In-Depth: Huawei’s Odyssey Heads Into Uncharted Waters

Founder Ren Zhengfei once told employees that Huawei should develop its overseas business like tai chi, a slow, internally focused martial art.

The telecom equipment giant should “focus internally” and “empower ourselves” rather than “showing aggressive” gestures, Ren said at a November company meeting in reference to growing challenges facing Huawei Technologies Co. Ltd. in foreign markets.

But Ren’s low-profile approach didn’t prevent Huawei from becoming embroiled in public controversies worldwide over its technology and speculation about its ties to the Chinese government. The arrest of Meng Wanzhou, Huawei’s chief financial officer and a daughter of Ren, again put the company at the center of a firestorm.

Meng was arrested in Vancouver Dec. 1 on the U.S. government’s request and was later released on bail. The U.S. is seeking her extradition on allegations that her fraudulent statements about Huawei’s tie with a Hong Kong firm led American banks into transactions that violated sanctions against Iran. Meng and Huawei denied the charges.

|

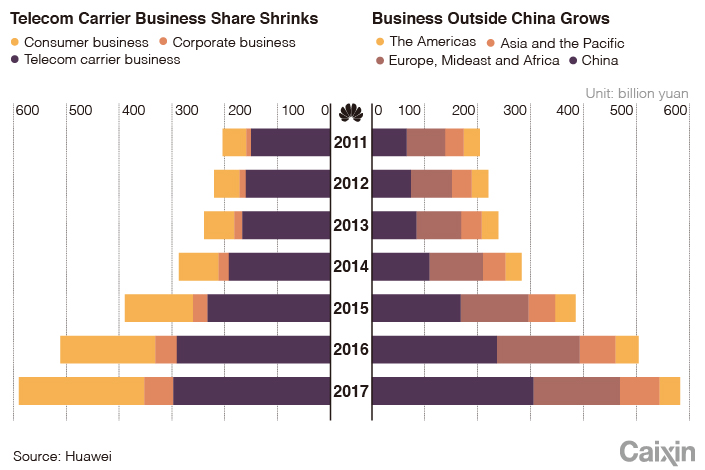

Huawei has clearly grown too big to fly under the radar. In 2017, Huawei reported global revenue of nearly $90 billion with net profit of $7 billion, making it one of the world’s largest suppliers of telecom gear. For the first nine months this year, Huawei's global telecom revenue equaled the combined revenue of Finland’s Nokia and Sweden’s Ericsson, according to the market research organization Dell'Oro. It recently surpassed Apple as the world's second-largest smartphone maker behind Samsung.

Global player

Established in 1987 as a small maker of cut-rate electronics, Huawei has sought overseas expansion since 1996, driven by slower growth and heated competition at home.

By the end of 2017, Huawei was operating in more than 170 of the world’s 195 countries and participated in the construction of 1,500 telecom networks worldwide. Overseas sales contributed nearly half of Huawei’s total revenue in 2017, according to the company.

Ren has emphasized Huawei’s strategy as “globalization” rather than “internationalization” to highlight his ambition for Huawei to be seen as a global player rather than as a Chinese company. Since 2010, Huawei has initiated a series of restructurings to support its global resource allocation and cross-region operations.

In 2017, combined sales in Europe, the Mideast and Africa accounted more than 27% of Huawei’s revenue. Businesses in Central and South America, including Mexico, Argentina and Peru, contributed 6.5%.

But Huawei’s growing ubiquity has caused anxiety over national security risks related to alleged connections between Huawei and China’s Communist Party and military.

|

Huawei has been mostly shut out of the U.S. market since 2012, when U.S. lawmakers began to block American wireless carriers from buying equipment from Chinese companies on national security grounds. The previous year, Huawei reported $1.3 billion of revenue in the U.S., or about 4% of total revenue.

Huawei has remained a marginal presence in the American market, mainly offering lower-end devices. The company has made repeated efforts to crack the world’s second-largest telecom market after China, but mostly in vain. In 2015, Huawei’s sales in the U.S. totaled $2 billion, 3% of worldwide revenue.

In January at the International Consumer Electronics Show in Las Vegas, Huawei was set to announce a partnership with AT&T to sell mobile phones in the U.S., but Huawei canceled the event without giving a reason.

Sources close to the matter said Huawei has recalled most of its staff dispatched to the U.S. since April after smaller rival ZTE Corp. was hit with a business ban by the Trump administration citing violations of sanctions on Iran.

Huawei’s setback in America also reflects the growing competition between China and the U.S. on advanced technology, analysts said. The two countries will vie for telecom leadership for the next 10 years, a U.S. telecom expert said.

5G setbacks

The looming transition to the super-speedy, co-called fifth-generation (5G) mobile-phone networks poses an opportunity as well as challenge to Huawei.

Experts say the 5G technology will be a crucial driver of the “Internet of Things,” which will connect all kinds of devices online. The technology is expected to power the next industrial revolution.

Telecom operators around the world have been spending massively to install equipment to upgrade their services to 5G, which is expected to start operation as soon as next year.

The high 5G expectations have fueled worries about risks related to control of such key infrastructure. Several countries including Australia, New Zealand and Japan have recently shied away from Huawei's technology, citing security concerns. Officials in Britain and Canada also publicly addressed the risks associated with 5G.

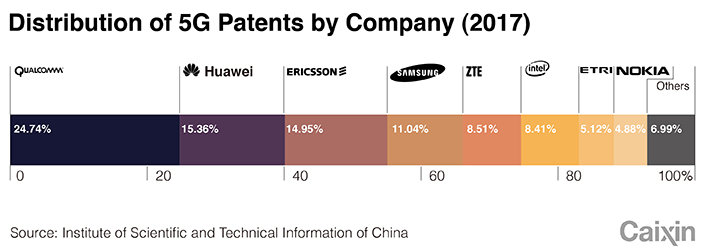

Huawei started 5G research in 2009 with a team of 60,000 people. In 2013, the company pledged to invest $600 million in the new technology over five years to compete with rivals including Ericsson, Nokia and ZTE.

Data from China’s Institute of Scientific and Technical Information showed that by the end of 2017, Huawei held 15.36% of global 5G patents, behind only the American chipmaker Qualcomm’s 24.7%.

At the Global Mobile Broadband Forum in London last month, BT Group Chief Architect Neil McRae endorsed Huawei’s technology and said the Chinese company is “the only true 5G supplier right now.”

In an interview with CNBC, Huawei’s rotating Chairman Xu Zhijun said security concerns over Huawei’s 5G technology are based on politics rather than facts. Xu said excluding Huawei from the 5G market will hurt competition and lead to higher costs for consumers and carriers.

Ren said Huawei needs to deepen its understanding of the Western world.

“Huawei can only find a solution when it can truly understand the Western values and follow their mindset to communicate,” the 74-year-old said in a recent company speech.

Contact reporter Han Wei (weihan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas