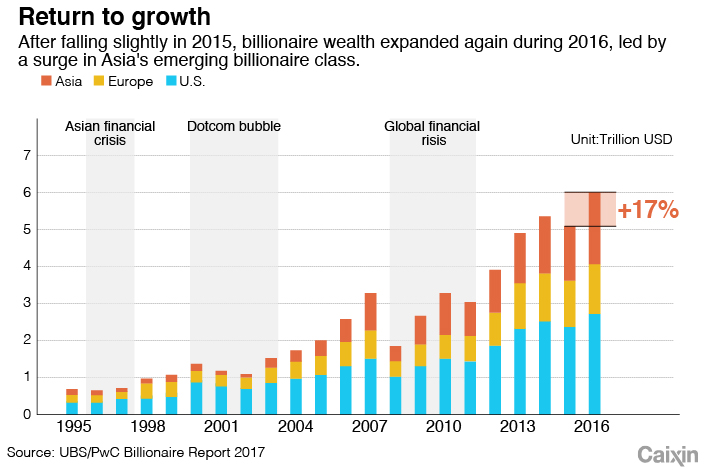

“This year, we have seen not only a return to growth for billionaire wealth, but also a significant shift in its geographic dimensions,” said Josef Stadler, head of the global ultrahigh-net-worth division at UBS Wealth Management.

|

China had 318 billionaires at the end of 2016 compared to 215 one year earlier; 34 Chinese whose personal worth fell below $1 billion during 2016 were dropped from the list.

The amount of wealth controlled by Chinese billionaires at the end of 2016 rose 36% year-on-year to $804 billion, with each billionaire's treasure chest swelling an average 7% to about $2.5 billion.

James Chang, who works at the China financial services consulting unit of PwC China, said government policy contributed to the latest amassing of wealth. For example, new entrepreneurs have benefited from recent government initiatives encouraging financial technology innovation.

On the other hand, Chang said, a Chinese billionaire's wealth can fluctuate as government policies can change quickly and the nation is awash with aggressive entrepreneurs.

Some 69% of China’s billionaire-linked businesses are publicly listed companies compared to 37% of the United States and 40% in Europe. Moreover, many Chinese billionaire-linked companies have listed overseas.

Some 43% of the wealthy individuals who had to be cut from the billionaire list worldwide last year were Chinese, Chang said.

Many of China's newly made fortunes "are vulnerable to reversals of fortune whether in the form of unstable markets, policy changes, industrial restructuring, their own operation and management issues or other factors,” he said.

|

UBS China's Andy Ho, who serves as the firm's acting president, sees strong potential for future wealth accumulation in China.

“With expectations for 6.8% annual economic growth in China in 2017, and a relatively stable financial market to be seen after the recent party congress reshuffle of the country’s leadership, we expect total wealth among Chinese billionaires to continue to grow in the coming years,” Ho said.

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas