Lenovo’s Comeback Plan? $94 Smartphone

Personal computer giant Lenovo Group Ltd. is aiming for a comeback on its home turf by launching a slew of smartphones priced as low as 600 yuan ($94).

The once-prominent Lenovo has fallen behind its homegrown rivals. It sold 1.8 million handsets in China last year, ranking 10th among smartphone-makers, according to research firm GfK SE. Chinese manufacturers shipped 360 million phones in the country last year.

With the new launches, Lenovo vowed to retake its place as a major brand in China by providing “quality and affordable phones made for the Chinese.”

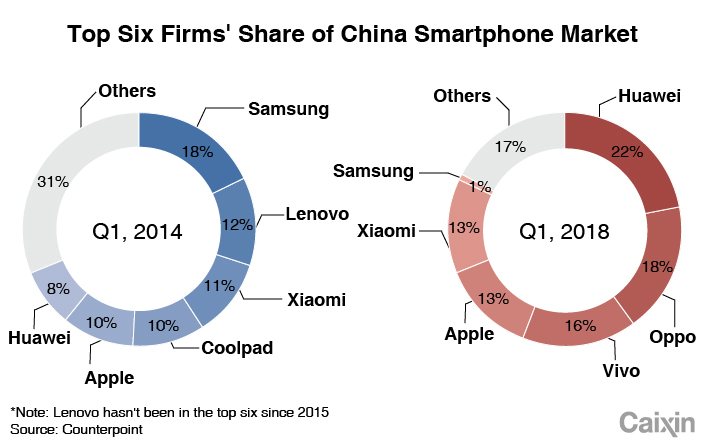

According to data from research firm Counterpoint, Lenovo held 12% of China’s market in the first quarter of 2014, ranking second. But by the end of 2017, its share had shrunk to less than 1%.

On Tuesday, the company launched three phones with prices starting from 599 yuan.

The flagship Z5 sells from 1,299 yuan, which Lenovo said is the most afforable full-screen-display smartphone on the market. The Z5 boasts a 6.2-inch screen that takes up 90% of the front body. It’s powered by a Qualcomm Snapdragon 636 processor, and claims to allow users to talk for up to half an hour on 0% battery.

|

Lenovo has faced headwinds in China, the world’s largest smartphone market, which has become saturated. It has also had a hard time integrating the Motorola brand, which it acquired from Google Inc. in 2014 for $2.9 billion. The purchase came as it struggled against falling sales amid fierce competition from Apple Inc.’s iPhones and Samsung Electronics Co. Ltd.’s Galaxy series.

In 2015, Lenovo launched in China a relatively popular brand targeting young people, the ZUK, but discontinued the model in late-2016 as part of its product-streamlining effort.

“Lenovo doesn’t lack smartphone know-how. What it needs is to react faster to the changing market and consumer needs,” a market watcher told Chinese technology portal Jiweinet. “The new Z5 is quite similar to the ZUK, showing Lenovo’s attempt to shore up sales with that well-received model.”

Zhao Zuoyan contributed to this report.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas