Tesla Reports Drop in China Sales as Trade War Bites

American electric carmaker Tesla is feeling the pinch of the trade war between the U.S. and China.

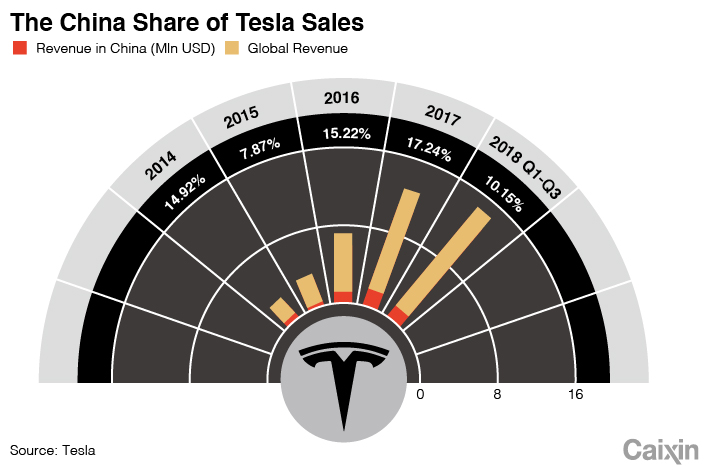

The California-based company reported a shrinking share of revenue from China in 2018 amid unsettled trade disputes that have led to rounds of punitive tariff levies affecting a wide range of products including vehicles.

Tesla said its revenue in China totaled $1.76 billion in 2018, down 13% from the previous year although global revenue nearly doubled, according to Tesla’s filing with the U.S. Securities and Exchange Commission Tuesday.

Revenue in China, Tesla’s largest foreign market, accounted for 8.18% of global revenue in 2018, down 9 percentage points from the previous year, according to the filing.

Tesla attributed the shrinking share of China sales to punitive tariffs imposed by China on U.S. cars. The company said heavier American tariffs on auto parts from China also led to rising production costs in the U.S.

Tesla imports all the vehicles it sells in China from the U.S. Deliveries in China were hurt when China imposed a 40% import tax on American-made cars after the trade war kicked off in July. The tariff was later lowered to 15% — equivalent to duties on imports from other countries — but risks of higher taxes remain as China and the U.S. move closer to a March 1 deadline to end a 90-day truce unless a deal is worked out.

Tesla is counting on a new China factory to avoid tariff uncertainties and expand sales in the country. The plant in Shanghai, Tesla’s first overseas production complex, is set to complete construction in the summer and roll out the first China-made Tesla Model 3 by the end of the year.

Domestic production will allow Tesla to avoid import taxes and reduce prices in China by 40%, according to Cui Dongshu, secretary-general of the China Passenger Car Association (CPCA).

|

Sales of the Model 3, which debuted in 2016, were a main driver of Tesla’s revenue growth in the U.S., analysts said. In the 2018 second half, Tesla for the first time reported net profit in two consecutive quarters, although it booked an annual loss of $976 million, according to the company’s financial reports.

Analysts said sales of Model 3 will be key to the company’s future profitability.

Tesla started to deliver imported Model 3 cars in China earlier this year. The company said it expects the Shanghai factory to produce 3,000 Model 3s a week, with a long-term goal of 10,000 vehicles weekly.

China is an important market for Tesla as demand in North America has tailed off. Reuters reported earlier this month that Tesla cut half of the jobs at its North America delivery department.

China remained the world’s largest and fastest-growing electric car market in 2018. Last year, China’s electric vehicle sales jumped 83% to 1.01 million units, according to data from the China Passenger Car Association.

Contact reporter Han Wei (weihan@caixin.com)

- 1China Officials Dismiss Tax Hike Rumors After Tech Selloff

- 2Cover Story: How Gutter Oil Became a Prized Fuel for International Airlines

- 3Maersk Unit Takes Over CK Hutchison Panama Ports After Court Ruling

- 4Prominent Chinese Journalist Liu Hu Detained by Police in Chengdu

- 5China Provinces Set Cautious 2026 Growth Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas