Five Things to Know About the Race for 5G

5G cars, 5G smartphones, 5G firefighting drones and 5G breakfast trays.

Innovations powered by fifth-generation (5G) mobile network technology took center stage at Mobile World Congress this week. The annual trade show, held between Feb. 25 and Feb. 28 in Barcelona, serves as a bellwether for what to expect for the global mobile devices industry in the coming months.

While we have heard a lot about 5G of late, what exactly does the technology entail and how different it is from the current 4G mobile networks that we now use? And most importantly, how is China faring in the global race to get ahead in the much-coveted next generation technology?

1. What is 5G, exactly? Why the hype?

Simply speaking, 2G networks were designed for voice, 3G networks were for voice and data, and the current 4G networks cater to broadband internet experiences.

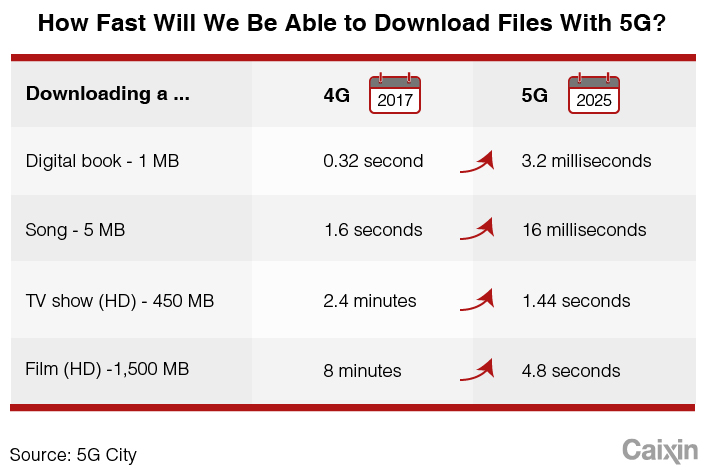

The new technology will provide data at speeds up to 100 times faster than 4G, support up to 100 times more internet-connected devices, and provide near-universal coverage and availability. For instance, users can download a 1.5 gigabyte high-definition movie in 4.8 seconds via 5G, compared to around eight minutes via 4G.

5G is not limited to smartphones; it can be applied to sensors, autonomous cars, robots and technologies such as virtual reality. 4G can’t beat this because it doesn’t have the bandwidth to process the sheer amount of data transmitted among those devices and technologies.

Research group HIS predicts that the deployment of 5G networks will create an industry worth $12.3 trillion, and offer nearly 22 million jobs by 2035. That explains why governments and mobile carriers are rushing to research and deploy 5G to lead innovation, and tap lucrative business opportunities.

|

2. Chinese firms unveiled the first batch of 5G phones at the Mobile World Congress.

Huawei Technologies Co. Ltd. unveiled the Mate X, a foldable phone that sells for an eye-watering $2,600. The device will run on its own-developed 5G chipset, called the Balong 5000, and is expected to enter the market in the middle of 2019.

Formidable rival Xiaomi Corp. has also unveiled the Mix 3, slated for delivery by May. ZTE Corp. showcased the Axon 10 Pro 5G, which will be available to consumers in China and Europe in the first half of 2019.

Small players Oppo and OnePlus also showcased prototypes of their 5G phones.

However, not all smartphone-makers are equally enthused by the 5G hype. Despite showing its first 5G smartphone prototype, Oppo Vice President Shen Yiren said in Barcelona that it will take at least two years before 5G phones will be truly valuable to consumers.

Issues currently hindering the mass adoption of 5G phones include the availability of the 5G networks, high price tags of such phones, and a lack of killer applications.

3. China is pulling out all the stops to take the lead in 5G

Having trailed its Western counterparts in the development of earlier wireless technologies through 4G, China this time is determined not to let history repeat itself.

Beijing has encouraged the country’s three major mobile operators to develop 5G networks across major cities over the past five years, helping China to amass more information and understanding of rolling out 5G technology ahead of any single country.

The investment, however, doesn’t come cheap. Upgrading existing telecom networks to 5G will set Chinese carriers back 1.2 trillion yuan ($174 billion), or 1.5 times their investment in 4G networks, the Ministry of Industry and Information Technology told Caixin in December.

But this didn’t deter wireless carriers and technology companies from joining the fray. A report out in December from patent tracker IPlytics showed that Huawei and ZTE are now the world’s second- and third-biggest owners of 5G-related patents, behind only Samsung and ahead of global giants Ericsson and Qualcomm.

|

4. How are other countries faring in the game?

Other countries and companies have not been able to mobilize resources on the same scale as China, industry watchers said. A report released in last April by research firm Analysys Mason seconded that — it said China was leading the U.S., South Korea and Japan on preparation to commercialize 5G services. The big-three telecom operators — China Mobile, China Unicom and China Telecom — have committed to launching 5G services by 2020.

The U.S. has become increasingly concerned by how far back it is falling in the race. Chip leaders Qualcomm Inc. and Intel Corp. hold just 14% of key 5G patents, according to IPlytics. Last week, U.S. President Donald Trump lamented America’s apparent slow-footedness in 5G in a tweet, saying “American companies must step up their efforts, or get left behind. There is no reason that we should be lagging behind,” he said, while calling for a push into 6G technology, which does not exist yet.

The EU’s legislative body, the European Commission, has earmarked 700 million euros ($796 million) of funding for 5G technology through 2020. Its focus however has been more on developing international standards for 5G rather than supporting companies in developing their architecture.

Japan is already in the advanced stages of rolling out its 5G technology, which is expected to begin this year. While South Korean giant Samsung and Japan’s NEC Corp. only have around 5% share in telecom infrastructure, the two announced in December that they would work together to develop their 5G offerings in a bid to reduce costs.

5. What lies ahead for Huawei?

Huawei was the world’s largest manufacturer of telecommunication network gear in 2017, and claims to lead in the 5G space . It said this week it has won over 30 commercial contracts with global mobile carriers for 5G.

However, Huawei’s 5G businesses has faced strong headwinds after the U.S. late last year rallied allies such as Australia, New Zealand and the U.K. to ban Huawei from involvement in bidding for their 5G networks.

Leading executives in Mobile World Congress argued this week that outright bans on Huawei would be costly and slow 5G development, according to CNN. Vodafone CEO Nick Read was quoted as saying that bans would be disruptive and “very, very expensive.” He said a major equipment swap would delay 5G in Europe by around two years.

Huawei was also on the offensive at the tradeshow. In a keynote speech Tuesday, Rotating Chairman Guo Ping said (link in Chinese) Huawei “has not and will never plant backdoors” in its products, rebutting Washington claims that its equipment is spying for Beijing.

Tang Ziyi contributed to this report.

Contact reporter Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas