Fintech Pioneer Sees Money in the Masses

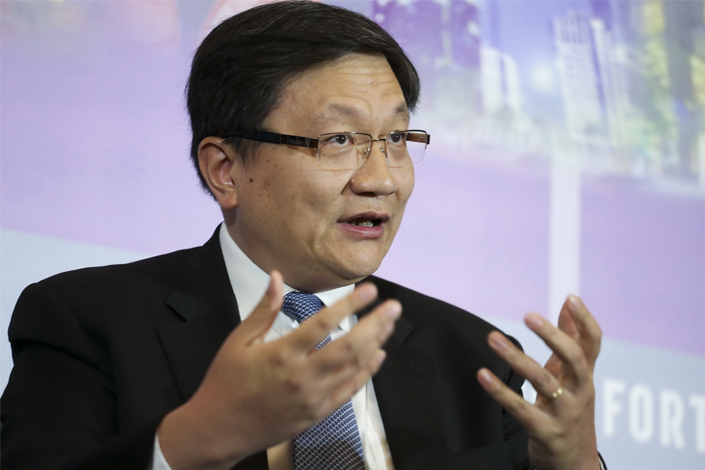

China’s booming fintech sector will see growth come from small business loans, wealth management tools for the “affluent masses,” and technology that helps you sift through thousands of insurance products in minutes, according to Tang Ning, founder and CEO of financial conglomerate CreditEase.

The former Wall Street investment banker, who studied math at Peking Universty, said he first spotted the potential for innovation amid China’s growing hunger for credit when he started lending money to a group of students to pay for vocational training.

CreditEase, with its roots in microlending, has quickly expanded into wealth management and offering other financial services since it was founded in 2006.

As of September, the company’s wealth management business oversaw assets worth $20 billion for nearly 50,000 high net-worth customers in China. It also manages $1 billion through a venture fund, which is among the ten most active venture capital investors in global fintech companies, according to data provider CB Insights.

China’s wealth management industry is undergoing a paradigm shift, according to Tang.

“It is moving from fixed income investments to equity investment, from short-term speculation to long-term investment, from China-focused investment to global opportunities, from investing into single products, single opportunity to comprehensive risk management and comprehensive asset allocation.” he said. Some families have shifted their focus from “managing this generation’s wealth to thinking about succession planning and inheritance.”

Caixin sat down with Tang on the sidelines of the recent Fortune Global Forum in Guangzhou to talk about what’s on the horizon for the fintech industry.

Caixin: What are the most promising fintech trends over the next decade?

Tang Ning: We see small business lending being a key area of growth. In the past 10 years, creative lending models have done a good job at serving individuals, but there is much more to be done for small businesses.

Another area of growth we see is digital wealth management for the mass affluent investor base, another group that has been underserved. Today investments in the capital market tend to be speculative, and the investment horizon is short, which is not in line with long-term value creation. This is detrimental for people in an increasingly aging society. With this kind of investment attitude, investors will not be able to meet their financial goals for retirement several decades down the road.

We also see the emergence of insurance tech. With the development of technology, we can match thousands of insurance products with business and consumer needs, a task that machines can carry out much more effectively than human insurance agents.

How are Chinese investors’ needs changing?

We are seeing the Chinese wealth management industry go through profound changes. It is moving from fixed-income investments to equity investment, from short-term speculation to long-term investment, from China-focused investment to global opportunities, from investing into single products, single opportunity to comprehensive risk management and comprehensive asset allocation, from managing this generation’s wealth to thinking about succession planning and inheritance.

We see tremendous anxiety among China’s early rich, who no longer face the same investment opportunities they did previously when there were options with implicit government guarantees and short-term investment horizons. Today, individual investors rarely have the expertise to predict which company will be the next Google in a decade’s time. This is why they have to depend on professionals.

What is your investment philosophy?

When I did early stage investing, we had an investment framework based on six criteria: market, model, men, money, mobile, and motivation. A promising startup should be in a large, fast-growing market. It should have a sustainable, sticky model. It is run by a capable team that has access to capital markets and investors. Finally, the business needs to be great at utilizing technology. If these five criteria are met, we know it is a promising company that we must invest in.

But in the long run, the game-changing future leader must also meet the sixth criteria: motivation. While the first five criteria answer the question of “how,” the last criteria answers the question “why” and is the reason entrepreneurs stay on when they run into difficulty.

Do you foresee the emergence of major global fintech brands?

I think the term fintech will disappear. Financial services have been driven, and will continue to be driven, by technology. So when we talk about future brands, what we are really talking about is leading financial institutions and leading technology companies helping financial institutions. I don’t think fintech will necessarily be a unique category decades down the road.

What are some of the challenges your company faces?

People need to understand that getting rich quick is not the purpose of investment. China is still a fast-growing economy, and while there are still opportunities where people can accumulate a fortune, that’s not the right way to think about investment.

If you ask China’s high-net-worth individuals what they want today, they would talk about where to buy real estate, how to find double digit returns, which stocks to invest in. But they need to start thinking about comprehensive risk and asset management.

CreditEase’s subsidiary Yirendai was among half a dozen companies whose stock prices dipped after China announced new regulations to tighten supervision over the online lending sector in early December. How have the regulations impacted the industry?

The market will continue to change and regulators will play a key role in this market to help it become healthier and more organized. While online lending has made finance more inclusive, it is not without risks. I believe the regulations are a good thing for leading companies that intend to be in the market for a long time. For us, it's a marathon rather than a 100-meter dash, which means that we want the road to be as smooth as possible.

Contact reporter Liu Xiao (liuxiao@caixin.com)

Caixin Hot Pot is a regular feature that introduces you to the colorful array of players in today’s China — from the leaders of top U.S. companies doing business here to the migrant woman selling noodles from a pushcart.

- MOST POPULAR