Foxconn Looks Beyond Apple With 8K Screens

Chen Zhenguo, vice president of Foxconn Technology Group, has spent years overseeing the manufacturing giant’s production of Apple products.

For a long time, Foxconn, which produces four out of every 10 Apple products sold globally, depended on orders from PC-makers and smartphone brands to grow its factory empire.

But when Chen attended the Beijing World Winter Sports Expo in September, he was there to showcase something different — 8K ultra-high resolution display technology developed by Sharp, the century-old Japanese company Foxconn acquired in 2016.

Foxconn hopes that popularizing 8K display technology in fields as diverse as medicine and sports broadcasting will revolutionize its business, now that the world’s PC and smartphone markets are increasingly saturated.

The massive manufacturer, which employs over a million workers, needs change, urgently. Last year, its parent company Hon Hai Precision Industry Co. Ltd. experienced its first-ever profit drop since going public in 1991. In the 2016 financial year, Taiwan-based Hon Hai saw its profit plunge 39% to NT$21.03 billion ($699.39 million) — far lower than analysts had expected.

Foxconn’s biggest customer, Apple Inc., was also having a bad year — Apple’s revenue fell in 2016 for the first time since 2003. Lackluster demand for Apple phones had a direct impact on Foxconn, which received fewer orders.

“These past five to 10 years, the industry has really changed too fast,” Zheng Ruiting, a former Foxconn manager, told Caixin.

The decline of the PC industry, the rise of mobile internet, and the changing tastes of younger consumers all mean Foxconn must now fight to maintain its dominance.

|

City-sized factory

Established in Taiwan in 1974, Foxconn has grown into the world’s largest contract electronics manufacturer, buoyed in its early years by subsidies from local governments on the Chinese mainland during China’s economic opening-up.

Foxconn’s massive complex in Shenzhen’s Longhua district is more like a city than a factory. Spacious enough to accommodate 300,000 employees, it contains at least one kindergarten, cafeterias, gyms, and its own transport system that runs 400 buses. According to Taiwan media reports, it’s also home to China’s largest central kitchen, which goes through 200 pigs, more than 10,000 chickens, 40 tons of cooked rice and 300,000 eggs each day. To ensure punctual mealtimes, almost all of the cooking equipment is automated.

Shenzhen is home to tens of thousands of “original equipment manufacturers” — factories that produce the parts that other companies market. But of the city’s many manufacturers, only Foxconn has established a global manufacturing empire.

“Many people can make a few thousand, tens of thousands, of each product, very well. But when the iPhone 8 came out … it required millions or even tens of millions of units to be delivered within a month. Pulling the yield up in such a short period of time, that’s something different,” Zheng, the former Foxconn staffer, told Caixin.

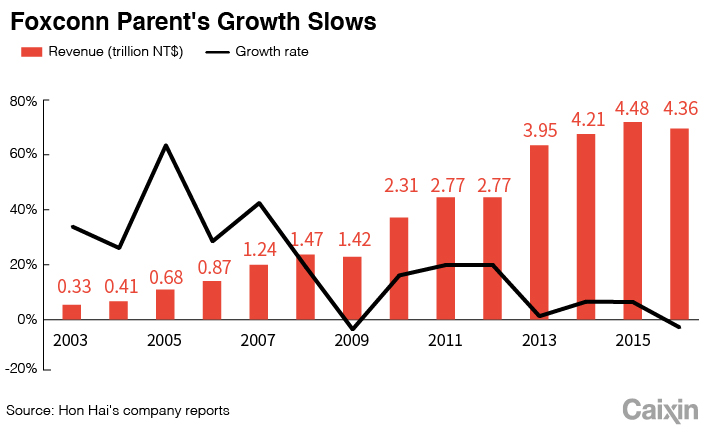

It was this superhuman ability to meet orders that lifted Foxconn’s operating revenue growth as high as 40% each year between 2010 and 2015. In 2015, parent company Hon Hai’s revenue was double the revenue of Baidu Inc., Alibaba Group Holding Ltd. and Tencent combined. As long as the PC and smartphone markets were expanding, Foxconn’s revenue did too, because it simply accepted orders from whichever brand was dominating the market.

Warning signs

But that formula is no longer working for Foxconn. In 2016, the company experienced its first annual revenue decline since going public in 1991, primarily due to a drop in demand for phones sold by its most important client, Apple.

Hardware manufacturers like Foxconn are extremely sensitive to changes in consumer tastes. In the past decade, they looked on in horror as mobile phone pioneer Nokia went from controlling 40% of the global mobile phone market to exiting the industry in just five short years.

Foxconn is determined to aviod Nokia’s fate. The company has made many attempts to diversify and move out of a purely manufacturing role. In 2009, Hon Hai started a joint venture with German electronics retailer MediaMarktSaturn Retail Group, and opened seven Media Markt stores in Chinese cities.

And in 2010, Foxconn launched two e-commerce platforms, eFeihu and eFox. But fierce competition from bigger e-commerce sites like JD.com Inc. have stopped Foxconn’s retail ambitions from going far. In 2013, Foxconn closed all its Media Markt stores.

The manufacturer has also been betting on tech innovations. In March 2015, Foxconn joined with Tencent Holdings Ltd. to launch Future Mobility, an electric car company. That year, Foxconn also made a significant investment in Japan’s Softbank Robotics Holdings.

Sharp designs

Of all its recent investments, Foxconn has placed the greatest hope on Japanese electronics brand Sharp, in which Foxconn acquired a 66% stake in August 2016.

Since the acquisition, Foxconn has begun a major publicity campaign for the brand, sponsoring Hunan TV’s “Singer” reality series and festive variety shows using the Sharp brand. “The things old Sharp couldn’t do in the past, we’re doing. We don’t have a limit on our marketing budget for the whole year. We’ve already invested 200 million yuan ($30.23 million) for just one season,” Yuan Xuezhi, Foxconn’s first-ever chief marketing officer, told Caixin.

The manufacturer’s previously publicity-shy executives have also been more actively seeking media attention. “I’ve been with the organization for 17 years but I only started doing interviews this year,” Chen Zhenguo said. Chen is now in charge of distributors and e-commerce, what he calls the “advance guard” of the company’s transformation.

At the heart of Foxconn’s Sharp ambitions is the 8K ultra-high resolution technology that Sharp has developed. In August, Sharp launched the Aquos 8K, the world’s first affordable, mass-produced 8K TV.

“8K displays have a resolution that 4.3 times greater than human vision,” Chen said, comparing the technology to its predecessor, 4K, which has roughly the same resolution as human vision. Foxconn believes this superhuman technology could bring about a sensory revolution, with applications in fields including driverless vehicle technology and facial recognition.

8K technology could be used to see distinguish between two human cells, or identify a terror suspect in a crowded stadium by simply zooming in, Chen said.

But the most important audience, in Foxconn’s view, isn’t surgeons or law enforcement — it’s the average consumer. Foxconn is looking for an opportunity to introduce 8K technology to the general public, and international sporting events seem to offer that opportunity.

“The Tokyo Olympics will be broadcast using 8K technology in 2020. What technology are we going to use to receive this, 2K?” Xiong Xiaoge, chairman of IDG Capital, which has invested in Sharp’s 8K business, told Caixin.

Popularizing 8K displays gives Foxconn an opportunity to dominate an entire supply chain. To view 8K images, you need to create cameras, transmission equipment, file compressors, storage devices, and screens capable of handling the format.

But there’s no guarantee the road ahead will be smooth for Foxconn. Its bid for Toshiba Corp., which produces the solid-state hard drives necessary for storing large 8K video files, failed. Toshiba announced in September that it would sell its semiconductor unit to a consortium led by Bain Capital.

Industry watchers also worry about what the high cost of producing TV panels and the rise of alternative OLED display technology will mean for Foxconn, and whether 8K, rather than augmented reality or virtual reality, really is the future of display technology.

Nevertheless, there’s no turning back. “I used to be in charge of a ‘conservative’ company,” meeting the needs of clients like Amazon and Apple, Chen told Caixin. “I now have a new duty — driving the speed and ambition of our employees’ transformation.”

Contact reporter Teng Jing Xuan (jingxuanteng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas