Caixin View: Few Surprises Save for Stronger-Than-Expected Fiscal Stimulus

The government work report was released this morning, revealing China's key macroeconomic targets for 2019, including GDP growth, the fiscal deficit, and inflation, among others. You can find a rundown of all the key numbers here — we're just going to pick out the highlights.

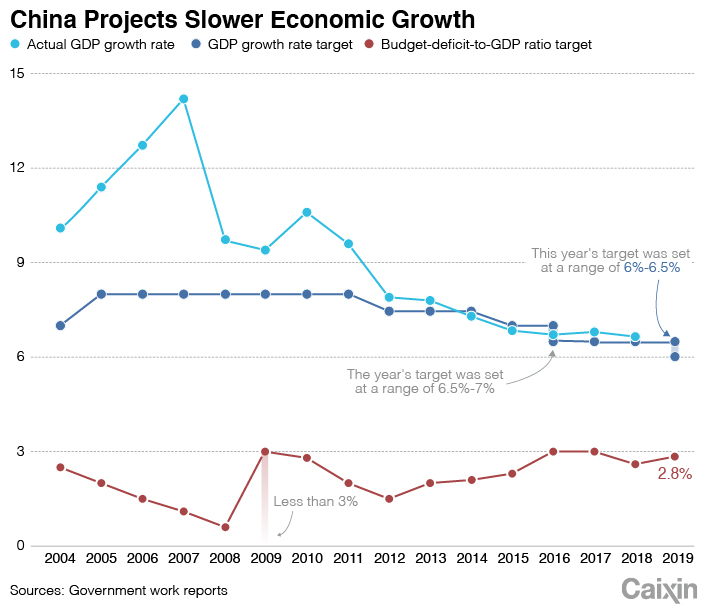

• As expected, the real GDP growth target was softened, to “6% to 6.5%,” down from last year's “around 6.5%” and the 6.6% adjusted actual growth rate that China achieved in 2018. A target range, which was used before in 2016, gives the government more flexibility in pursuing economic growth, and makes sense amid trade war uncertainties — a “graver and more complicated environment,” as Premier Li Keqiang said — and a general slowdown. China just needs to maintain 6.2% growth to meet its 2020 GDP targets. While unsurprising, the revised figure confirms that China will certainly not be attempting a massive stimulus this year, and indicates greater tolerance for lower growth rates among policymakers. This is good news for those fearing a lurch back towards the splashy debt-driven stimulus model of 2009.

|

• In line with the above conclusion, monetary policy is not set to loosen significantly overall — the report said M2 and total social financing should remain in line with nominal GDP growth in 2019, and reiterated the need to control financial risks and keep macro-leverage stable.

• Unlike last year, the work report mentioned interest rates as a tool of monetary policy directly. A benchmark interest rate cut this year, which would be the first since 2015, is looking more likely —a strengthening yuan, and a dovish U.S. Federal Reserve ceasing its cycle of rate hikes, have created a window of opportunity for this to occur.

•The government's ongoing concerns about the lack of financing reaching the real economy were clear however: specific measures were mentioned, such as targeted reserve ratio requirement cuts for banks, and the report referred to smaller enterprises’ need for credit several times, calling for significant reductions in financing costs. Large state-owned lenders will be required to increase their loans to small and micro enterprises by 30% in 2019.

• Fiscal stimulus measures that were announced were slightly stronger than expected. The planned fiscal deficit was raised to 2.8% of GDP, 0.2 percentage points higher than last year’s. Planned tax and fee cuts were set at 2 trillion yuan ($298 billion) for 2019, significantly higher than the 1.3 trillion yuan that was cut in 2018, according to the Ministry of Finance. The value-added tax (VAT) rate for manufacturers will be cut to 13% from 16%; for the transportation and construction sectors, it will be cut to 9% from 10%.

• Local governments’ special bond issuance quota was raised to 2.15 trillion yuan, a significant rise from last year’s 1.35 trillion yuan. While the increased bond issuance was in line with our expectations, the tax and fee cuts were greater than expected. This will put slightly more constraints on infrastructure spending growth by decreasing tax revenue.

• The government will also reduce the social security contribution ratio to alleviate pressure on companies, the report said — see our previous analysis here of how China is trying to balance reducing the burden on companies and the needs of its ageing population.

• Finally, the target “surveyed urban unemployment rate” — which intends to give a fuller picture than registered unemployment figures, and includes migrant workers — was set at "around" 5.5%, a slightly more flexible target than 2018's "within" 5.5%. We don’t want to read too much into the change, but it likely indicates the government may be preparing for slower growth to start hitting jobs figures.

Calendar:

March 7: State Administration of Foreign Exchange releases foreign exchange reserves data for February

March 8: General Administration of Customs releases import and export data for February

March 8: The new foreign investment law is scheduled to be reviewed by the National People's Congress

March 9: The National Bureau of Statistics releases the consumer price index (CPI) and producer price index (PPI) for February

A previous version of this story said banks will be required to increase their loans to small and medium sized enterprises by 30% in 2019. However, the actual requirement is for small and micro enterprises.

- 1Cover Story: How China’s Growing Gig Economy Has Left a Generation Adrift

- 2In Depth: China’s Sweeping Banking Law Rewrite Targets Hidden Risks

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 5Over Half of China’s Provinces Cut Revenue Targets

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas