Hotelier GreenTree to Branch Out With New York IPO: Source

GreenTree Inns has launched the process for a New York IPO to raise up to $600 million, becoming the last major Chinese hotel operator to publicly list, a source with direct knowledge of the situation told Caixin.

The company has hired Morgan Stanley and Bank of America Merrill Lynch to underwrite the offering, with a timeline of listing in the second quarter of next year, said the source, speaking on condition of anonymity because the matter is still private. The listing could raise anywhere from $400 million to $600 million under current plans, he added.

GreenTree, which operates more than 2,600 hotels mostly in China and Southeast Asia, did not immediately respond to a request for comment on its plans.

|

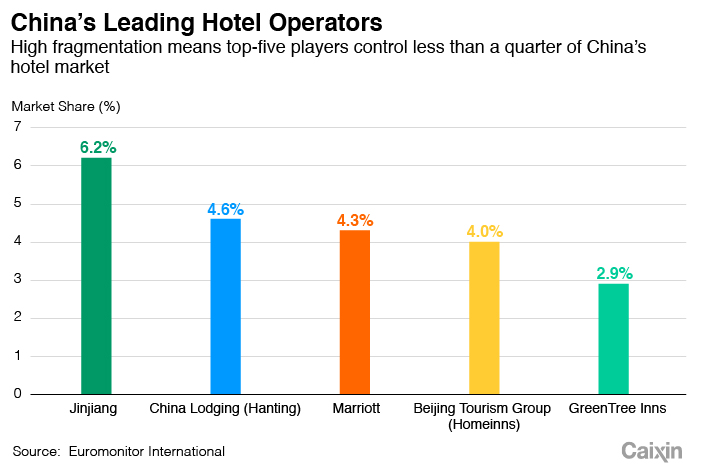

All of the world’s top hotel companies have major presences in the market, which has also spawned a younger crop of local players that traditionally focused on the lower end but more recently have begun to move up market. Among the global players, only Marriott International Inc. is in the top 5, finishing third with 4.4% of the Chinese market, according to Euromonitor.

GreenTree is the fifth largest player, behind industry leader Jinjiang at No. 1 with 6.4% share, China Lodging Group in second with 4.8% share, and Beijing Tourism Group at fourth with 4.1%. All three of the other domestic leaders are already listed, though the only other one with a New York listing is China Lodging Group, which has a major equity tie-up with French industry giant Accor SA.

GreenTree’s listing would also become one of the latest among a recent wave of Chinese companies going public in the U.S. to take advantage of bullish sentiment. One of the biggest in that wave came last month, when online microlender Qudian Inc. raised $900 million with a listing on the New York Stock Exchange.

Contact reporter Yang Ge (geyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas