Update: Chinese Economy Grows at 6.4%, Outstripping Estimates

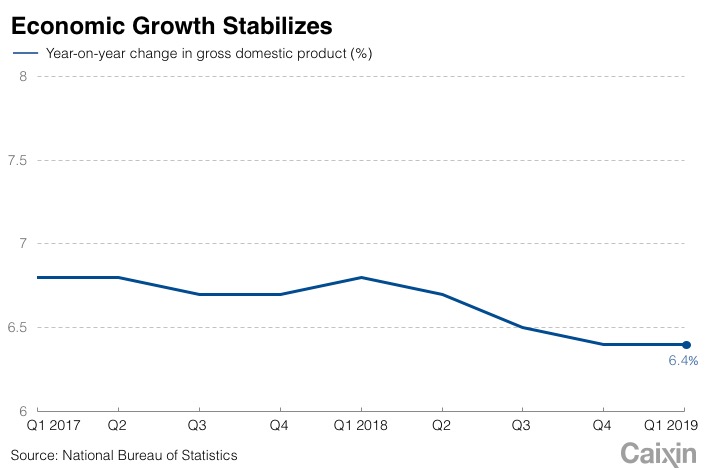

China’s economic growth stabilized in the first quarter of 2019, bucking analysts’ expectations of a slowdown to stand at 6.4%, as market confidence recovered on the back of policy support and progress in Sino-U.S. trade war negotiations.

The expansion in the nation’s gross domestic product (GDP) was unchanged from the rate logged in the last three months of 2018, snapping a slowing streak in the past three consecutive quarters. It also beat a median forecast of 6.3% by economists polled by Bloomberg.

All other major activity indicators gauging investment, industrial output and consumption hit multi-month highs, according to data released by the National Bureau of Statistics (NBS).

“The operation of the Chinese economy was stable in the first quarter. Most indicators were better than expected in March, as market expectations continued to improve and positive factors gradually increased,” NBS spokesman Mao Shengyong told reporters at a briefing.

Fixed-asset investment, a key driver of domestic demand that includes infrastructure, increased 6.3% year-on-year in the first three months of the year, NBS data showed. The NBS only releases cumulative figures of fixed-asset investment, and the first quarter reading marked the strongest since the January-April period of 2018.

|

Infrastructure investment got a boost from the earlier sale of local government bonds in the first quarter ahead of the usual schedule. China’s top legislature passed a bill in December allowing the issuance of 1.39 trillion yuan worth of the debt before the release of an official 2019 quota in March.

Value-added industrial output, which measures production at factories, mines and utilities, soared 8.5% from March 2018, the steepest increase since July 2014’s increase of 9%, NBS figures showed. The rate was also much stronger than a median projection of a 5.9% increase in the Bloomberg survey of economists.

Retail sales, which include spending by governments, business and households, jumped 8.7% last month, the strongest pace since September, beating a prediction of 8.4%.

The NBS data release added to signs that the world’s second-largest economy was gaining momentum after weakening over the past year.

“China’s high frequency economic indicators confirm that growth is bottoming out,” ANZ economists said in a report on Wednesday. The bank is now revising its full-year growth forecast for 2019 up to 6.4%, from 6.3%.

The pickup in growth momentum will likely reduce the urgency for policymakers to introduce further stimulus, such as a cut in the second quarter in the amount of cash banks must keep in reserve. And it provides leeway for Beijing to press ahead with much-needed structural reforms of the country’s growth model, they said.

China’s value-added tax rate for manufacturers was cut from 16% to 13% from April, which could have prompted firms to increase purchases of raw materials in the spot market in March to sell the commodities later, taking advantage of the tax break, analysts said previously.

|

In his annual government work report in March, Premier Li Keqiang pledged to carry out more generous reductions in taxes and fees this year to benefit more manufacturing companies and small firms. Analysts had broadly expected tax and fee cuts for 2019 to reduce business costs by between 1.3 trillion yuan and 1.5 trillion yuan.

Business confidence also recovered on hopes that further progress had been achieved in talks between China and the U.S. to deescalate trade tensions. Ministry of Commerce Spokesman Gao Feng said last week that the two countries have made headway in drafting an agreement, specifically on the thorny issues of intellectual property protection, forced technology transfers, nontariff measures, the services industry, agriculture, the trade balance and an agreement implementation mechanism.

Tai Hui, chief market strategist for Asia at J.P. Morgan Asset Management, also hailed the first quarter GDP figure as showing growth had reached its lowest point for the time being.

“This momentum is likely to continue going into months ahead with recent surge in credit growth and a possible agreement between the U.S. and China on trade issues,” he said in a note.

China’s total social financing — a broad measure of credit and liquidity in the economy — grew by a net 2.86 trillion yuan ($426 billion) in March, quadrupling a net increase of 703 billion yuan the month before, central bank data showed Friday.

But Tai cautioned against fresh stimulus because Beijing “would want to avoid another debt fuelled boom after reducing corporate debt to GDP ratio in 2017.”

Contact reporter Fran Wang (fangwang@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas