Update: China Sets 2019 GDP Growth Target at 6% to 6.5% Amid Slowdown

China is stepping up its pro-growth policies with billions of dollars of cuts to taxes and fees, expanded government spending and greater credit support for small businesses as economic growth slowed to a near-30-year low.

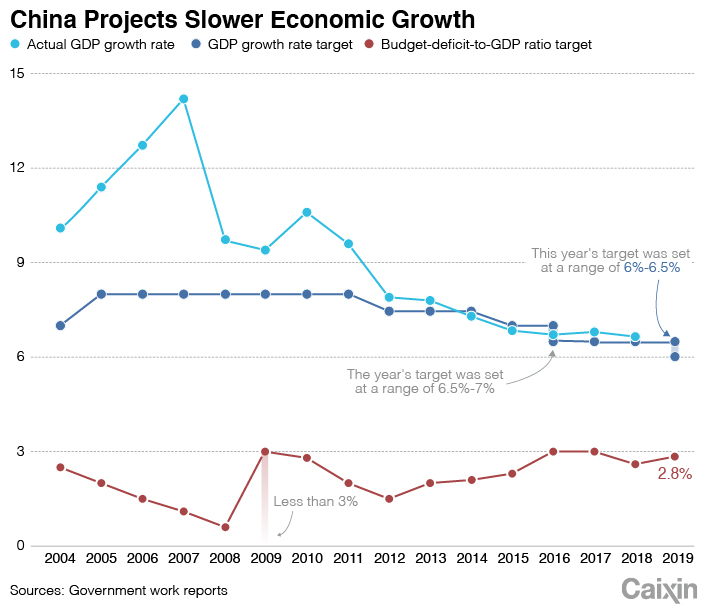

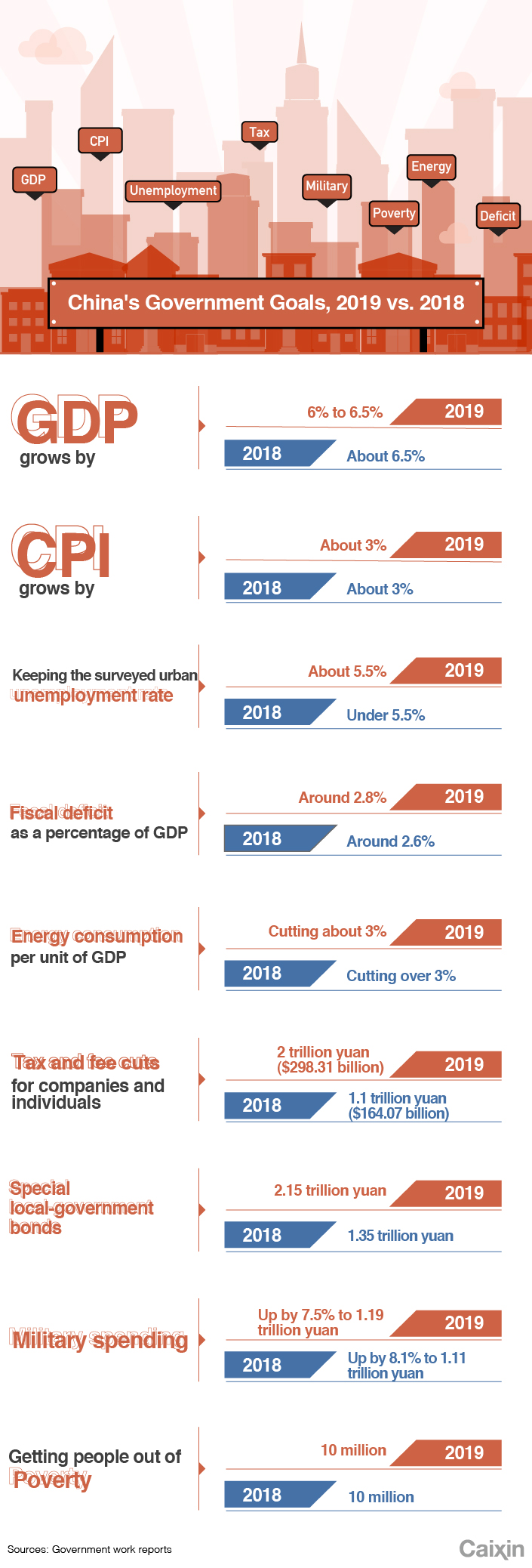

China set its target for gross domestic product (GDP) growth at a range between 6% and 6.5%, according to the government work report that Premier Li Keqiang delivered Tuesday at the opening of the National People’s Congress’s annual session.

The target falls in line with analysts’ expectations and is lower than last year’s goal of around 6.5%. The government last adopted a flexible GDP growth target — which offers more room for policy maneuvers — in 2016, when it was set at a range of 6.5% to 7%.

China’s GDP expanded at 6.6% in 2018, the slowest pace since 1990, underscoring growing downward pressure from economic headwinds that have posed challenges to businesses, cooling investment and damage from the monthslong trade war with the United States.

The lower and flexible target “reflects top officials’ maturity in accepting that China needs to stabilize growth in a sustainable manner, instead of a rush of liquidity to the economy, as in previous downturns,” said Tai Hui, Asia Pacific chief market strategist at J.P. Morgan Asset Management.

Policymakers need to strike a balance between boosting economic activity and avoiding another debt-fueled boom, Hui said.

China must be “fully prepared for a tough struggle” as the country will face “a graver and more complicated environment as well as risks and challenges,” Li told the nearly 3,000 delegates to the annual gathering of China’s top legislature.

China faces challenges to stabilizing growth this year as the impact of the trade war becomes evident. The country is also facing sluggish investment due to a cooling property market and tightened regulatory oversight over local government borrowing.

Although this year’s growth target is set lower than the “around 6.5%” of the past two years, it is in line with the government’s goal of doubling 2010’s GDP by 2020, which requires average growth of 6.2% in 2019 and 2020.

To shore up growth, the government will cut nearly 2 trillion yuan ($298 billion) in taxes and fees, according to the premier’s report. The government will also boost infrastructure financing with 2.15 trillion yuan of local government special purpose bonds to support key projects.

|

With greater fiscal support, the Chinese government’s budget deficit in 2019 is expected to widen to 2.76 trillion yuan, representing around 2.8% of GDP, Li said. That compares with 2018’s ratio of 2.6%.

China’s consumer price inflation is expected to rise around 3% this year, unchanged from last year, according to the premier.

China will create over 11 million new urban jobs and keep the surveyed urban unemployment rate at around 5.5% and the registered urban unemployment rate under 4.5%, he said.

Li called the targets for 2019 “ambitious but realistic,” as they are “in line with the goal of completing the building of a moderately prosperous society in all respects.” China has also set itself the goal of doubling 2010’s GDP level by 2020, which requires average growth of 6.2% in 2019-2020.

Deeper tax cuts

The government pledged a package of 2 trillion yuan tax and fee cuts to bolster business, focusing primarily on reducing burdens in manufacturing and on small and micro businesses, including a 3 percentage point cut to value-added tax (VAT) for manufacturers and 1 percentage point cut in VAT rate for the transportation and construction sectors.

Ding Shuang, chief economist at Standard Chartered Ltd. for Greater China and North Asia, said the VAT cut for manufacturers will reduce companies’ tax payments by 520 billion yuan.

“The cuts to VAT rates will be widely welcomed, although some firms might have expected more,” said Tom Rafferty, principal China economist at The Economist Intelligence Unit, in a research note.

Analysts broadly expected the 2019 reduction in taxes and fees to be between 1.3 trillion yuan and 1.5 trillion yuan. In 2018, cuts amounted to around 1.3 trillion yuan, Assistant Finance Minister Xu Hongcai said in January.

The premier said the government will ensure tax burdens in “main industries” are meaningfully reduced with more support measures, such as increased tax deductions. The government will also reduce the social security contributions made by employers to alleviate pressure on companies, he said.

But a research note by Macquarie Group expressed caution about the tax and fee cuts, saying the fiscal deficit target leaves little space for the potential cut.

The premier said in the work report that governments at all levels must tighten their belts and find “workable means” of raising funds to support enterprises. The central government needs to increase revenue and reduce expenditures, according to the report.

Heavier spending

This year’s work report didn’t set a general goal for fixed-asset investment but said “effective investment” should be expanded appropriately.

The premier said rail investment will amount to 800 billion yuan — 70 billion yuan more than last year’s target but less than what was actually spent — and spending on road and water transportation will total 1.8 trillion yuan, along with a batch of key projects in logistics, civil aviation and information infrastructure.

The central government has set aside 577.6 billion yuan for its investment budget, up 40 billion yuan from the previous year, according to Li.

Li said around 2.15 trillion yuan worth of local government special bonds will be issued this year to support financing for infrastructure projects. That compares to 1.35 trillion yuan of issuance last year.

Some analysts voiced concerns that the expanding policy support may add to the government’s debt overhang, which is already high. “The government’s fiscal position at both the central and local levels will deteriorate, while looser controls over lending to small companies could lead to widening bad debts,” said Economist Intelligence Unit’s Rafferty.

“This will likely encourage a shift back to more conservative policy settings in 2020-21,” Rafferty said.

Li said in his report China will continue a proactive fiscal policy and a prudent monetary policy, while maintaining appropriated levels of aggregate monetary supply. The country will refrain from using a deluge of stimulus. Instead it will use a variety of monetary policy instruments to “effectively mitigate difficulties” faced in the real economy, the premier said.

|

Contact reporter Han Wei (weihan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas