Chart: Property Plays Bigger Role in GDP Than Believed, Study Says

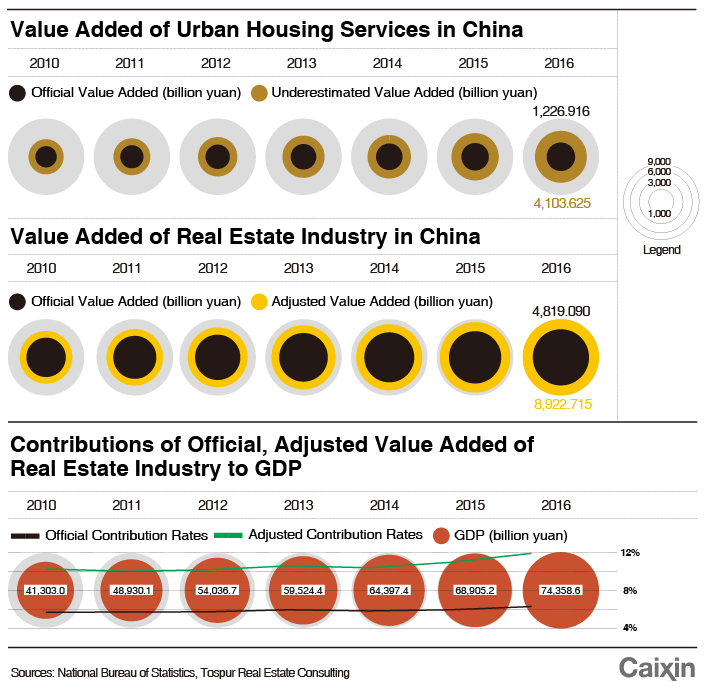

The adjusted contribution rate of the real estate industry to China’s gross domestic product (GDP) in 2016 was 12%, or 5.52 percentage points higher than the official figure, according to recent nongovernmental research.

The previously released official figures from the National Bureau of Statistics (NBS) said that the value added of the real estate industry in China amounted to 4.82 trillion yuan ($751.6 billion) in 2016, accounting for 6.48% of the country’s GDP, which was 74.41 trillion yuan.

However, the NBS used the cost-accounting method to calculate the value added of housing services, which accounted for the largest proportion of the value added of the real estate industry.

Using this method was unreasonable as it could not reflect the influence of sharply rising house prices in recent years, according to research by Sheng Songcheng, a counselor to the People’s Bank of China, and Song Hongwei, a researcher at consultancy Tospur Real Estate Consulting Co. Ltd.

The researchers used the market rental method, which has been adopted by the U.S. and Japan, to recalculate the value added of housing services, and found that the adjusted figure was 5.33 trillion yuan in 2016, much higher than the one calculated with the cost-accounting method, which was 1.23 trillion yuan.

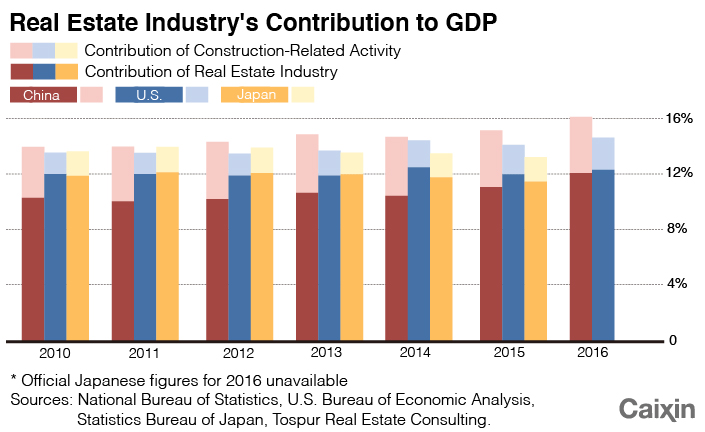

Taking that into account, the adjusted value added of the real estate industry in China was 8.92 trillion yuan in 2016, accounting for 12% of its GDP, which was basically the same as the U.S. and Japan, according to the research.

|

In addition, the researchers added activities related to real estate in the construction industry to the real estate industry figure, and that made the contribution of the whole real estate industry in a broader sense even larger. This is consistent with the fact that there has been continuing demand for new housing during China’s rapid urbanization, while the U.S. and Japan have basically completed urbanization, they said.

|

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas