Quick Take: Baidu First-Quarter Profit Nearly Quadruples

Internet giant Baidu Inc.’s profit surged 277% year-on-year in the first quarter, buoyed by strong online advertising sales.

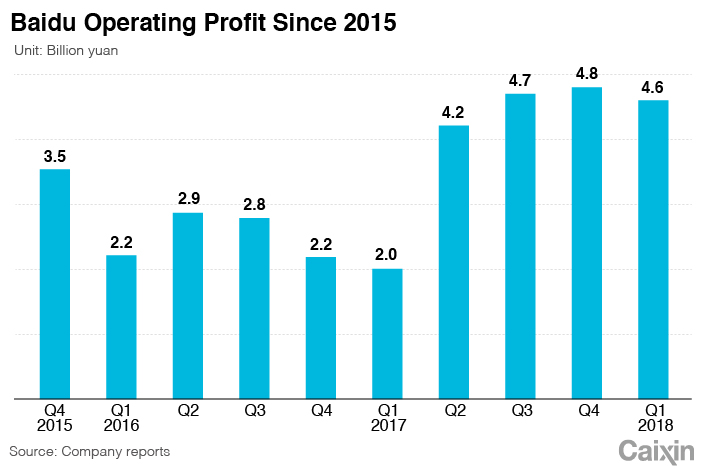

Profit hit 6.7 billion yuan ($1.1 billion) for the three months ending March 31, according to a statement on Friday. The company’s operating profit rose to 28% to 4.6 billion yuan, while revenue jumped more than 30% to 20.9 billion yuan.

Baidu expects revenue of between 24.9 billion yuan and 26.2 billion yuan in the second quarter, an increase of as much as 33% year-on-year.

“We had a strong start in 2018, with our core business exhibiting robust growth, and we continue to execute our strategy to strengthen Baidu’s mobile foundation and lead in artificial intelligence,” said Robin Li, Baidu chairman and CEO.

John Choi, an analyst with Daiwa Capital Markets in Hong Kong, forecast 20% growth this year for Baidu’s core search revenue, which includes traditional searches and feeds.

Baidu’s dynamic ads and optimized-cost-per-click initiatives are receiving positive feedback, he said in a note on April 6.

U.S.-listed shares of Baidu rose 5.6% to $252 in after-hours trading, indicating a positive response from investors.

Separately, Baidu-owned video-streaming site iQiyi Inc. reported a net loss of 395.7 million yuan for the quarter, narrowing from 1.1 billion yuan in the same period in 2017. Revenue grew 57% to 4.9 billion yuan.

iQiyi listed in the U.S. in March in the second-largest U.S. initial public offering (IPO) of a Chinese company ever, trailing e-commerce giant Alibaba Group Holding Ltd., whose listing was $25 billion in 2014.

|

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas