Huawei Dials Up Its Dominance of China Smartphone Market

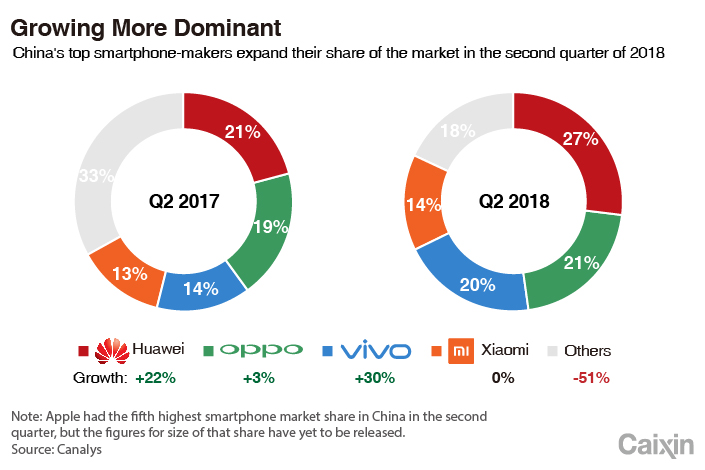

Huawei Technologies Co. Ltd. saw its share of the domestic smartphone market soar to 27% in the second quarter, the highest share for any brand since the second quarter of 2011, a market research report shows.

Huawei brand Honor accounted for 55% of its total shipments in the same period, data tracker Canalys said in a statement Wednesday. This is an increase of 33% from the same period last year, showing Honor is gaining strong momentum within the Huawei portfolio of phones.

Honor was originally launched in 2013 as a cost-effective smartphone brand targeting young Chinese consumers. It made its first international foray a year later and has since expanded into higher-end phones.

“Honor is now the largest smartphone brand in the Huawei Consumer Business Group. Enjoying a high level of autonomy within Huawei, Honor has been pushing to make a name for itself in the market. It has expanded successfully into the $500+ segment with its latest flagship models and continues to erode the market share of its direct competitors in the low-cost segment, such as Xiaomi,” Canalys analyst Jia Mo said in the statement.

|

Huawei announced that goal in June, which would represent a rise from 153 million shipments last year. If the 200 million goal is achieved, Huawei will be nipping at the heels of archrival Apple Inc., which industry experts expect to ship as many as 210 million iPhones this year.

Oppo Electronics Corp. was the second-most popular brand in China in the second quarter, with a market share of 21%, followed by Vivo Communication Technology Co. at 20%, and Xiaomi Corp. at 14%, the Canalys data showed.

Apple came in at No. 5, with its share dropping year-on-year, Canalys said, though it didn’t disclose the size of the decline.

Overall, China-based manufacturers shipped a total of 104 million smartphones in the second quarter, down 8% from the same period last year.

Canalys expects the market to continue its dwindle in the coming quarters due to “declines in shipments from smaller vendors that are unable to sustain volumes and are therefore finding it difficult to justify further investment in the market,” Jia said.

The top five vendors commanded 90% of total shipments in the April-to-June period.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas