Baidu Finds Success, Weibo Takes Pause in First Quarter

A resurgent and refocused Baidu Inc. was the big winner among China’s top internet companies in the first quarter of the year, while an overinflated Weibo Corp. moved to the bottom of investors’ lists as its red-hot growth showed inevitable signs of cooling.

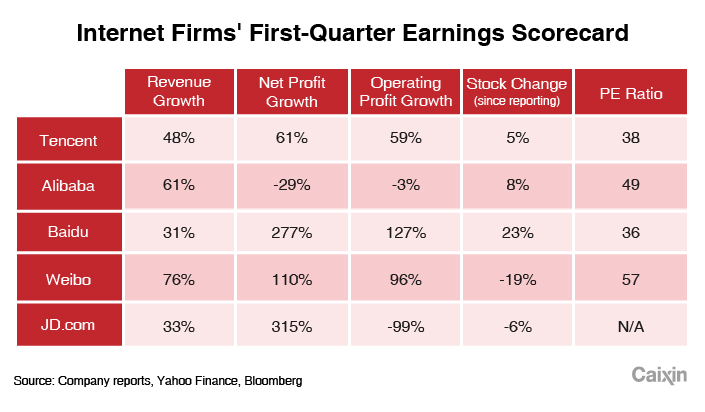

Baidu, operator of China’s leading search engine, saw its profit nearly quadruple in the first three months of the year, including a 127% rise in its underlying operating profit, as the company bounced back from a difficult two years. That marked the best performance among the Chinese quintet of Baidu, alongside e-commerce giants Alibaba Group Holding Ltd. and JD.com Inc., and social networking leaders Tencent Holdings Ltd. and Weibo.

Baidu had come under pressure after a 2016 misleading advertising scandal that forced it to pare back its core advertising business, and briefly saw its revenue drop before returning to growth a year ago. At the same time, it continued to shed some of its money-losing newer businesses, helping to improve its overall profitability.

|

Those efforts, combined with growing distance from the scandal, helped Baidu to post 31% revenue growth for the quarter, up sharply from the more modest 7% revenue gain it reported a year earlier. The growing recovery helped to fuel a 23% rally for Baidu shares since it announced its results late last month, helping its price-to-earnings (PE) multiple begin to re-approach levels of its rivals.

Alibaba also did well, beating Wall Street consensus by posting revenue growth of 61% and forecasting similar growth for the entire year, according to research house Nomura. But the company’s investments in new retailing, logistics and international expansion are likely to pressure its margins, tempering investor enthusiasm, Nomura added.

“These are likely to put pressure on its profitability,” it said in a note. That impact was already apparent on Alibaba’s bottom line, with its net profit falling 29% during the first quarter and a more modest 3% on an operating basis. The expectation-beating performance combined with generally strong revenue growth helped to lift Alibaba shares 8% since it reported its results earlier this month.

At the other end of the spectrum, Weibo emerged as the clear loser in the latest earnings season, as China’s equivalent of Twitter saw inevitable signs that its breakneck growth was slowing. The company’s profit doubled in the first three months of year, marking a major slowdown from the more six-fold rise a year earlier.

Weibo’s shares have sagged 19% since the results came out, continuing a steady decline this year after a nine-fold run-up over the previous two years on surging business for its popular live-broadcasting services. Even after the sell-off, Weibo’s shares still trade at a 57 PE ratio, higher than any of China’s other major internet players.

JD.com, which has posted inconsistent profits since its 2014 listing, was also a loser for the quarter as it came under pressure due to falling margins that eroded most of its operating profit. The stock has fallen 6% since it announced its results last week.

“We expect the market to be concerned about JD’s weaker-than-expected margins in (the first quarter of 2018),” research house Daiwa wrote in a note. “With ongoing investments in logistics and technology, we believe JD will experience a slower pace of margin expansion than in prior years.”

Contact reporter Yang Ge (geyang@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas