Overseas Investors Bail Out of Shenzhen-Listed Surveillance Firm

Overseas investors have been dumping the Shenzhen-listed shares of one of the world’s largest makers of surveillance cameras and security products, amid speculation the U.S. was considering adding the company to a blacklist that would curb its ability to buy foreign technology.

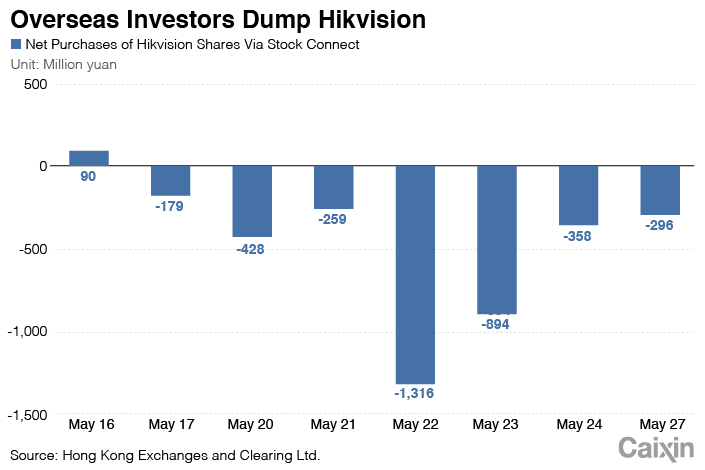

In the seven trading days through Monday, foreign investors have sold a net 3.7 billion yuan ($530 million) of shares in Hangzhou Hikvision Digital Technology Co. Ltd. through the stock connect program between Hong Kong and Shenzhen, according to data compiled by financial data provider iFind from Hong Kong Exchanges and Clearing Ltd.

|

The sell-off began on May 17 and surged to a peak of a net 1.3 billion yuan on Wednesday, the day after the New York Times reported that the Trump administration might limit Hikvision’s ability to buy U.S. technology and require American companies to obtain government approval to sell products to the firm. In the seven trading days through May 27, Hikvision shares dropped 12.2% to 25.15 yuan from 28.63 yuan.

But threats to Hikvision aren’t only coming from the U.S. The company is facing growing competition from new entrants to the surveillance industry, including two of China’s biggest technology groups — Huawei Technologies Co. Ltd. and Alibaba Group Holding Ltd.

Hikvision also reported its first quarterly decline in earnings since listing on the Shenzhen Stock Exchange in 2010. Net profit attributable to shareholders fell 15.4% in the first quarter of 2019 from the same period a year earlier, and revenues were up just 6.2% year-on-year, the first time the company reported single-digit gains.

Contact reporter Liu Jiefei (jiefeiliu@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas