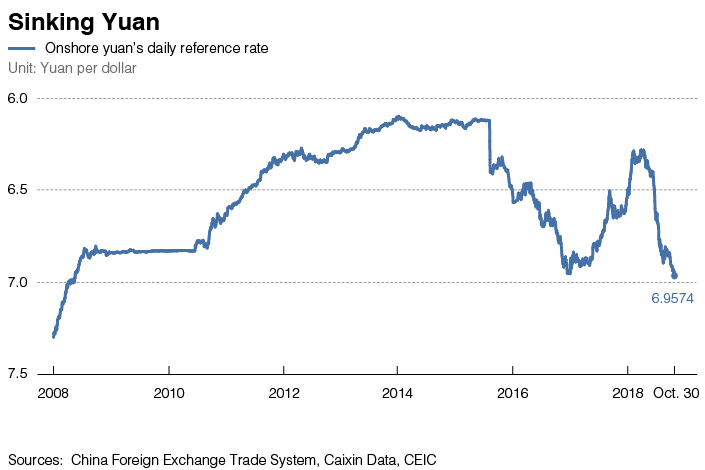

Chart of the Day: China’s Yuan Dips to 10-Year Low

China’s onshore yuan slid to its weakest level in more than 10 years on Tuesday, taking it a step closer to the 7-yuan-per-dollar level, a psychological threshold that some see as key to underpinning of market confidence in China.

|

The People’s Bank of China (PBOC) weakened the yuan’s daily reference rate to 6.9574 per dollar on Tuesday, 197 pips weaker than the previous fix, marking its lowest level since May 2008, according to data from the central bank-backed China Foreign Exchange Trade System. The yuan traded as low as 6.9722 per dollar in the onshore market on Tuesday.

So far this year, the Chinese currency has tumbled nearly 7% against the backdrop of a strengthening greenback, escalating trade frictions with the U.S. and the Federal Reverse’s rate hikes.

“With China’s economy facing growing headwinds and the direction of monetary policy diverging from the U.S., the renminbi will continue to come under pressure,” economists with research firm Capital Economics said in a note on Monday.

Recently, there has been speculation whether the PBOC will defend the 7-per-dollar level to ease pressure on capital outflows and shore up market confidence.

PBOC Deputy Governor Pan Gongsheng said at Friday’s press briefing (link in Chinese) that China has confidence that it can keep the yuan’s exchange rate basically stable at a reasonable and balanced level. Meanwhile, he reiterated that China won’t use yuan devaluation as a tool to deal with external turbulences such as trade disputes.

The yuan depreciation has been a topic of concern to U.S. President Donald Trump, who has accused China of manipulating its currency to make its exports more competitive. However, the U.S. Treasury Department didn’t label China a currency manipulator in its semiannual report published earlier this month.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 5Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas