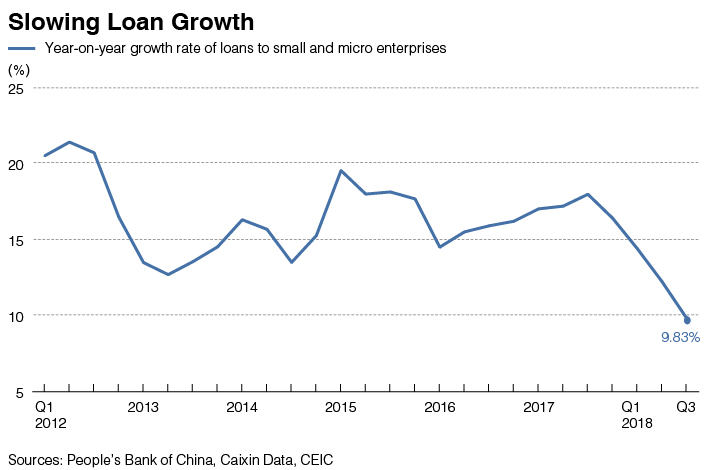

Chart of the Day: Deleveraging Drags on Small-Business Loan Growth

Bank lending to small and micro enterprises last quarter grew at the slowest pace since at least 2012, despite Beijing’s recent push to make more financing available to smaller companies.

|

Total loans to small and micro enterprises rose 9.83% year-on-year in the third quarter of 2018 to 25.81 trillion yuan ($3.72 trillion), down from 12.24% in the second quarter and marking the fourth straight quarter of slower growth, according to the People’s Bank of China, the central bank.

Smaller companies in China have always had a harder time getting financing than larger state-owned companies, which banks view as safer because of their government ties. However, the situation has only grown worse this year as the government has ratcheted up a nationwide deleveraging campaign that has made financing scarcer across the economy, with smaller companies hit particularly hard. Slowing economic growth has not helped either.

In recent months, Beijing has introduced a series of measures to make financing easier for smaller enterprises to obtain. Since January, the central bank has lowered the amount of cash that commercial lenders are required to hold in reserve on four separate occasions, while earmarking some of the freed-up cash for smaller companies.

In addition, the central bank this month has added 150 billion yuan of relending and rediscount quotas that target the financing needs of small businesses, in addition to 150 billion yuan of similar quotas issued in June.

Small and micro companies were granted a total 1.48 trillion yuan in new loans in the first three quarters, accounting for 22.4% of all new corporate loans over the period, according to the central bank.

Contact reporter Charlotte Yang (yutingyang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas