Update: CDR Excitement Wanes as Tech Firms Balk Over Price

* Internet firms have been unwilling to compromise on price of CDR issuances, a fund manager said

* It has also been difficult to price the shares of tech giants like Alibaba and JD.com because their lofty overseas valuations exceed caps set by mainland regulators

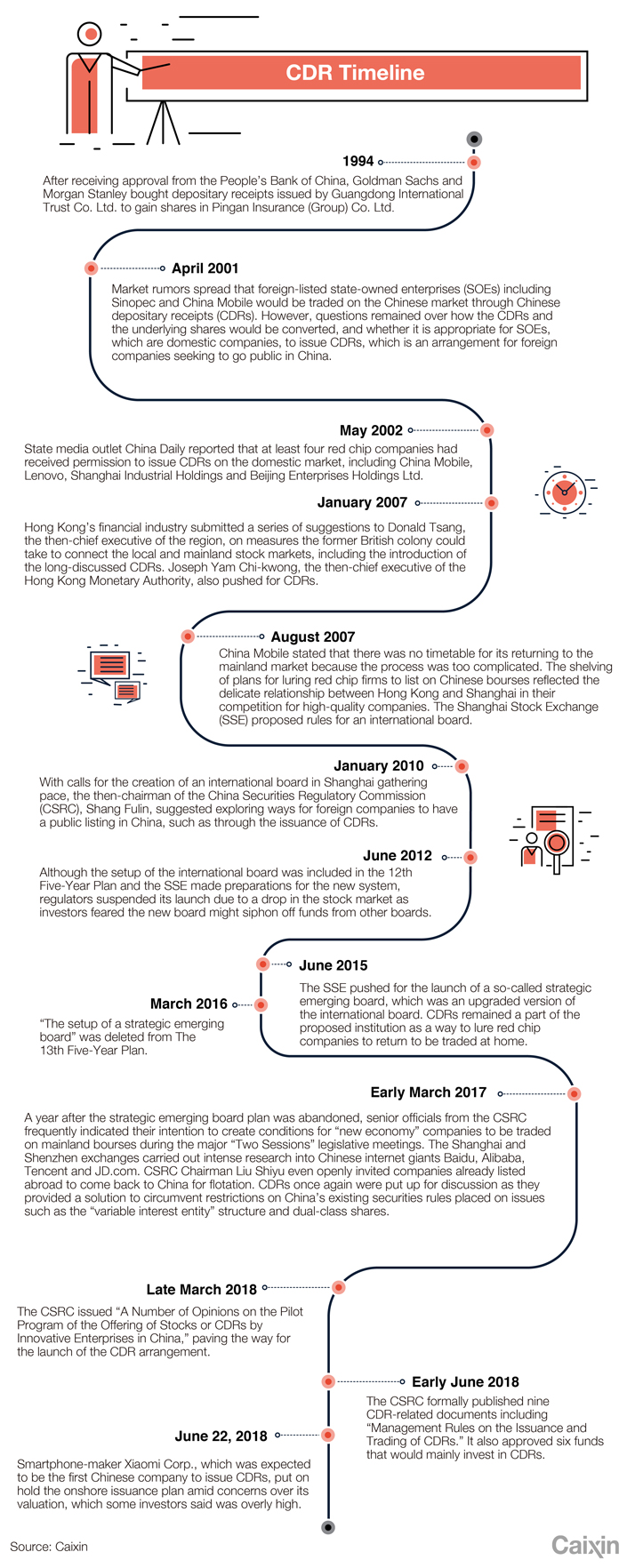

(Beijing) — One after another, China’s internet giants are growing less enthusiastic about Chinese depositary receipts (CDRs), as the companies struggle to reach an agreement with regulators about how they should be priced under existing market rules.

Caixin has learned from industry sources that Alibaba Group Holding Ltd. and JD.com Inc. have pushed back their timelines for issuing CDRs — securities that allow Chinese mainland investors to buy shares of overseas-listed companies on the domestic stock market.

Baidu Inc., which was poised to be the first firm to issue CDRs after smartphone-maker Xiaomi Corp. shelved its issuance plans, has not made any new moves since racing to prepare its application to offer its securities domestically, a person close to the company told Caixin.

Xiaomi initially planned to offer CDRs at the same time as its Hong Kong initial public offering, but then announced two weeks ago that it had decided to postpone the issuance.

Several sources close to regulators said Xiaomi pushed back its CDR plan because it could not come to an agreement with the China Securities Regulatory Commission on the issue price.

The plunging stock market has also been a source of uncertainty for potential issuers. The Shanghai Composite Index hit a 28-month low on Tuesday as a result of trade tensions between China and the U.S., tight liquidity conditions, and a weakening yuan, according to analysts.

Regulators hope to discuss CDR arrangements once the A-share market stabilizes and market sentiment recovers, a source from a securities firm told Caixin, but added that regulators did not specify at what level the market needs to recover to before continuing to push forward with CDRs.

The delay marked an inauspicious start for the China’s CDR program, said a source from a fund company that recently set up a fund to invest in CDRs. From the start, the fund company believed that the first CDR issuer should be a Chinese company that is already listed overseas. “That’s because the (company’s stock) price on the overseas market price is certain, so the risk is low, and it is simpler to determine a (domestic) price,” the fund manager told Caixin.

|

Internet companies such as Xiaomi are unable to make compromises on price and other aspects of the offering as previously hoped, and regulators cannot fully follow market principles to determine prices, the fund manager said.

“The level of trust between the two sides is already weak. Now companies are even more keen to take a ‘wait and see’ attitude,” the fund manager said.

Alibaba and JD.com have all the necessary documents required to apply to issue CDRs, but appear to be in no rush to hand them over to the regulator, a securities firm source told Caixin.

Alibaba was one of the first companies to express its intention to issue CDRs, and started to make the necessary preparations as early as the end of 2017. But a person close to regulators told Caixin that Alibaba is still in discussions with regulatory authorities on the scale and price of its potential offering, adding that the company has pushed back the date it initially expected to submit application documents.

Trading at a price-earnings ratio (P/E) of 47 in the U.S., Alibaba’s shares are difficult to price domestically because this ratio is more than two times the P/E cap of 23 that China’s securities regulator has set for new listing since 2014 — a move first taken to protect small investors in an unstable stock market. The scale of Alibaba’s issuance is also a point of contentions as it is difficult to predict what the market can tolerate.

“Even if Alibaba brings 5% of its shares back to the domestic market, this would already be 150 billion yuan (based on a market cap of $476 billion). It is difficult to predict if this will create capital pressure in the A-share market,” a person close to regulators told Caixin.

Pricing for JD.com is even more of a challenge as the company is currently trading at a P/E of 300.

If JD.com meets the same strict examination process as Xiaomi, which was given a list of 84 questions by regulators, the company will find it difficult to answer the questions within 30 days, a person close to JD.com told Caixin. “Currently, the risks appear to outweigh the rewards for issuing CDRs,” the source said, “These companies are not short on money, and the U.S. stock market is doing fairly well.”

Compared with Alibaba and JD.com, Baidu was a latecomer in starting preparations to issue CDRs. In the first half of June, Caixin learned from a source close to Baidu that the company was racing to prepare its CDR application. Baidu has moved ahead of Alibaba and JD.com in terms of the application process, the source said.

Compared to Alibaba and JD.com, Baidu should have an easier time determining the size and price of its issuance because it is trading at a P/E of 23.

“Currently, it looks like Baidu will be the first company to issue CDRs, but the company has not made any additional progress,” the person close to the company told Caixin.

These delays in CDR issuances have also been bad news for the six government-appointed equity funds set up for investing in CDRs.

As of June 19, six funds had finished raising money from institutional investors and entered the final step of verification of assets and registration, Caixin has learned. However, as of Friday, the companies still had not received product registration confirmation — the regulatory approval to start investing — leaving the funds unable to invest in anything except bank deposits.

A chief inspector of fund compliance at a mutual fund firm in Shenzhen told Caixin that it typically takes two or three days to get the registration confirmation, at which point the fund’s contract with investors takes effect. But before getting the final nod, funds can sit only in entrusted accounts, earning deposit interest rates.

The market is now debating what should be done with the more than 100 billion yuan ($15.02 billion) earmarked to invest in CDRs when there are no CDRs to invest in.

According to their contracts, the six funds are also allowed to invest in domestically listed shares, government bonds, AAA-rated bonds, nonfinancial firms and bank loans. Several sources close to regulators told Caixin that the funds can invest in high-growth tech stocks through the Hong Kong-mainland Stock Connect programs.

Contact reporter Liu Xiao (liuxiao@caixin.com)

Read more on Caixin’s coverage of Chinese depositary receipts

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas