Foreign Investors Will Get More Tools to Bet on Chinese Stocks

* The operator of the Hong Kong Stock Exchange said it has signed a license agreement with MSCI to introduce futures contracts on the MSCI China A Index

* The new contracts will enable investors to bet on or against the A-share market and protect them from adverse price movements

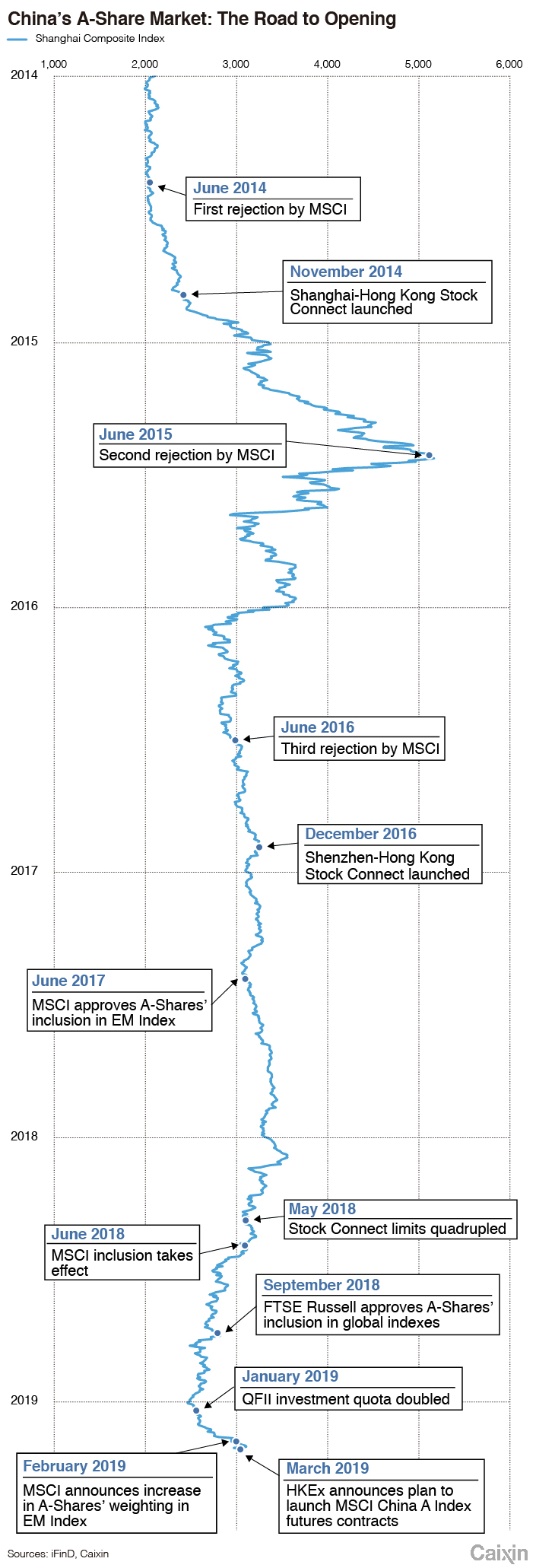

(Hong Kong) — Plans are afoot to give international investors trading stocks in China the ability to hedge their risks and better manage their exposure to the mainland equity market by introducing futures contracts on the MSCI China A Index, which represents the A-share portion of MSCI’s flagship Emerging Markets Index.

The operator of the Hong Kong Stock Exchange said Monday it has signed a license agreement with the global index provider, to introduce futures contracts on the index, which will by November comprise 421 large- and mid-cap A-shares which are available to foreign investors through the Stock Connect programs that link mainland and Hong Kong markets. The new contracts, which will be listed and traded in Hong Kong, will enable investors to bet on or against the A-share market and protect them from adverse price movements.

The Hong Kong Exchanges and Clearing Ltd. (HKEx) did not give a timetable for the launch of the product, but Chief Executive Charles Li said in a conference call that he hoped the product could be launched “as soon as possible,” pending regulatory approvals and market conditions. Li said that as the HKEx and mainland exchanges strengthen their ties, more derivative products covering both stocks and commodities will be introduced over the longer term.

The announcement was made less than two weeks after MSCI announced it would gradually raise the weighting of A-shares in its benchmark Emerging Market Index to 3.3% from the current 0.7% by raising the inclusion factor, a calculation used to represent the weight of A-shares in the index based on their adjusted market capitalization, to 20% from 5%.

Managing risk

MSCI made the changes to reflect wider access to the A-share market for foreign investors after China quadrupled daily quotas for the Stock Connect programs in May 2018, as well as growing demand from global fund managers attracted by the relatively low valuations of mainland stocks. As a result, demand for hedging is also increasing.

“This new agreement with MSCI will facilitate the development of a key risk management tool for international investors who need to manage their A-share equity exposure.” Li said in the announcement. “The international trading community has wanted a product like this for some time, and HKEx’s MSCI China A Index futures contracts will directly address their needs.”

The move is also a part of HKEx’s strategic plan for 2019 to 2021 to strengthen ties with the mainland and elevate the city's position in global markets.

Foreign investors who want to manage their exposure to A-shares do already have some hedging options in overseas markets using index-tracking futures, swaps or exchange-traded funds (ETFs). The most widely used product is the FTSE A50 stock index futures contract which was launched by the Singapore Exchange and is listed in the city.

In Hong Kong, investors can take out options on ETFs that track various indexes including the FTSE China A50 Index, and can gain indirect exposure through derivatives based on the Hang Seng China Enterprises Index, a gauge of mainland companies, mostly large state-owned enterprises, listed in Hong Kong. Investors can also trade index swaps over the counter on the FTSE China A50 and the CSI300, one of the gauges tracking blue-chip companies listed on the mainland.

But the FTSE China A50 Index has only 50 constituent stocks, far smaller than the MSCI China A Index, which will have more than 400 stocks. Li from the HKEx said that the new futures contracts will be more useful to investors.

“The futures products we are going to launch will be more precise and comprehensive to match the hedging needs of these long-term investors trading through the stock connects,” Li said.

Although there are stock index futures products in China, the process for getting new products approved is cumbersome, an executive involved in the mainland financial futures sector told Caixin. In contrast, the regulatory environment in the Hong Kong market is more flexible and efficient, so Hong Kong can take the lead in situations where there is a large demand in the market.

|

Contact reporter Leng Cheng (chengleng@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3China Business Uncovered Podcast: A $15 Billion Bitcoin Seizure and the Fall of a Cybercrime Kingpin

- 4Over Half of China’s Provinces Cut Revenue Targets

- 5In Depth: Inside the U.K.’s China-Linked Shell Company Factory

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas