In Depth: Surveillance Equipment Giant Hounded by Competition, Security Concerns

Despite being the world’s largest maker of equipment used to follow others, Hangzhou Hikvision Digital Technology Co. Ltd. is itself coming under growing scrutiny that could severely crimp its future.

One set of pressures on the Shenzhen-listed company, valued at nearly 300 billion yuan ($44 billion), is coming from U.S. regulators who worry about Hikvision’s government ties. At home, meanwhile, the company is also fending off competition from new entrants including the powerful Huawei and Alibaba.

As the surveillance industry puts more focus on software over traditional hardware, the equipment-maker has also found itself defending its fort against an onslaught by a long list of ambitious software players.

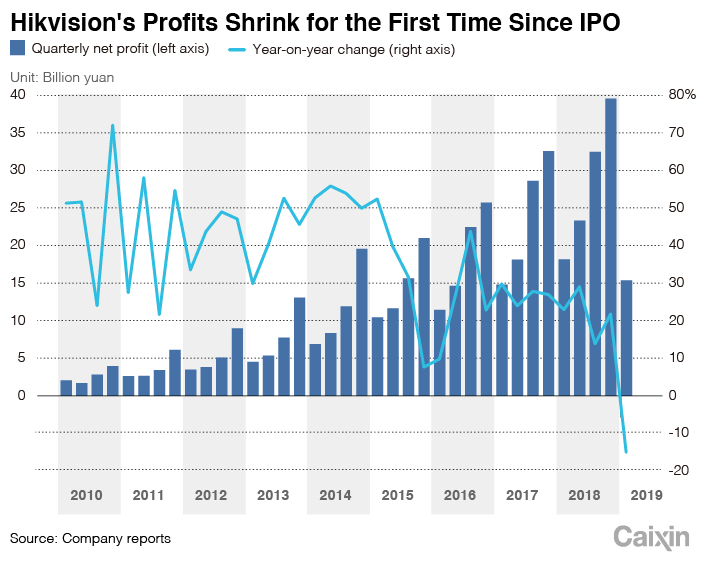

The company’s first-quarter profit fell for the first time since its initial public offering (IPO) in 2010— by 15.4% — as it fended off the challenges on multiple fronts. Revenue rose just 6.2% during that period, the first time the gain was less than 10%.

|

Those disappointing numbers extended a slowdown that began the previous year. In 2018, the company’s revenue increased by nearly 19% to 49.8 billion yuan — the first annual growth rate below 20% since Hikvision’s 2010 initial public offering.

Huawei challenge

People who follow Hikvision used to cite competitor Zhejiang Dahua Technology Co. Ltd. as the company’s biggest threat. But Dahua is being mentioned less frequently these days, as new, deep-pocketed names like Huawei Technologies Co. Ltd. and Alibaba Group Holding Ltd. enter the space.

Hikvision CEO Hu Yangzhong frequently fields questions about challenges posed by Huawei during internal company meetings, as well as from reporters and analysts, company insiders told Caixin.

“The pressure has always been there — regardless of whether Huawei had entered the industry or not,” acknowledged Hu in a recent interview with Caixin. Huawei’s rapid advance draws partly on its resources in other related areas. Such areas include cloud technologies and artificial intelligence, which are increasingly important for analytics services that accompany traditional surveillance equipment.

Huawei founder Ren Zhengfei said previously his company will move aggressively into the public surveillance industry, in a bid to replicate its success in the telecommunication sector.

That effort has already begun to bear fruit. Subsidiaries of the world’s top telecom gear maker already supply chips for China’s surveillance cameras, and Huawei itself supplies surveillance cameras, servers and cloud services to clients at home and abroad.

Analytical services

Huawei wants to cut further into the sector by providing analytic services that come with the surveillance networks and databases.

“In the past, government institutions accumulated a vast amount of data produced by hardware infrastructure including cameras that they deployed. This is the area we can cash in,” said Yan Lida, one of Huawei’s executives overseeing company’s data-related services.

Huawei currently partners with the water supply department in East China’s Jiangsu province, which can now manage its surveillance system in real time. Its cameras can automatically recognize any floating objects in the city’s waters for purposes such as crisis management and rescue efforts.

|

A Huawei surveillance camera in a park in Beijing on March 19. The established telecom giant is seen as a major threat to Hikvision as it pushes into surveillance. Photo: IC Photo |

While Hikvision has 35,000 employees globally, Huawei’s current workforce focused on its security surveillance business is still relatively small. Last year, it doubled its people working for the business, according to Huawei’s 2018 financial report, without providing more specifics.

Huawei isn’t the only company looking to tap the multibillion-dollar industry. Big names like Alibaba as well as smaller startups such as Alibaba-backed SenseTime have all geared up to get a slice of the pie.

Like Huawei, Alibaba is also touting its cloud capabilities. In Hangzhou, where the tech giant is based, the local government has adopted Alibaba’s cloud platform to improve efficiency of the city’s transportation system. Similarly, facial-recognition startups including Megvii, SenseTime, Yitu and CloudWalk have armed police departments with their technology to better empower their surveillance systems.

These startups, whose competitive edge mainly lies in services and software, won’t eat into Hikvision’s core area as an equipment supplier, according to Cui Kai, a researcher at consultancy IDC. But Hikvision should proactively increase its AI capabilities to offer added value to its customers, he said.

Regulatory hurdles

Competition from domestic rivals isn’t Hikvision’s only challenge. Another threat is coming from regulatory resistance in the U.S., which now accounts for 5% of Hikvision’s revenue. Such resistance caused the company’s U.S. revenue to contract last year, an insider told Caixin.

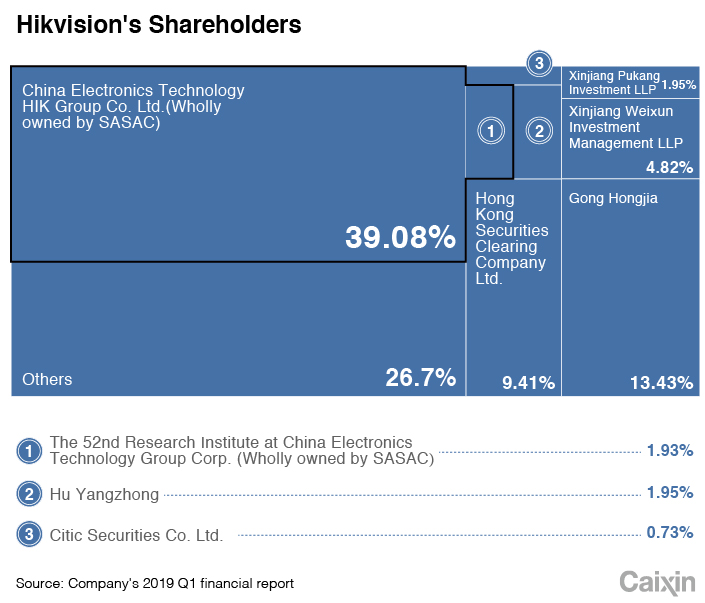

Hikvision’s biggest shareholder is Zhongdian Haikang Group Co. Ltd., a tech company that owns 40% of Hikvision. Zhongdian itself is fully-owned by the State-owned Assets Supervision and Administration Commission (SASAC), a government entity that oversees China’s largest state-owned enterprises. Those direct ties to Beijing have worried some in the U.S. about connections between Hikvision and the Chinese government.

|

Hikvision cameras have been widely used in the U.S. to monitor streets, homes, and military bases, as well as at American embassies and consulates overseas.

But in January last year its surveillance cameras were removed from a U.S. military base in the state of Missouri to allay public concerns. That move came even after the base’s chief told the Wall Street Journal such cameras posed no threat because they operated in a closed, self-contained network and had never been used above roads leading to the base and its parking lots.

Four months later, the U.S. House of Representatives voted to approve a $717 billion 2019 defense policy bill that included a provision banning government agencies from using Chinese-made video surveillance equipment or services on grounds of national security concerns. President Donald Trump signed the bill in August.

The defense bill singled out Hikvision as well as other Chinese surveillance equipment-makers, including radio-transceiver-maker Hytera Communications Corp. and Hikvision rival Dahua. The bill also bans U.S. government purchases of surveillance-related technology from Huawei and ZTE Corp., China’s two largest telecom equipment-makers that have faced their most trying challenges yet in America.

Read more

In-Depth: The Shockwaves of Meng Wanzhou’s Arrest

Global footprint

Hikvision currently employs more than 20,000 people at research and development centers in Montreal, Canada and Silicon Valley, California, as well as in Beijing, Shanghai, Chongqing, and Wuhan in China. Its surveillance products and services are deployed in over 100 markets, according to the company’s website.

In 2018 alone, the giant opened seven new overseas branches in the Philippines, Mexico, Panama, Pakistan, Peru, Israel and Vietnam.

“Hikvision is a commercial entity whose global operations strictly conform to all relevant (national) regulations,” the surveillance maker said in May last year in response to the U.S. bill. “We are dedicated to the advancement of safety in all countries and jurisdictions.”

Hikvision CEO Hu said his company has not committed any wrongdoing, while also acknowledging security loopholes are an inevitable challenge for every player. Therefore what matters most is how, and how fast, companies deal with problems when they occur, he said.

The U.S. resistance has opened a window to smaller rivals like locally-based Identiv Inc.

“The national defense law mandates that government agencies are going to be required not to just stop buying systems from the two largest Chinese video providers, Hikvision and Dahua,” said Steven Humphreys, Identiv CEO, at the company’s earnings call in August. “But within the next year (2019) to develop plans to uninstall them so that any of their devices previously bought have to be removed.”

This story has been corrected to state that Hikvision's quarterly profit fell for the first time since its IPO in 2010. An earlier version of the story also misstated how much the company’s first-quarter profit fell by. It was 15.4%.

Contact reporters Mo Yelin (yelinmo@caixin.com) and Jason Tan (jasontan@caixin.com)

- 1Cover Story: China Carves Out a Narrow Path for Offshore Asset Tokenization

- 2Drownings Shake Chinese Enthusiasm for Travel to Russia

- 3Over Half of China’s Provinces Cut Revenue Targets

- 4Li Ka-Shing’s Port Empire Hit by Forced Takeover Amid Panama Legal Dispute

- 5In Depth: China’s Mutual Fund Industry Faces Overhaul After a Banner 2025

- 1Power To The People: Pintec Serves A Booming Consumer Class

- 2Largest hotel group in Europe accepts UnionPay

- 3UnionPay mobile QuickPass debuts in Hong Kong

- 4UnionPay International launches premium catering privilege U Dining Collection

- 5UnionPay International’s U Plan has covered over 1600 stores overseas