Update: China Stocks Tumble to Four-Year Low After U.S. Sell-Off

Chinese stock markets saw their biggest daily drop in two and half years on Thursday, with two major mainland bourses tumbling to a near-four-year low. The plunge followed a sharp decline in the U.S., as China’s two main benchmarks fell further into bear territory on concerns about that country’s economic outlook.

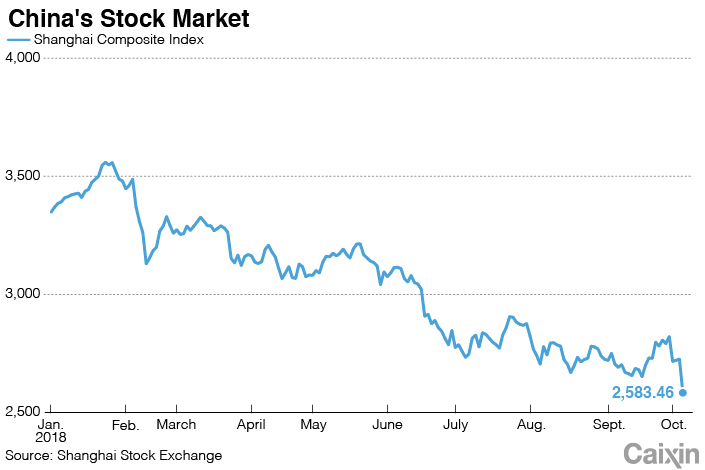

The benchmark Shanghai Composite Index, the primary indicator of China’s stock market, closed down 5.22% at 2,579.58. The Shenzhen Component Index fell by an even-sharper 6.07% to 7,521.40. Hong Kong’s benchmark Hang Seng Index, which includes many Chinese companies, closed down 3.6% at 25,250.41.

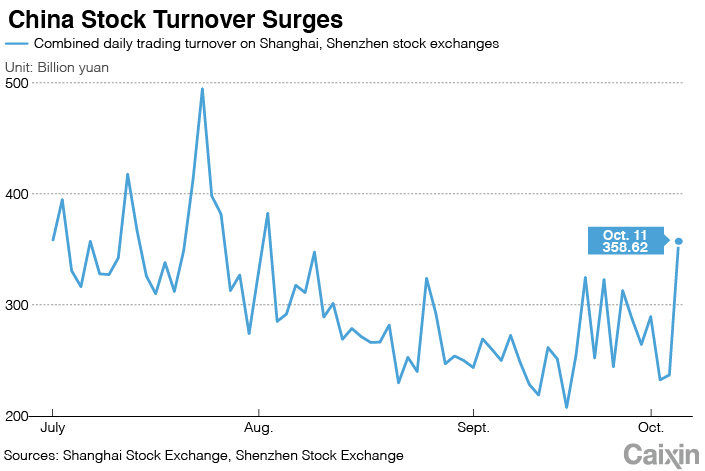

The daily stock turnover reached 358.6 billion yuan ($51.78 billion) on the Shenzhen and Shanghai markets combined. This was up 51.9% on the previous day.

The sell-off came after U.S. stock markets fell sharply on Wednesday, with the benchmark S&P 500 down 3.29%. That infected markets in Asia, which often take their lead from the U.S.

|

China’s stock markets have been slumping since the beginning of this year on concerns about the country’s economic outlook, making them some of the world’s worst performers. The Shanghai Composite Index is down nearly 20% from the start of this year, and is down nearly 27% from a peak in late January.

Chinese stocks officially entered bear market territory in June, when the Shanghai index was down more than 20% from its high earlier in the year amid growing trade tensions.

The U.S. sell-off that later spread to Asia was triggered by an increase in yields of U.S. Treasurys, caused by the Fed raising interest rates in September, said Chen Li, director of Chuancai Securities’ research department. Chen said uncertainty surrounding the U.S. midterm congressional elections, which will be early next month, also contributed to the fall.

But China stocks overall remain a bargain at current levels following the declines this year, said Medha Samant, investment director for Asian equities at Fidelity International. “The valuation story for Asia remains compelling,” he said. “Onshore Chinese equity valuations are at bear-market levels and offer the best risk reward profile across Asia.”

|

Shares in companies related to oilfield services, communication devices, domestic software and 5G have seen the biggest drops across the markets.

To boost the market, authorities might implement more policies such as tax reductions and encouraging more investment by private and foreign capital, said Shen Meng, an executive at Xiangsong Capital. He added Beijing could also slow down the deleveraging process, which has seen it encourage big companies and local governments to pay down their debt levels.

The People’s Bank of China announced on Sunday that it would lower the reserve requirement ratio by 100 basis points for most Chinese banks and all foreign banks, which will release around 1.2 trillion yuan into the banking system.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas